Question: Payroll Problem #4 You are the accountant for Eastern Building Contractors. Complete the following tasks related to the preparation of the last payroll for the

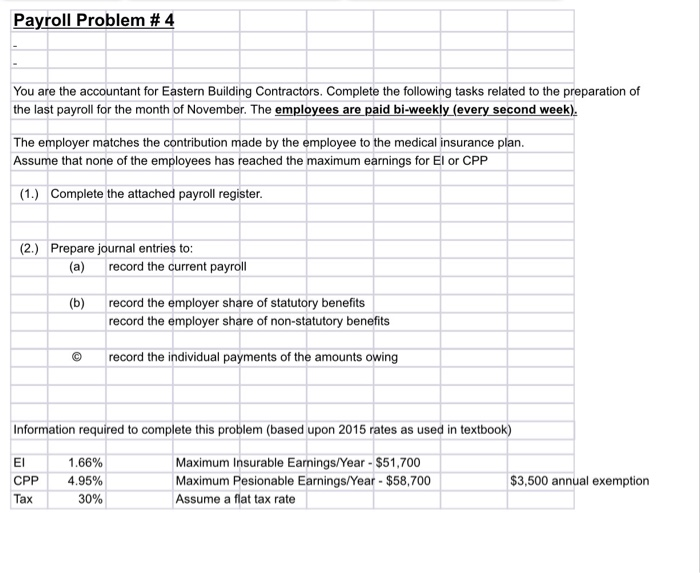

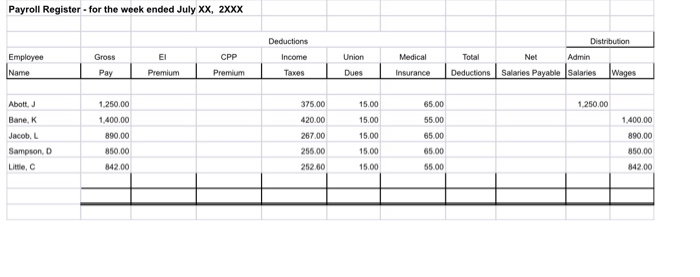

Payroll Problem #4 You are the accountant for Eastern Building Contractors. Complete the following tasks related to the preparation of the last payroll for the month of November. The employees are paid bi-weekly (every second week). The employer matches the contribution made by the employee to the medical insurance plan. Assume that none of the employees has reached the maximum earnings for El or CPP (1.) Complete the attached payroll register. (2.) Prepare journal entries to: (a) record the current payroll (b) record the employer share of statutory benefits record the employer share of non-statutory benefits record the individual payments of the amounts owing Information required to complete this problem (based upon 2015 rates as used in textbook) EI CPP Tax 1.66% 4.95% 30% Maximum Insurable Earnings/Year - $51,700 Maximum Pesionable Earnings/Year - $58,700 Assume a flat tax rate $3,500 annual exemption Payroll Register - for the week ended July XX, 2xxx Deductions Distribution Admin Employee Gross CPP Income Union Medical Total Net EI Premium Name Pay Premium Taxes Dues Insurance Deductions Salaries Payable Salaries Wages 1.250,00 Abott, Bane, K Jacob, L Sampson D LC 1.250.00 1.400.00 890.00 850.00 842.00 375.00 420.00 267.00 255.00 252.60 15.00 15.00 15.00 15.00 15.00 65.00 55.00 65.00 65.00 55.00 1.400.00 890.00 850,00 84200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts