Question: PepsiCo's Asset Analysis Using the Above Data EXHIBIT 3 Balance Sheet Assets 2008 (in millions except share amounts) ASSETS Current Assets Cash and cash equivalents

PepsiCo's Asset Analysis Using the Above Data

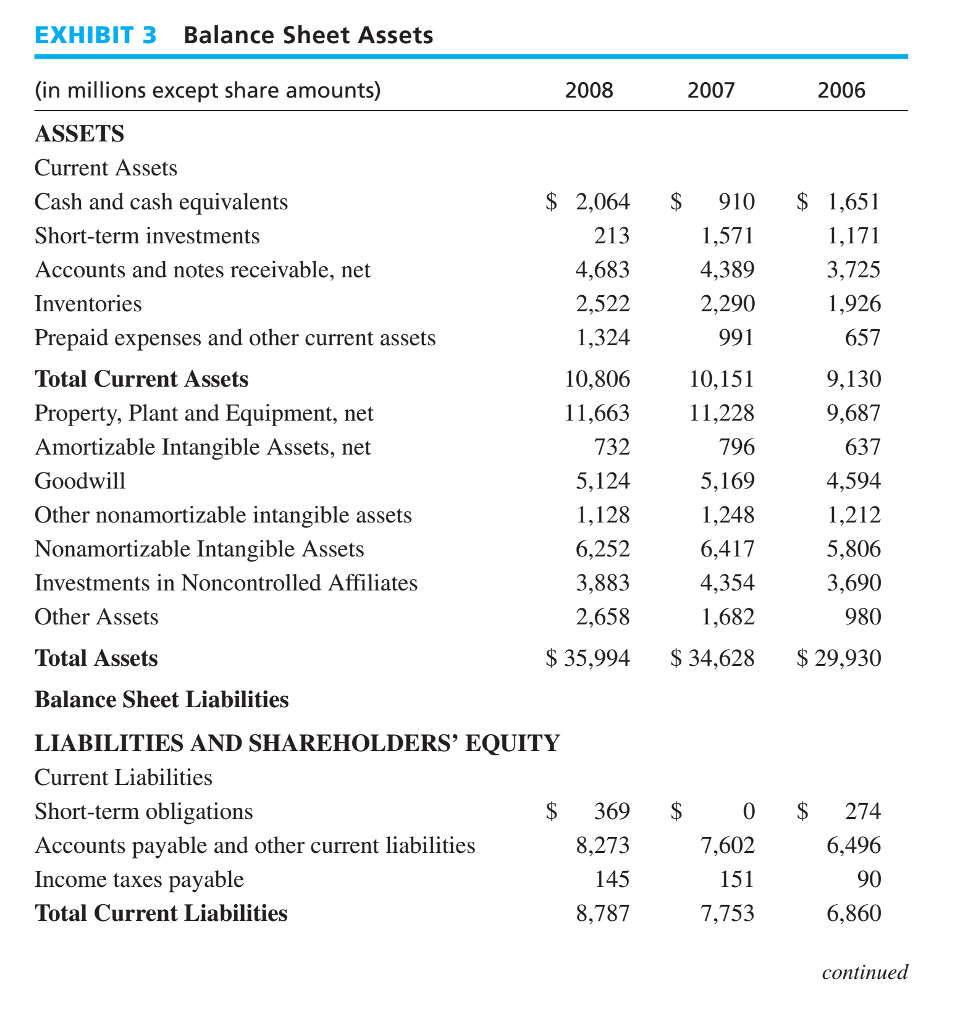

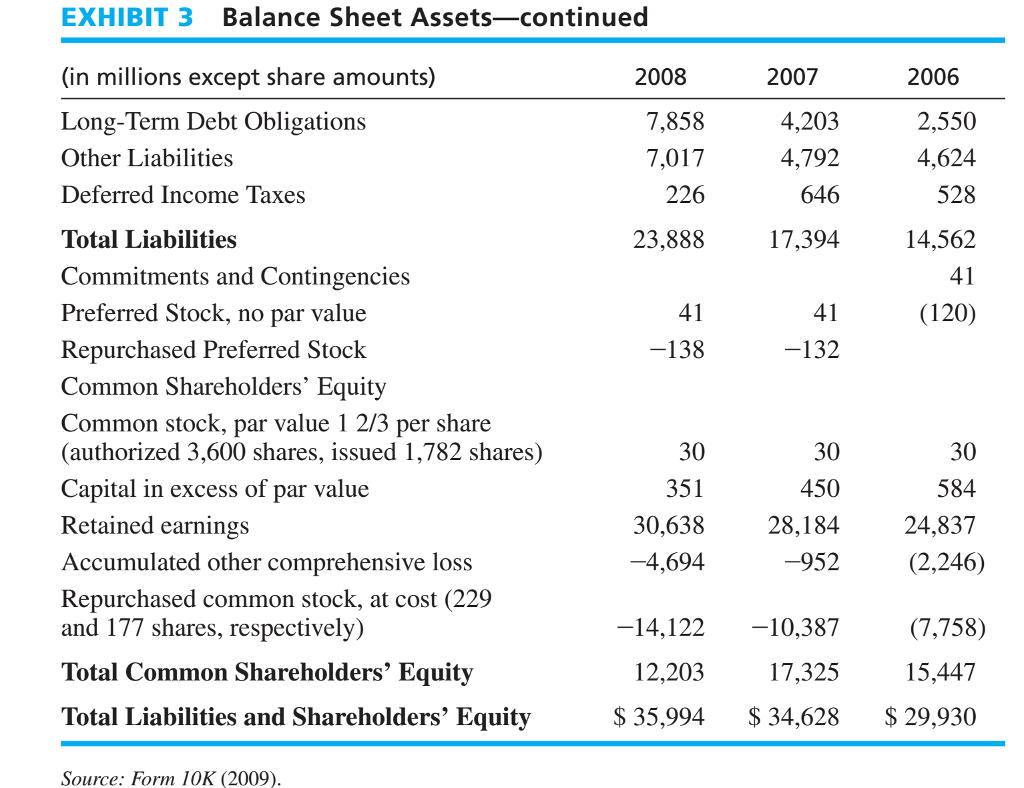

EXHIBIT 3 Balance Sheet Assets 2008 (in millions except share amounts) ASSETS Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable, net Inventories 2007 2006 repaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Other nonamortizable intangible assets Nonamortizable Intangible Assets Investments in Noncontrolled Affiliates Other Assets Total Assets Balance Sheet Liabilities LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Short-term obligations Accounts pavable and other current liabilities Income taxes payable Total Current Liabilities $ 2,064 $ 910 1,651 1,171 3,725 1,926 657 9,130 9,687 637 4,594 1,212 5,806 3,690 980 $35,994 34,628 29,930 213 4,683 2,522 1,324 10,806 11,663 732 5,124 1,128 6,252 3,883 2,658 1,571 4,389 2,290 991 10,151 11,228 796 5,169 1,248 6,417 4,354 1,682 $369$ 8,273 145 8,787 7,602 151 7,753 0 $ 274 6,496 90 6,860 continued EXHIBIT 3 Balance Sheet Assets 2008 (in millions except share amounts) ASSETS Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable, net Inventories 2007 2006 repaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Other nonamortizable intangible assets Nonamortizable Intangible Assets Investments in Noncontrolled Affiliates Other Assets Total Assets Balance Sheet Liabilities LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Short-term obligations Accounts pavable and other current liabilities Income taxes payable Total Current Liabilities $ 2,064 $ 910 1,651 1,171 3,725 1,926 657 9,130 9,687 637 4,594 1,212 5,806 3,690 980 $35,994 34,628 29,930 213 4,683 2,522 1,324 10,806 11,663 732 5,124 1,128 6,252 3,883 2,658 1,571 4,389 2,290 991 10,151 11,228 796 5,169 1,248 6,417 4,354 1,682 $369$ 8,273 145 8,787 7,602 151 7,753 0 $ 274 6,496 90 6,860 continued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts