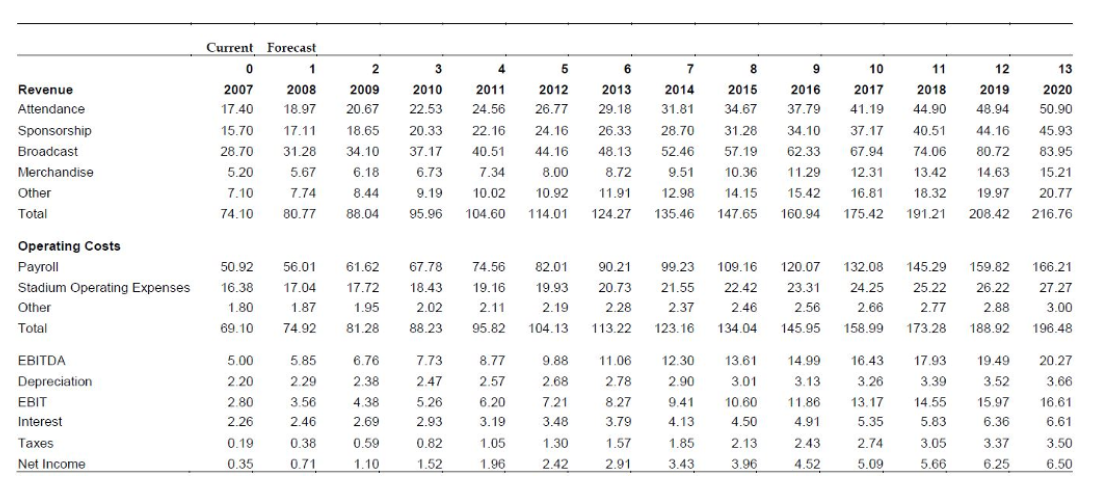

Question: Perform a DCF analysis using the cash flow projections in Exhibit 5 of the case.Calculate the NPV and determine the overall value of Tottenham.At its

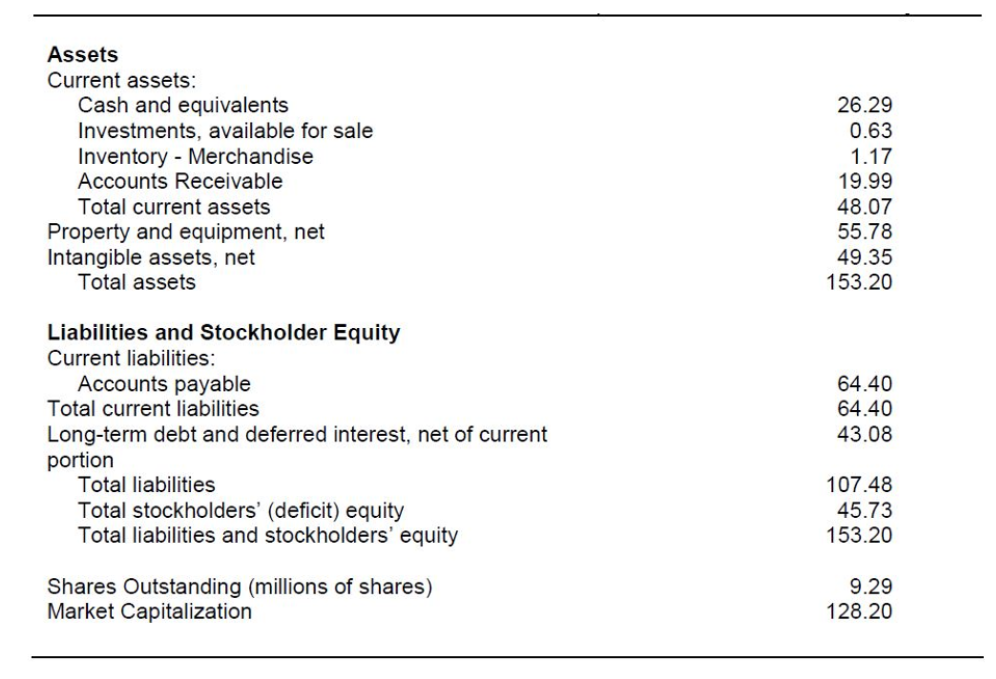

Perform a DCF analysis using the cash flow projections in Exhibit 5 of the case.Calculate the NPV and determine the overall value of Tottenham.At its current stock price of $13.80, is Tottenham fairly valued?

Please answer the following questions with financial support for each scenario and put the answers in excel.

1.Using a DCF/NPV approach, provide your recommendation to management regarding each of the following decisions/scenarios:

Scenario 1: Build the new stadium and do not sign the new striker

The major assumptions behind building a new stadium include:

- We assume 2007 is year 0 and discount all cash flows back to their 2007 values

- Increase of attendance revenue by 40% vs forecasted in base case scenario

- Increase in sponsorship revenue by 20% vs forecasted in base case scenario

- Increase in stadium opex by 14% vs forecast in base case scenario

- We assume the stadium starts getting built in 2008 and as a result capex depreciation of the

stadium begins from 2010 (i.e., once the stadium is completed) and depreciates to 0 by 2019 (10

years from completion)

- Maintenance capex and depreciation of maintenance Capex growing at 4% per year- same as base

case scenario

Scenario 2: Sign the new striker but do not build the new stadium

The major assumptions behind building a new stadium include:

We assume 2007 is year 0 and discount all cash flows back to their 2007 values

- The capped revenue increase of 5% due to stadium size limit ( of 24% * 80%) during the years

the player plays. We also multiply this by the probability of having a healthy player to get the

expected revenue.

- 52 week year with a the player salary increasing at 10% per year from 2009

- A tax deductible transfer fee of 20M

Scenario 3: Build the new stadium and sign the new striker

The major assumptions behind the scenario of building a new stadium and recruiting a new striker include

the following:

- We assume 2008 is year 0 and discount all cash flows back to their 2008 values

- A full overall revenue increase of 24%* 80% (We also multiply this by the probability of having

a healthy player to get the expected revenue) during the year the player plays.

- Increase of attendance revenue by 40% vs forecasted in base case scenario

- Increase in sponsorship revenue by 20% vs forecasted in base case scenario

- We use the same two Capex and capex depreciation assumptions from scenario 1

- A tax deductible transfer fee of 20M

2.What would be the impacting stock price in scenarios a, b, and c above?

3.If you do not agree with the projections/assumptions in the case or below, what would you change and why?How would it impact the outcome, and ultimately, your recommendation?

Some additional notes/hints:

1.Keep money in

2.NPV = Enterprise value

3.Assume Net W/C increases at same rate as total revenue

4.Assume market premium = 5%

5.Assume interest rate on debt = 6.4%

6.For every 1% increase in points, revenue increases by 1.52%.

7.New striker is expected to increase net points by 16%. (note: can ignore other comments related to relative performance, team rankings, etc.)

8.Assume funding available at current cost of capital. We will discuss capital decision making in a couple weeks.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts