Peanut Company acquired 80 percent of Snoopy Company's outstanding common stock for $300,000 on January 1,...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

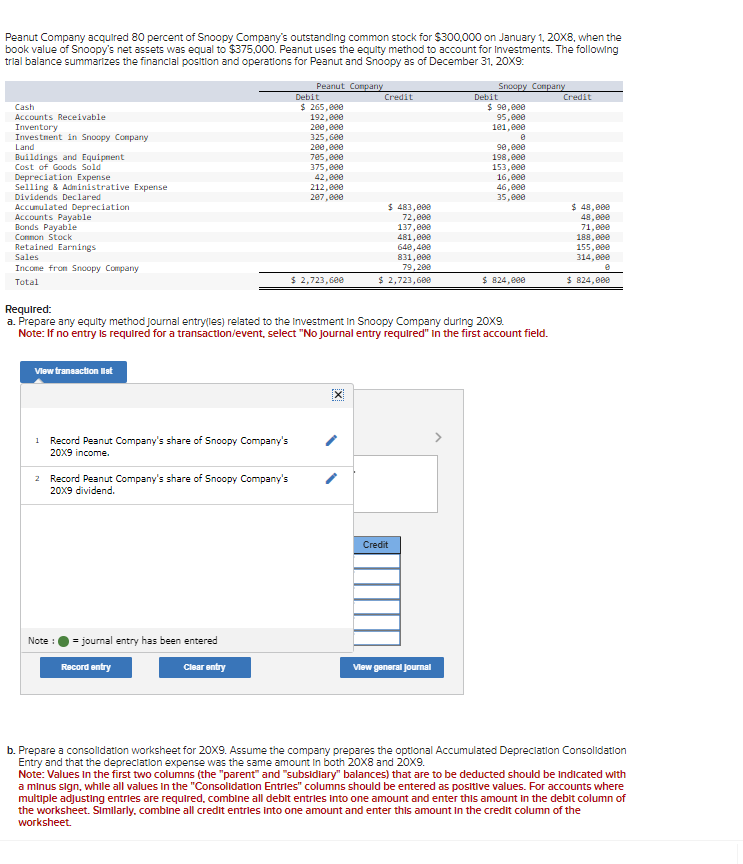

Peanut Company acquired 80 percent of Snoopy Company's outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $375,000. Peanut uses the equity method to account for Investments. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Required: Peanut Company Debit Credit $ 265,000 192,000 200,000 325,600 200,000 705,000 375,000 42,000 212,000 207,000 Snoopy Company Debit Credit $ 90,000 95,000 101,000 8 90,000 198,000 153,000 $ 483,000 72,000 16,000 46,000 35,000 $ 48,000 48,000 137,000 71,000 481,000 188,000 640,400 155,000 831,000 314,000 79,200 B $ 2,723,600 $ 2,723,600 $ 824,000 $ 824,000 a. Prepare any equity method journal entry(les) related to the Investment In Snoopy Company during 20X9. Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. View transaction Nat 1 Record Peanut Company's share of Snoopy Company's 20x9 income. 2 Record Peanut Company's share of Snoopy Company's 20X9 dividend. Note: = journal entry has been entered Record entry Credit Clear entry View general journal b. Prepare a consolidation worksheet for 20X9. Assume the company prepares the optional Accumulated Depreciation Consolidation Entry and that the depreciation expense was the same amount in both 20X8 and 20X9. Note: Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Peanut Company acquired 80 percent of Snoopy Company's outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $375,000. Peanut uses the equity method to account for Investments. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Required: Peanut Company Debit Credit $ 265,000 192,000 200,000 325,600 200,000 705,000 375,000 42,000 212,000 207,000 Snoopy Company Debit Credit $ 90,000 95,000 101,000 8 90,000 198,000 153,000 $ 483,000 72,000 16,000 46,000 35,000 $ 48,000 48,000 137,000 71,000 481,000 188,000 640,400 155,000 831,000 314,000 79,200 B $ 2,723,600 $ 2,723,600 $ 824,000 $ 824,000 a. Prepare any equity method journal entry(les) related to the Investment In Snoopy Company during 20X9. Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. View transaction Nat 1 Record Peanut Company's share of Snoopy Company's 20x9 income. 2 Record Peanut Company's share of Snoopy Company's 20X9 dividend. Note: = journal entry has been entered Record entry Credit Clear entry View general journal b. Prepare a consolidation worksheet for 20X9. Assume the company prepares the optional Accumulated Depreciation Consolidation Entry and that the depreciation expense was the same amount in both 20X8 and 20X9. Note: Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.

Expert Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0078025624

10th edition

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

Posted Date:

Students also viewed these accounting questions

-

tell us about a product or service that has been a hit by changing the product's target or the company's position. And why do you think it worked

-

A 5.72-g sample of graphite was heated with 68.4 g of O2 in a 8.00-L flask. The reaction that took place was C(graphite) + O2(g) CO2(g) After the reaction was complete, the temperature in the flask...

-

While valuing the equity of Rio National Corp. (from the previous problem), Katrina Shaar is considering the use of either cash flow from operations (CFO) or free cash flow to equity (FCFE) in her...

-

A BBB-rated corporate bond has a yield to maturity of 13.7%. A U.S. Treasury security has a yield to maturity of 11.7%. These yields are quoted as APRs with semiannual compounding. Both bonds pay...

-

Aaron Rivers, CPA, is auditing the financial statements of Charger Company, a client for the past five years. During past audits of Charger, Rivers identified some immaterial misstatements (most of...

-

Consider the following variant of the Cournot Model: Two firms simultaneously choose how much to produce and sell on the market. The inverse demand is given by P(Q) = 120-2Q. Firm 1's costs are given...

-

a. (2) A 0.50 kg cart moves on a straight horizontal track. The graph of velocity v versus time for the cart is given below. b. 0.8 0.6 0.4 0.2 -0.6 -0.8 v (m/s) 1.0 -0.2 -0.4 -1.0 0 10 20 Indicate...

-

Two carts are moving towards each other. Car A has a velocity of 1.0 m/s to the right, along the +x-direction and Cart B also has a velocity of 1.0 m/s to the left, along the -x-direction. Cart A has...

-

Replace the missing term: ______ management is the design and management of the flow of products, information, and funds through the network of all entities involved in the production and delivery of...

-

Jimmy is preparing a document that lists all the ledger accounts along with their ending balances. What is this document known as?

-

Define Emotional Intelligence and place its significance in the context of personal selling. Why are knowing and practicing emotional intelligence essential? Please provide an example or illustration...

-

When using statistical inventory reconciliation, how often must a precision tightness test be conducted on the UST system? Explain

-

Rocky bayou golf clubs, which uses the fifo method, has the following account balances at January 31, 2012, prior to releasing the financial statements for the year: inventory balance: $14,000 costs...

-

If you want to solve a minimization problem by applying the geometric method to the dual problem, how many variables and problem constraints must be in the original problem?

-

What is the ratio T f /T i for this process? A. 1/4 B. 1/2 C. 1 (no change) D. 2 E. 4 F. There is not enough information to decide. p (atm) 4 3- 2 1 0- 0 2 -V (m)

-

Jn Figure 12.22, by comparing the slope of the graph during the time the liquid water is warming to the slope as steam is warming, we can say that A. The specific heat of water is larger than that of...

-

An aluminum ring is tight around a solid iron rod. If we wish to loosen the ring to remove it from the rod, we should A. Increase the temperature of the ring and rod. B. Decrease the temperature of...

Study smarter with the SolutionInn App