Question: Parts A, B, C, D, E. Use info in tables for each. Check rm Healthy Hound, Inc., makes two lines of dog food: (1) Basic

Parts A, B, C, D, E. Use info in tables for each.

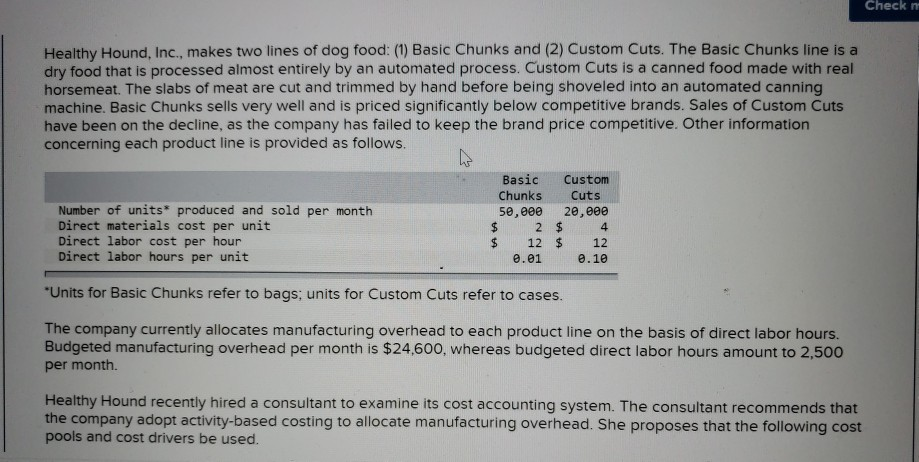

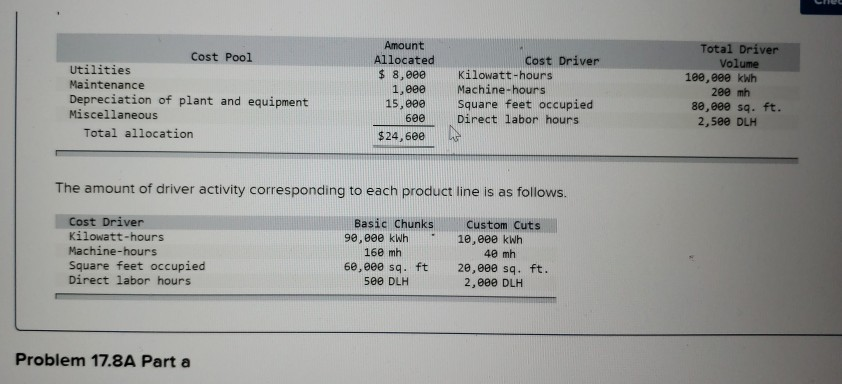

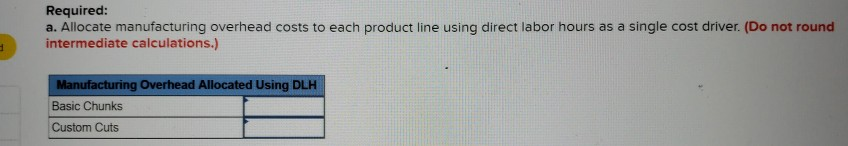

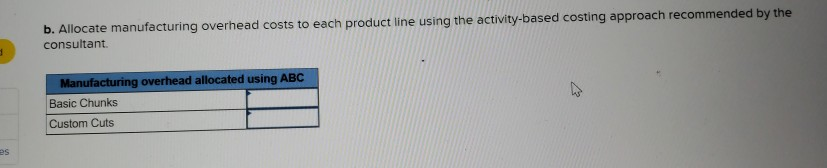

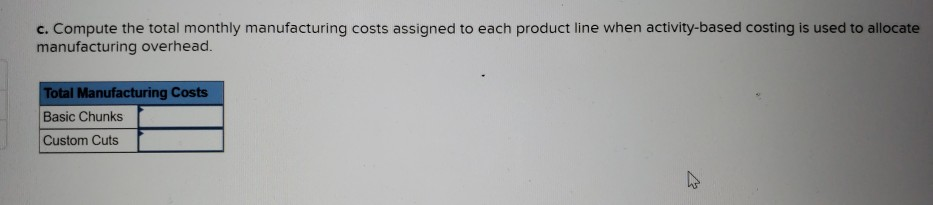

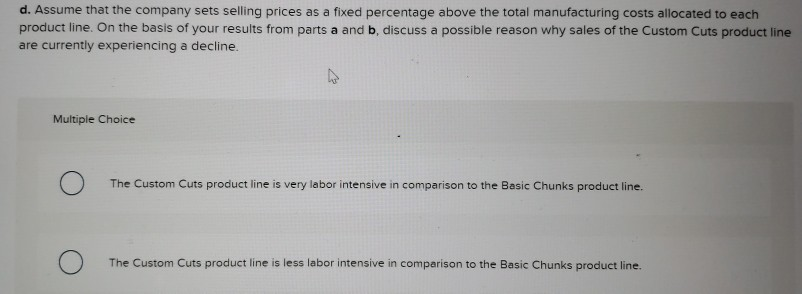

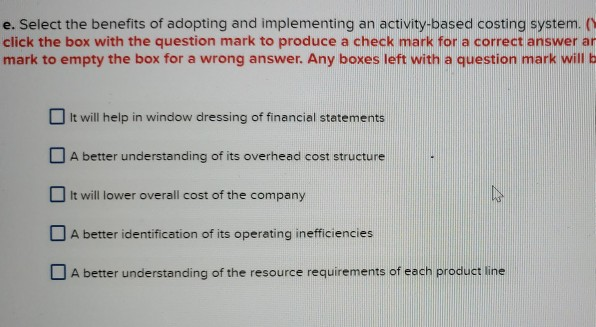

Check rm Healthy Hound, Inc., makes two lines of dog food: (1) Basic Chunks and (2) Custom Cuts. The Basic Chunks line is a dry food that is processed almost entirely by an automated process. Custom Cuts is a canned food made with real horsemeat. The slabs of meat are cut and trimmed by hand before being shoveled into an automated canning machine. Basic Chunks sells very well and is priced significantly below competitive brands. Sales of Custom Cuts have been on the decline, as the company has failed to keep the brand price competitive. Other information concerning each product line is provided as follows. Basic Custonm Chunks Cuts Number of units* produced and sold per month 50,000 20,0e 4 $12 12 0.01 e.10 Direct materials cost per unit Direct labor cost per hour Direct labor hours per unit Units for Basic Chunks refer to bags; units for Custom Cuts refer to cases. The company currently allocates manufacturing overhead to each product line on the basis of direct labor hours. Budgeted manufacturing overhead per month is $24,600, whereas budgeted direct labor hours amount to 2,500 per month. Healthy Hound recently hired a consultant to examine its cost accounting system. The consultant recommends that the company adopt activity-based costing to allocate manufacturing overhead. She proposes that the following cost pools and cost drivers be used. Amount Allocated s 8,0e0 Kilowatt-hours Total Driver Volume Cost Pool Cost Driver Utilities Maintenance Depreciation of plant and equipment Miscellaneous 1ee,e0 kWh 200 mh 1,000 Machine hours 15,eee Square feet occupied 80,ee0 sq. ft. 600 Direct labor hours 2,5e0 DLH Total allocation $24,68e The amount of driver activity corresponding to each product line is as follows. Cost Driver Kilowatt-hours Machine-hours Basic ChunksCustom Cuts 90,000 kWh10,90e kwh 48 mh 28,680 sq. ft 168 mh Square feet occupied Direct labor hours 6e,eee sq. ft 500 DLH 2,000 DLH Problem 17.8A Part a Required a. Allocate manufacturing overhead costs to each product line using direct labor hours as a single cost driver. (Do not round intermediate calculations.) ng Overhead Allocated Using DLH Basic Chunks Custom Cuts b. Alloc consultant ate manufacturing overhead costs to each product line using the activity-based costing approach recommended by the facturing overhead allocated using ABC Basic Chunks Custom Cuts es c. Compute the total monthly manufacturing costs assigned to each product line when activity-based costing is used to allocate manufacturing overhead. Total Manufacturing Costs Basic Chunks Custom Cuts d. Assume that the company sets selling prices as a fixed percentage above the total manufacturing costs allocated to each product line. On the basis of your results from parts a and b, discuss a possible reason why sales of the Custom Cuts product line are currently experiencing a decline. Multiple Choice The Custom Cuts product line is very labor intensive in comparison to the Basic Chunks product line. The Custom Cuts product line is less labor intensive in comparison to the Basic Chunks product line e. Select the benefits of adopting and implementing an activity-based costing system. ( click the box with the question mark to produce a check mark for a correct answer ar mark to empty the box for a wrong answer. Any boxes left with a question mark will b It will help in window dressing of financial statements A better understanding of its overhead cost structure It will lower overall cost of the company A better identification of its operating inefficiencies A better understanding of the resource requirements of each product line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts