Question: Perform a financial analysis for a project using the format discussed in the course. Assume the projected costs and benefits for this project are spread

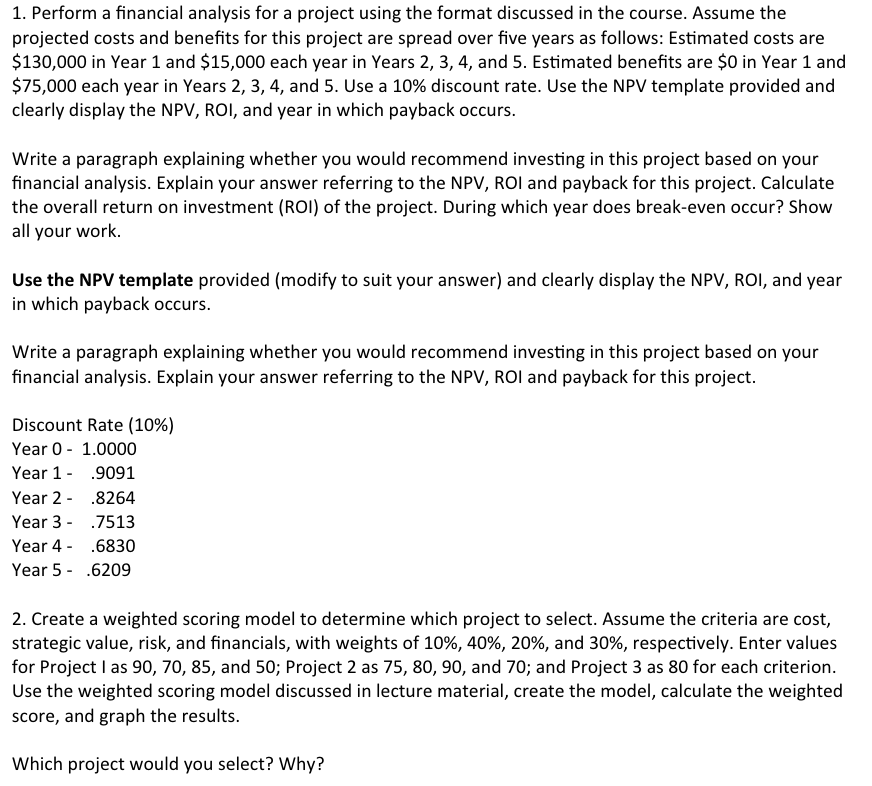

Perform a financial analysis for a project using the format discussed in the course. Assume the

projected costs and benefits for this project are spread over five years as follows: Estimated costs are

$ in Year and $ each year in Years and Estimated benefits are $ in Year and

$ each year in Years and Use a discount rate. Use the NPV template provided and

clearly display the NPV ROI, and year in which payback occurs.

Write a paragraph explaining whether you would recommend investing in this project based on your

financial analysis. Explain your answer referring to the NPV ROI and payback for this project. Calculate

the overall return on investment ROI of the project. During which year does breakeven occur? Show

all your work.

Use the NPV template provided modify to suit your answer and clearly display the NPV ROI, and year

in which payback occurs.

Write a paragraph explaining whether you would recommend investing in this project based on your

financial analysis. Explain your answer referring to the NPV ROI and payback for this project.

Discount Rate

Year

Year

Year

Year

Year

Year

Create a weighted scoring model to determine which project to select. Assume the criteria are cost,

strategic value, risk, and financials, with weights of and respectively. Enter values

for Project I as and ; Project as and ; and Project as for each criterion.

Use the weighted scoring model discussed in lecture material, create the model, calculate the weighted

score, and graph the results.

Which project would you select? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock