Question: Problem #3 PBO Calculation and Prior Service Cost Frank Lloyd a senior executive at Equity Solutions LLP was hired at the end of 2005. His

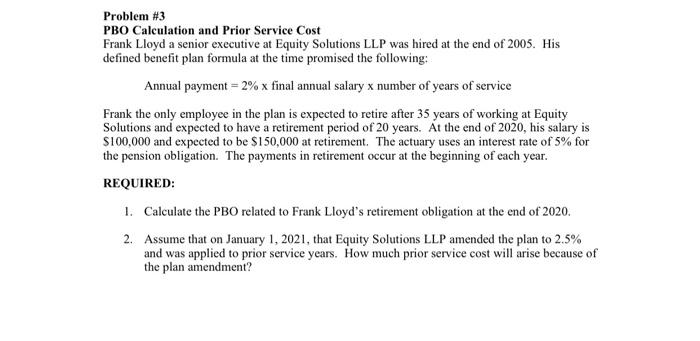

Problem #3 PBO Calculation and Prior Service Cost Frank Lloyd a senior executive at Equity Solutions LLP was hired at the end of 2005. His defined benefit plan formula at the time promised the following: Annual payment = 2% x final annual salary x number of years of service Frank the only employee in the plan is expected to retire after 35 years of working at Equity Solutions and expected to have a retirement period of 20 years. At the end of 2020, his salary is $100,000 and expected to be $150,000 at retirement. The actuary uses an interest rate of 5% for the pension obligation. The payments in retirement occur at the beginning of each year. REQUIRED: 1. Calculate the PBO related to Frank Lloyd's retirement obligation at the end of 2020. 2. Assume that on January 1, 2021, that Equity Solutions LLP amended the plan to 2.5% and was applied to prior service years. How much prior service cost will arise because of the plan amendment? Problem #3 PBO Calculation and Prior Service Cost Frank Lloyd a senior executive at Equity Solutions LLP was hired at the end of 2005. His defined benefit plan formula at the time promised the following: Annual payment = 2% x final annual salary x number of years of service Frank the only employee in the plan is expected to retire after 35 years of working at Equity Solutions and expected to have a retirement period of 20 years. At the end of 2020, his salary is $100,000 and expected to be $150,000 at retirement. The actuary uses an interest rate of 5% for the pension obligation. The payments in retirement occur at the beginning of each year. REQUIRED: 1. Calculate the PBO related to Frank Lloyd's retirement obligation at the end of 2020. 2. Assume that on January 1, 2021, that Equity Solutions LLP amended the plan to 2.5% and was applied to prior service years. How much prior service cost will arise because of the plan amendment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts