Question: Payroll Comprehensive Problem Congratulations! You have just been awarded the payroll contract for the company Jenn's BADM 5 0 Comprehensive Consultants ( 8 8 -

Payroll Comprehensive Problem

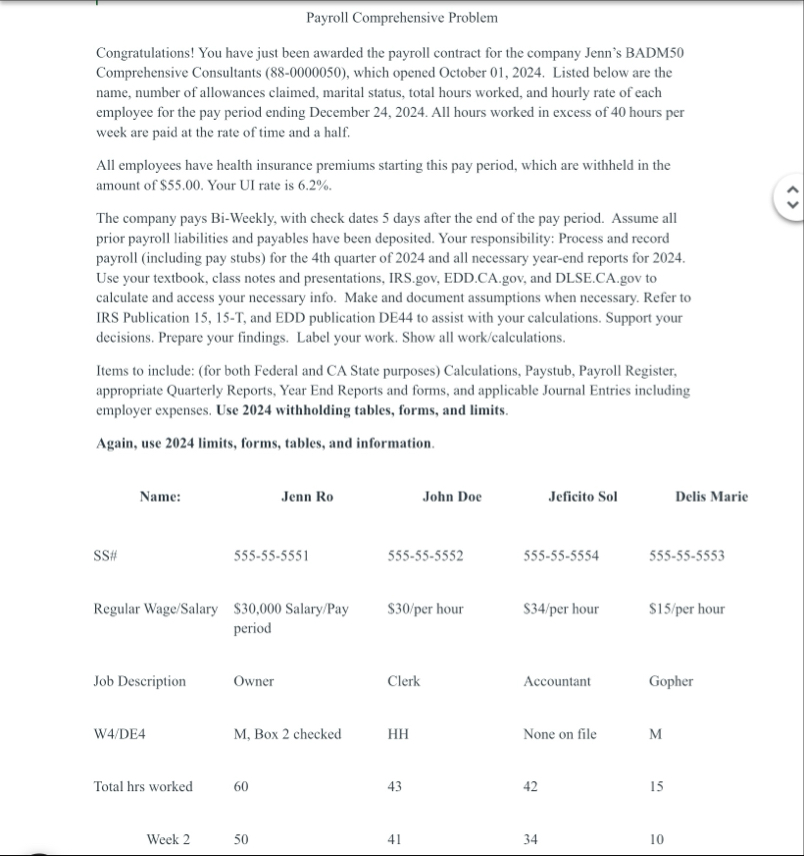

Congratulations! You have just been awarded the payroll contract for the company Jenn's BADM Comprehensive Consultants which opened October Listed below are the name, number of allowances claimed, marital status, total hours worked, and hourly rate of each employee for the pay period ending December All hours worked in excess of hours per week are paid at the rate of time and a half.

All employees have health insurance premiums starting this pay period, which are withheld in the amount of $ Your UI rate is

The company pays BiWeekly, with check dates days after the end of the pay period. Assume all prior payroll liabilities and payables have been deposited. Your responsibility: Process and record payroll including pay stubs for the th quarter of and all necessary yearend reports for Use your textbook, class notes and presentations,

IRS.gov,

EDD.CAgov, and

DLSE.CAgov to calculate and access your necessary info. Make and document assumptions when necessary. Refer to IRS Publication T and EDD publication DE to assist with your calculations. Support your decisions. Prepare your findings. Label your work. Show all workcalculations

Items to include: for both Federal and CA State purposes Calculations, Paystub, Payroll Register, appropriate Quarterly Reports, Year End Reports and forms, and applicable Journal Entries including employer expenses. Use withholding tables, forms, and limits

Again, use limits forms, tables, and information.

Name:

Jenn Ro

John Doe

Jeficito Sol

Delis Marie

SS#

$ per hour

$per hour

$per hour period

Job Description

Owner

Clerk

Accountant

Gopher

WDE

M Box checked

HH

None on file

M

Total hrs worked

Week

tableYTD Gross,$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock