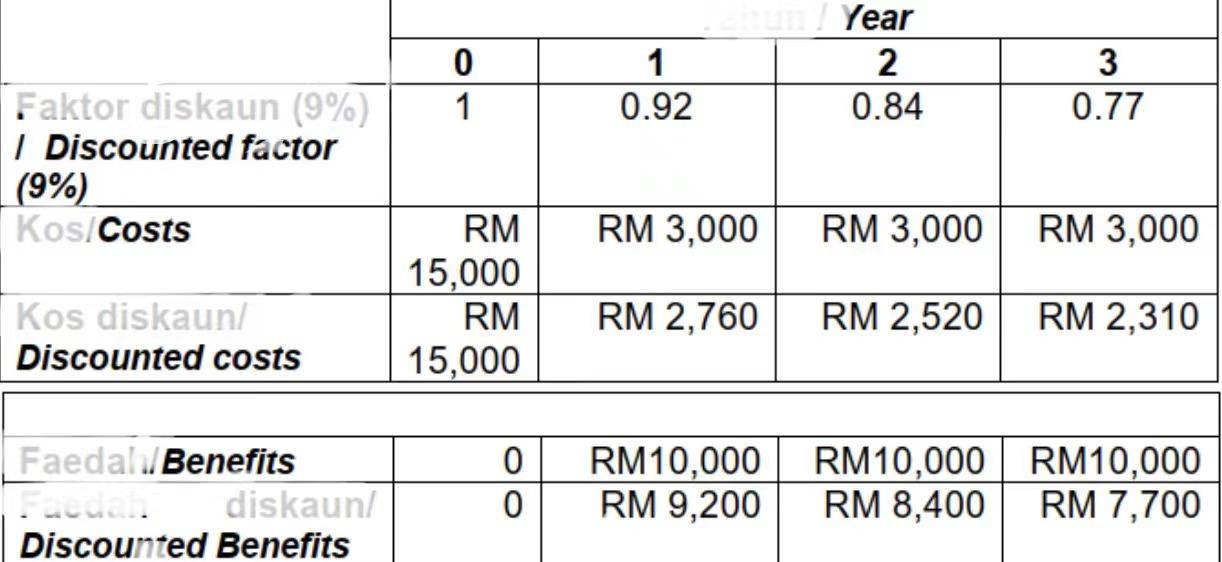

Question: Perform financial analysis for Project XYZ using NPV. Assume the projected costs and benefits of this project are spread over four years, as shown in

Perform financial analysis for Project XYZ using NPV. Assume the projected costs and benefits of this project are spread over four years, as shown in Table 2. Calculate the NPV and decide whether you would recommend investing in this project based on the financial analysis. Which is right

(1 ) NPV is positive and payback does occur. Based on the financial analysis, this project is a good investment

(2) NPV is zero. Based on the financial analysis, the project is not an attractive investment because it won't produce any positive cash flow once accounted for the initial investment.

(3) NPV is negative and payback does not occur. Based on the financial analysis, this project is a bad investment.

(4) NPV is positive and payback does occur. Based on the financial analysis, this project is a good investment.

0 1 1 0.92 Year 2 0.84 3 0.77 Faktor diskaun (9%) | Discounted factor (9%) Kos Costs RM 3,000 RM 3,000 RM 3,000 RM 15,000 RM 15,000 RM 2,760 RM 2,520 RM 2,310 Kos diskaun/ Discounted costs Faedal. Benefits TE diskaun/ Discounted Benefits 0 0 RM10,000 RM 9,200 RM10,000 RM10,000 RM 8,400 RM 7,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts