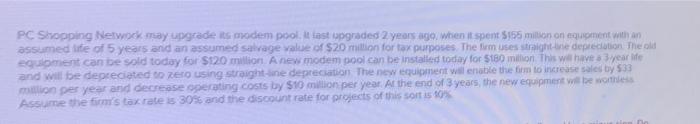

Question: PC Shopping Netwock may upgrade it modem pool last upgraded 2 years ago when it spent 5156 milion on equiment with assumed life of 5

PC Shopping Netwock may upgrade it modem pool last upgraded 2 years ago when it spent 5156 milion on equiment with assumed life of 5 years and an assumed salvage value of $20 million for tax purposes. The firm uses straight-use depreciation The old eguiment can be sold today for $120 million A new modem pool can be installed today for $180 million. This will have a 3 year Me and will be depreciated to get using straight-ne depreciation The new equipment will enable the form to increase sales by 533 million per year and decrease operating costs by $10 million per year. At the end of 3 years, the new equipment will be wote Assume the firm's tax rate is 30% and the discount rate for projects of this sort is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts