Question: pb11-3 help PB11-3 Comparing, Prioritizing Multiple Projects LO 11-1, 112,113,116 Harmony Company has a number of potential capital investments. Because these projects vary in nature,

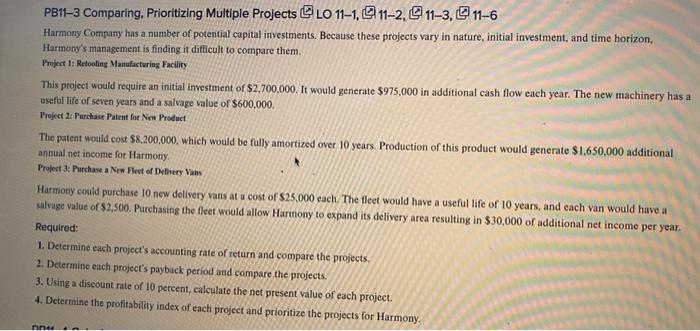

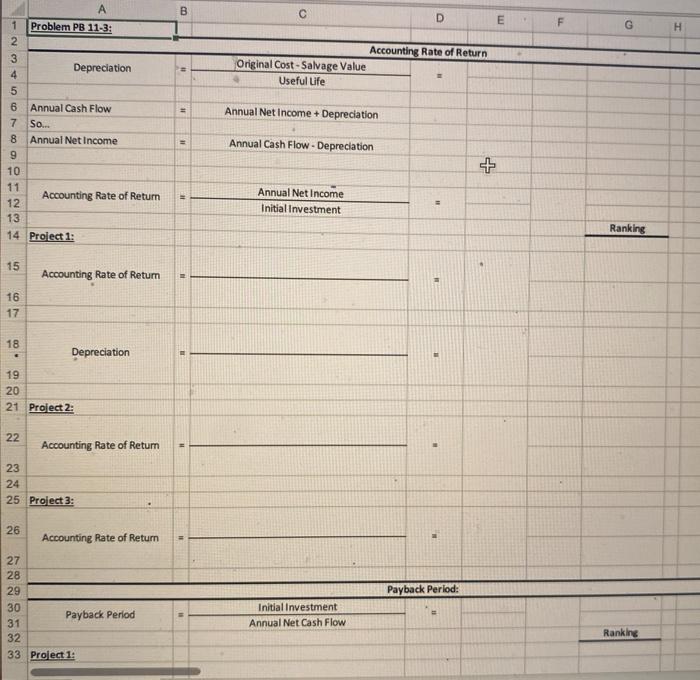

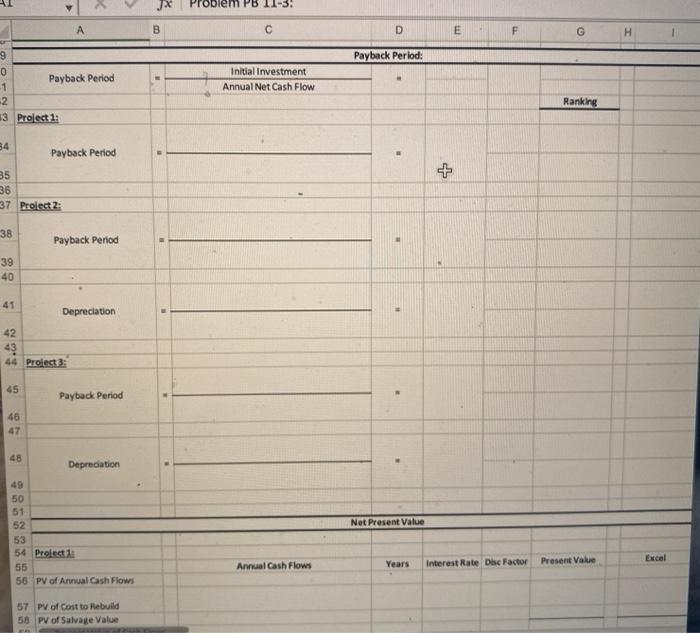

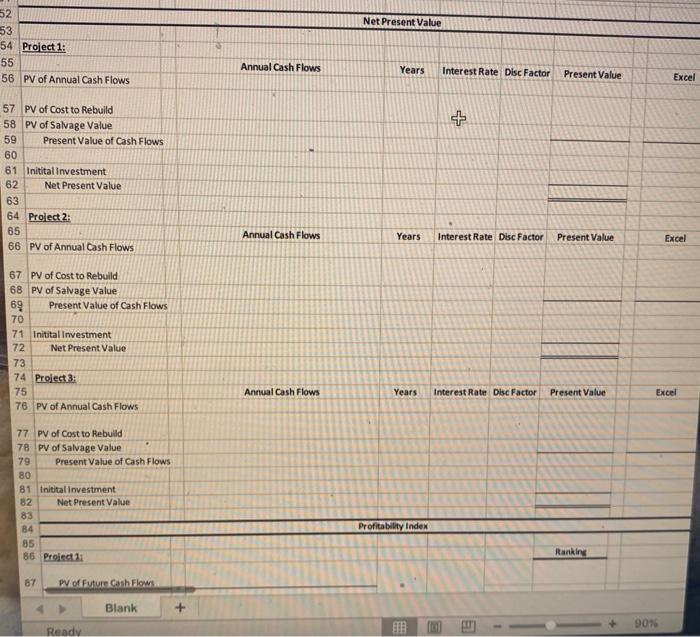

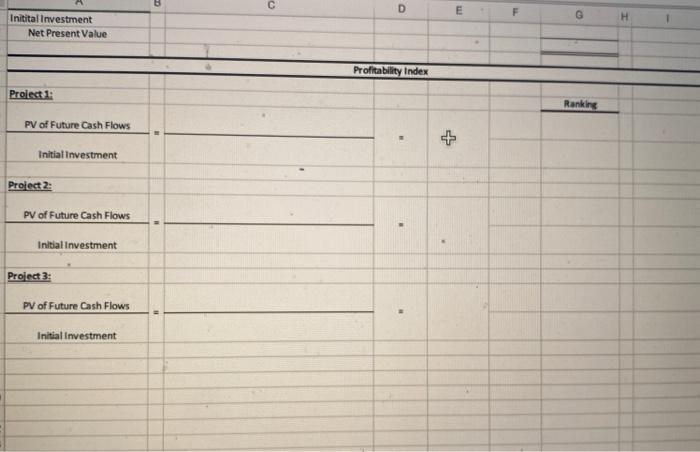

PB11-3 Comparing, Prioritizing Multiple Projects LO 11-1, 112,113,116 Harmony Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, Harmony's management is finding it difficult to compare them. Project 1: Retooling Manufacturing Facility. This project would require an initial investment of $2,700,000. It would generate $975,000 in additional cash flow each year. The new machinery has a usetul life of seven years and a salvage value of $600,000, Project 2: Purchase Patent foe New Product The patent would cost $8,200,000, which would be fully amortized over 10 years. Production of this product would generate $1,650,000 additional annizal net income for Harmony. Prolect 3: Purchase a New Bies of Deliery Vains Harmony coald parchase 10 new delivery vans at a cost of $25,000cach. The fleet would have a useful life of 10 years, and each van would have a alvige value of $2.500. Purchasing the fleet would allow Harmony to expand its delivery area resulting in $30,000 of additional net income per year. Required: 1. Determine each project's accounting rate of return and compare the projects. 2. Determine each project's paybuck period and compare the projects. 3. Usinga discount rate of 10 percent, calculate the net present value of each project. 4. Determine the profitability index of each project and prioritize the projects for Harmony. 57 PV of Cost to Rebuild 58 PV of Salvage Value 59 Present Value of Cash Flows 67 PV of Cost to Rebuild 68 PV of Salvage Value 6970PresentValueofCashflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts