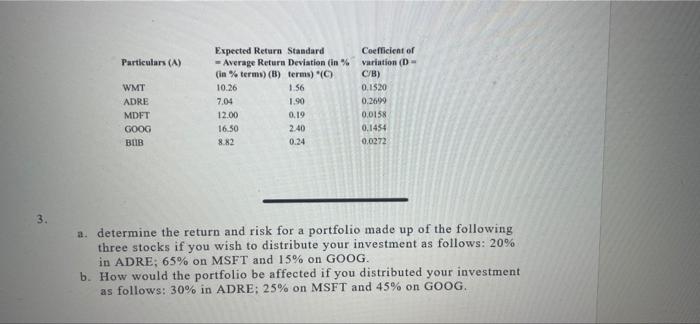

Question: Particulars (A) WMT ADRE MDFT GOOG BIB Expected Return Standard - Average Return Deviation (in % (in % terms)(B) terms) (C) 10.26 1.56 7.04 1.90

Particulars (A) WMT ADRE MDFT GOOG BIB Expected Return Standard - Average Return Deviation (in % (in % terms)(B) terms) (C) 10.26 1.56 7.04 1.90 12.00 0,19 16.50 2.40 8.82 0.24 Coefficient of variation (D- C/B) 0.1520 0.2609 0,0158 0.1454 0.0272 3. a. determine the return and risk for a portfolio made up of the following three stocks if you wish to distribute your investment as follows: 20% in ADRE; 65% on MSFT and 15% on GOOG. b. How would the portfolio be affected if you distributed your investment as follows: 30% in ADRE: 25% on MSFT and 45% on GOOG. Working Notes CALCULATION OF THE MA Particulars Sales Les Cost of Sales Gross Profit Gross Profile Margin- Gross Profit Divide by Sales Equato Multiply By Equal to means Jubilee. Incearings is 30% sales Salatban: Caciulation of Amost of Gross Profie Which Jabil Ending Inventory JPW Company holds at the end of Gross Margin on this wory of 2000 Share of Jubilee in JPW Company Share of profit is ending investory 157.00 X 30%) Antwer-Jubilee can defer in reporting this investment -51.860

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts