Question: 2. Post all journal entries to the appropriate accounts on the General Ledger. Required: 1. Using the payroll registers, complete the General Journal entries as

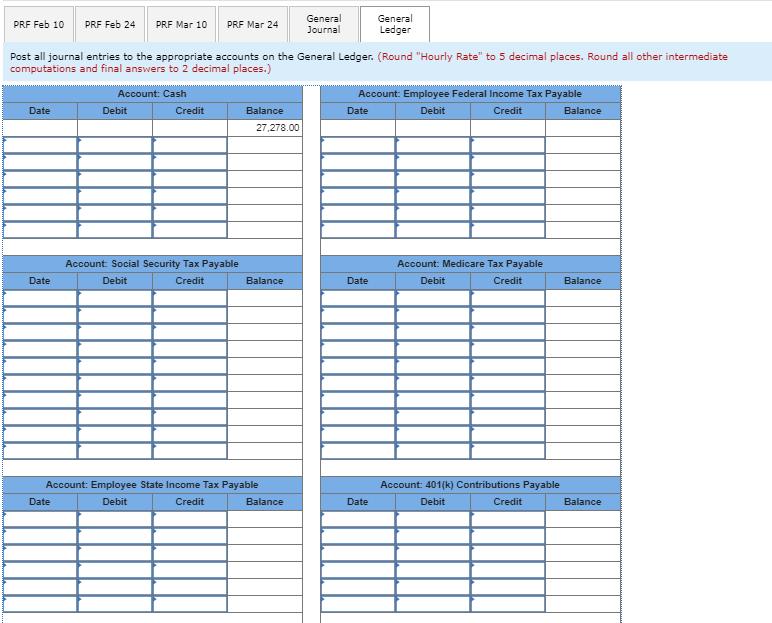

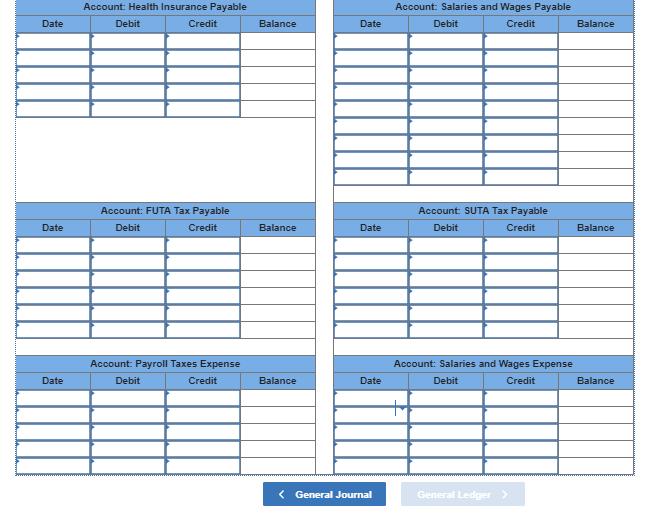

2. Post all journal entries to the appropriate accounts on the General Ledger.

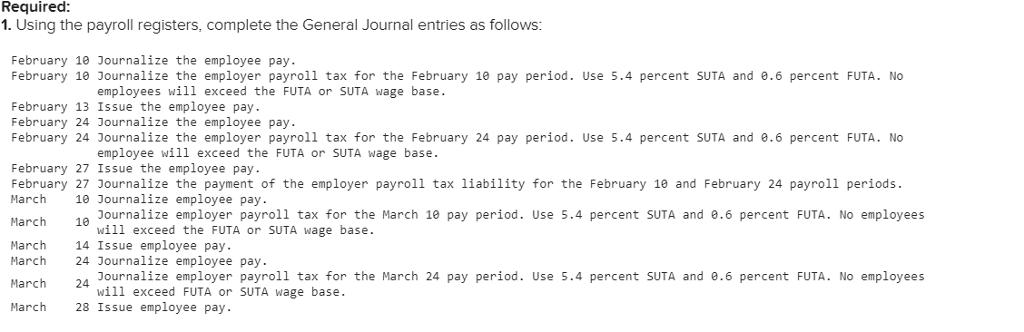

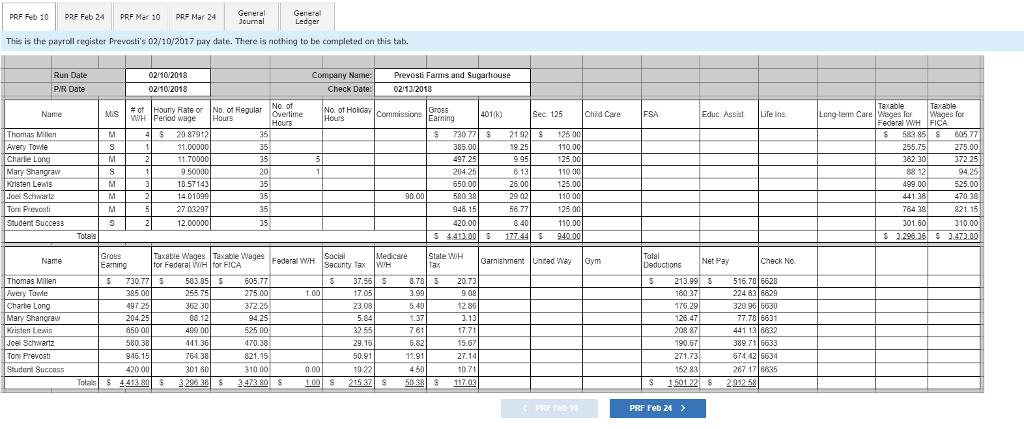

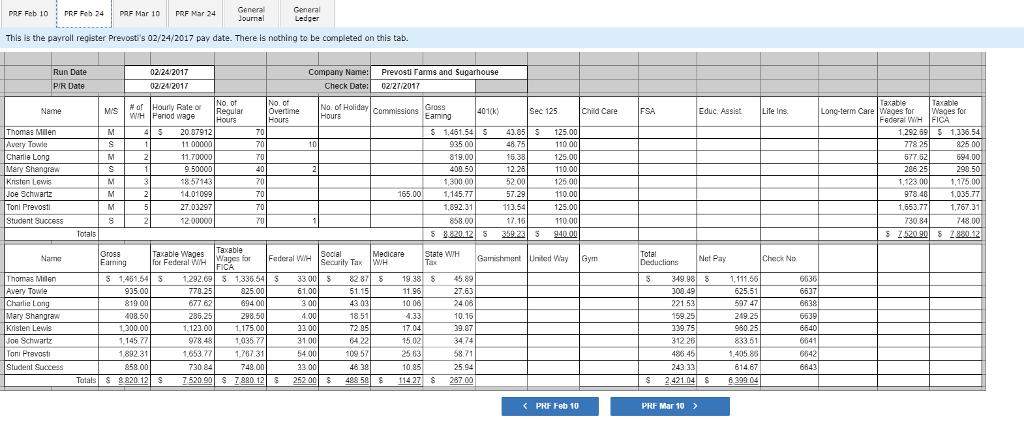

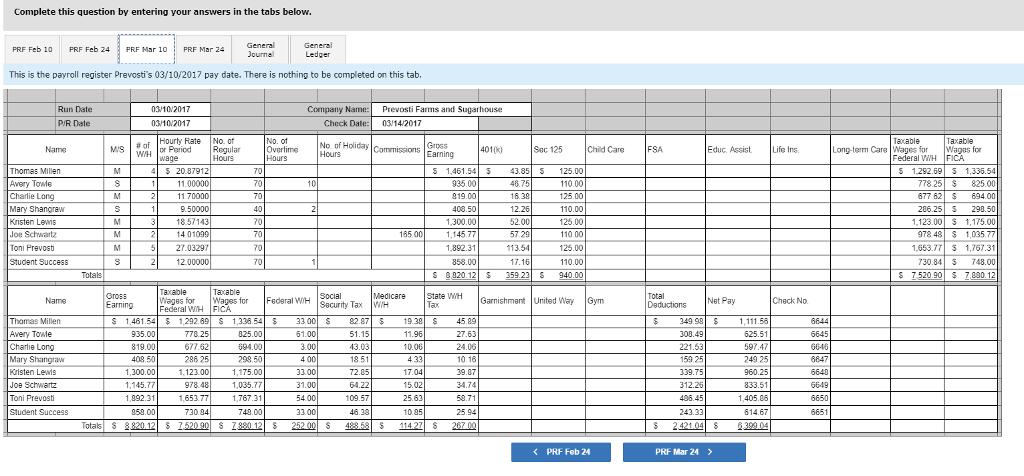

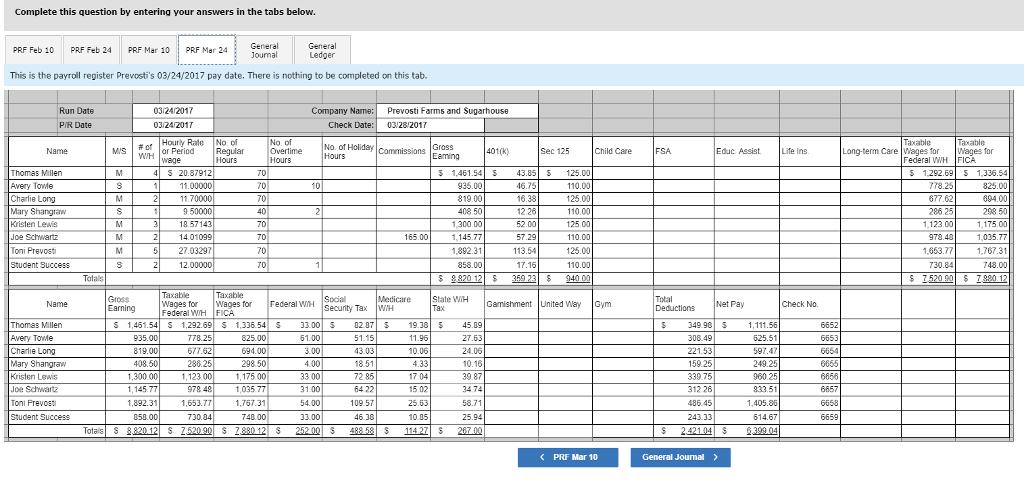

Required: 1. Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 13 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 27 Issue the employee pay. February 27 Journalize the payment of the employer payroll tax liability for the February 10 and February 24 payroll periods. March 10 Journalize employee pay. 1a Journalize employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. 14 Issue employee pay. 24 Journalize employee pay. Journalize employer payroll tax for the March 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees March March March March 24 will exceed FUTA or SUTA wage base. March 28 Issue employee pay.

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

1 General Journal Entries Date Account Titles Debit Credit 10Feb Salary and wages expense 441380 FederalIncome tax payable 100 Social security tax payable 21537 Medicare tax payable 5038 State income ... View full answer

Get step-by-step solutions from verified subject matter experts