Question: Paul enter into a forward contract with Tim. Paul is obligated to sell the underlying asset to Tim at expiration at the forward price F.

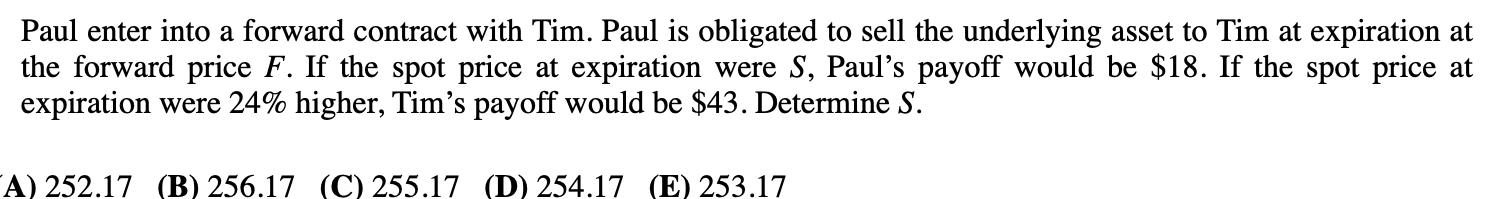

Paul enter into a forward contract with Tim. Paul is obligated to sell the underlying asset to Tim at expiration at the forward price F. If the spot price at expiration were S, Paul's payoff would be $18. If the spot price at expiration were 24% higher, Tim's payoff would be $43. Determine S. A) 252.17 (B) 256.17 (C) 255.17 (D) 254.17 (E) 253.17 Paul enter into a forward contract with Tim. Paul is obligated to sell the underlying asset to Tim at expiration at the forward price F. If the spot price at expiration were S, Paul's payoff would be $18. If the spot price at expiration were 24% higher, Tim's payoff would be $43. Determine S. A) 252.17 (B) 256.17 (C) 255.17 (D) 254.17 (E) 253.17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts