Question: Paste 11 IC A > al 10 On May 31, 2021, Forester Theatre's cash account per it general ledger showing the following balance $6,841. The

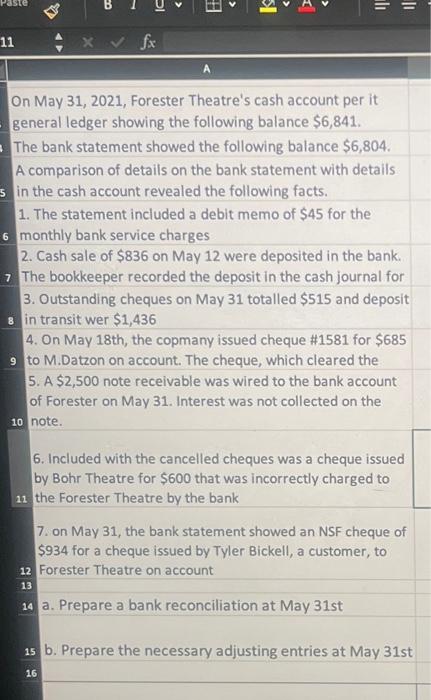

\\( f x \\) A On May 31, 2021, Forester Theatre's cash account per it general ledger showing the following balance \\( \\$ 6,841 \\). The bank statement showed the following balance \\( \\$ 6,804 \\). A comparison of details on the bank statement with details in the cash account revealed the following facts. 1. The statement included a debit memo of \\( \\$ 45 \\) for the monthly bank service charges 2. Cash sale of \\( \\$ 836 \\) on May 12 were deposited in the bank. 7 The bookkeeper recorded the deposit in the cash journal for 3. Outstanding cheques on May 31 totalled \\( \\$ 515 \\) and deposit 8 in transit wer \\( \\$ 1,436 \\) 4. On May 18 th, the copmany issued cheque \\( \\# 1581 \\) for \\( \\$ 685 \\) 9 to M.Datzon on account. The cheque, which cleared the 5. A \\( \\$ 2,500 \\) note receivable was wired to the bank account of Forester on May 31 . Interest was not collected on the 10 note. 6. Included with the cancelled cheques was a cheque issued by Bohr Theatre for \\( \\$ 600 \\) that was incorrectly charged to 11 the Forester Theatre by the bank 7. on May 31, the bank statement showed an NSF cheque of \\( \\$ 934 \\) for a cheque issued by Tyler Bickell, a customer, to Forester Theatre on account a. Prepare a bank reconciliation at May 31st b. Prepare the necessary adjusting entries at May 31st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts