Question: Pat is considering buying a Kool bond that will generate $1,400, $600, $600 and $1,500 for years 1-4 respectively. The current market rates on a

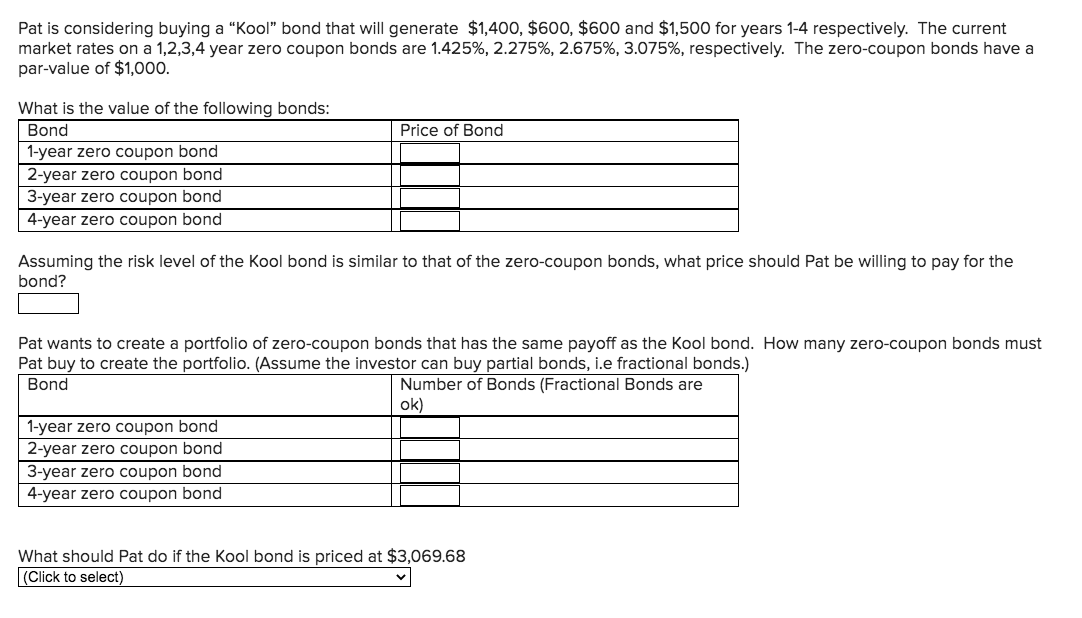

Pat is considering buying a "Kool" bond that will generate $1,400, $600, $600 and $1,500 for years 1-4 respectively. The current market rates on a 1,2,3,4 year zero coupon bonds are 1.425%, 2.275%, 2.675%, 3.075%, respectively. The zero-coupon bonds have a par-value of $1,000. Price of Bond What is the value of the following bonds: Bond 1-year zero coupon bond 2-year zero coupon bond 3-year zero coupon bond 4-year zero coupon bond Assuming the risk level of the Kool bond is similar to that of the zero-coupon bonds, what price should Pat be willing to pay for the bond? Pat wants to create a portfolio of zero-coupon bonds that has the same payoff as the Kool bond. How many zero-coupon bonds must Pat buy to create the portfolio. (Assume the investor can buy partial bonds, i.e fractional bonds.) Bond Number of Bonds (Fractional Bonds are ok) 1-year zero coupon bond 2-year zero coupon bond 3-year zero coupon bond 4-year zero coupon bond What should Pat do if the Kool bond is priced at $3,069.68 (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts