Question: PAYOFFS AND HEDGING I NEED HELP UNDERSTADING THIS AND HOW THE PROCESS WORK. I NEED SOMEONE TO EITHER EXPLAIN OR REWRITE FOR ME PLEASE. THE

PAYOFFS AND HEDGING

I NEED HELP UNDERSTADING THIS AND HOW THE PROCESS WORK.

I NEED SOMEONE TO EITHER EXPLAIN OR REWRITE FOR ME PLEASE.

THE SOLUTIONS ARE ALREADY PROVIDED.

ITS IT FINANCE OVER PUT AND CALL OPTIONS AND HEDGING.

ITS IT FINANCE OVER PUT AND CALL OPTIONS AND HEDGING.

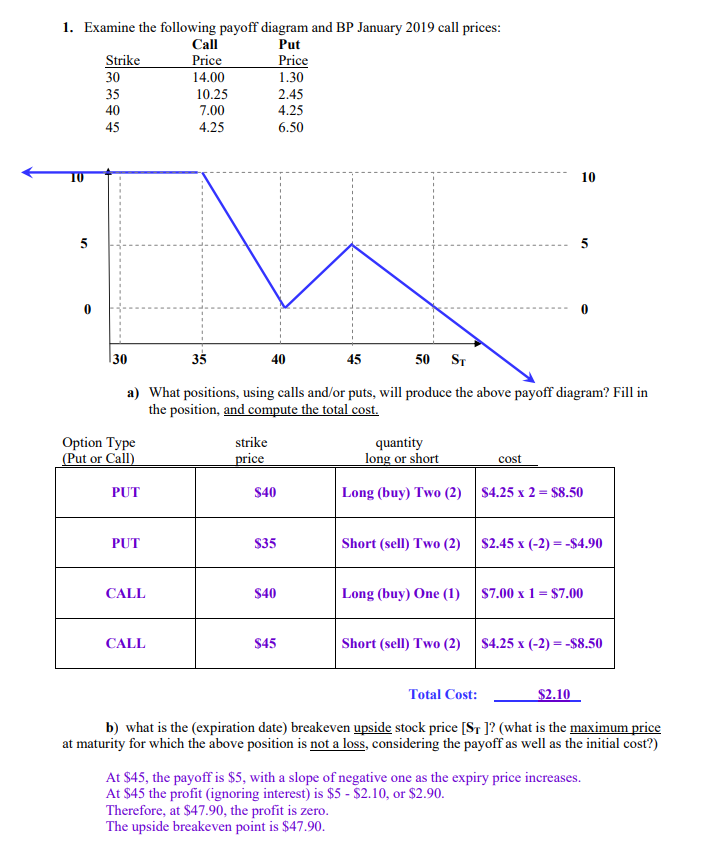

1. Examine the following payoff diagram and BP January 2019 call prices: Call Put Strike Price Price 30 14.00 1.30 10.25 2.45 7.00 4.25 4.25 6.50 30 35 40 45 50 ST a) What positions, using calls and/or puts, will produce the above payoff diagram? Fill in the position, and compute the total cost. Option Type (Put or Call) strike price quantity long or short cost PUT S40 Long (buy) Two (2) $4.25 x 2 = $8.50 PUT $35 Short (sell) Two (2) $2.45 x (-2) =-$4.90 CALL $40 Long (buy) One (1) $7.00 x 1 = $7.00 CALL $45 Short (sell) Two (2) $4.25 x (-2) = -$8.50 Total Cost: $2.10 b) what is the expiration date) breakeven upside stock price [ST ]? (what is the maximum price at maturity for which the above position is not a loss, considering the payoff as well as the initial cost?) At $45, the payoff is $5, with a slope of negative one as the expiry price increases. At $45 the profit (ignoring interest) is $5 - $2.10, or $2.90. Therefore, at $47.90, the profit is zero. The upside breakeven point is $47.90. 1. Examine the following payoff diagram and BP January 2019 call prices: Call Put Strike Price Price 30 14.00 1.30 10.25 2.45 7.00 4.25 4.25 6.50 30 35 40 45 50 ST a) What positions, using calls and/or puts, will produce the above payoff diagram? Fill in the position, and compute the total cost. Option Type (Put or Call) strike price quantity long or short cost PUT S40 Long (buy) Two (2) $4.25 x 2 = $8.50 PUT $35 Short (sell) Two (2) $2.45 x (-2) =-$4.90 CALL $40 Long (buy) One (1) $7.00 x 1 = $7.00 CALL $45 Short (sell) Two (2) $4.25 x (-2) = -$8.50 Total Cost: $2.10 b) what is the expiration date) breakeven upside stock price [ST ]? (what is the maximum price at maturity for which the above position is not a loss, considering the payoff as well as the initial cost?) At $45, the payoff is $5, with a slope of negative one as the expiry price increases. At $45 the profit (ignoring interest) is $5 - $2.10, or $2.90. Therefore, at $47.90, the profit is zero. The upside breakeven point is $47.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts