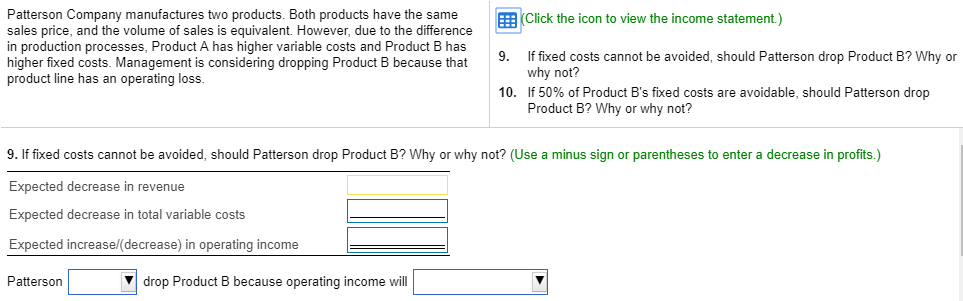

Question: Patterson ( should / should not ) drop product B because operating income will ( decrease by $14800 / decrease by $16700 / increase by

Patterson (should / should not) drop product B because operating income will (decrease by $14800 / decrease by $16700 / increase by $14800 / increase by $16700)

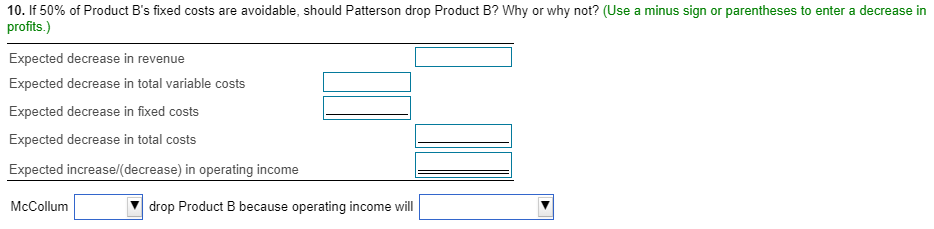

McCollum (Should/ Should not) drop product B because operating income will (increase by $950 / increase by $16700 / decrease by $950 / decrease by $16700)

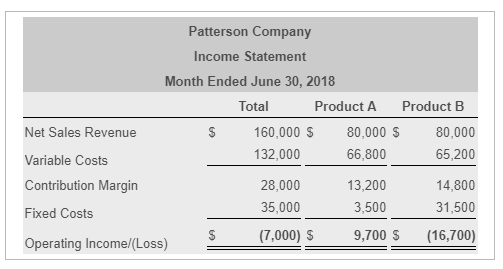

Patterson Company Income Statement Month Ended June 30, 2018 Total Product Product B 160,000 $ 80,000 $ 80,000 132,000 66,800 65,200 Net Sales Revenue Variable Costs Contribution Margin Fixed Costs 28,000 35,000 (7,000) $ 13,200 3,500 9,700 $ 14,800 31,500 (16,700) Operating Income/(Loss) $ Click the icon to view the income statement.) Patterson Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in production processes, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. 9. If fixed costs cannot be avoided, should Patterson drop Product B? Why or why not? 10. If 50% of Product B's fixed costs are avoidable, should Patterson drop Product B? Why or why not? 9. If fixed costs cannot be avoided, should Patterson drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected increase/(decrease) in operating income Patterson drop Product B because operating income will 10. If 50% of Product B's fixed costs are avoidable, should Patterson drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increase/decrease) in operating income McCollum drop Product B because operating income will

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts