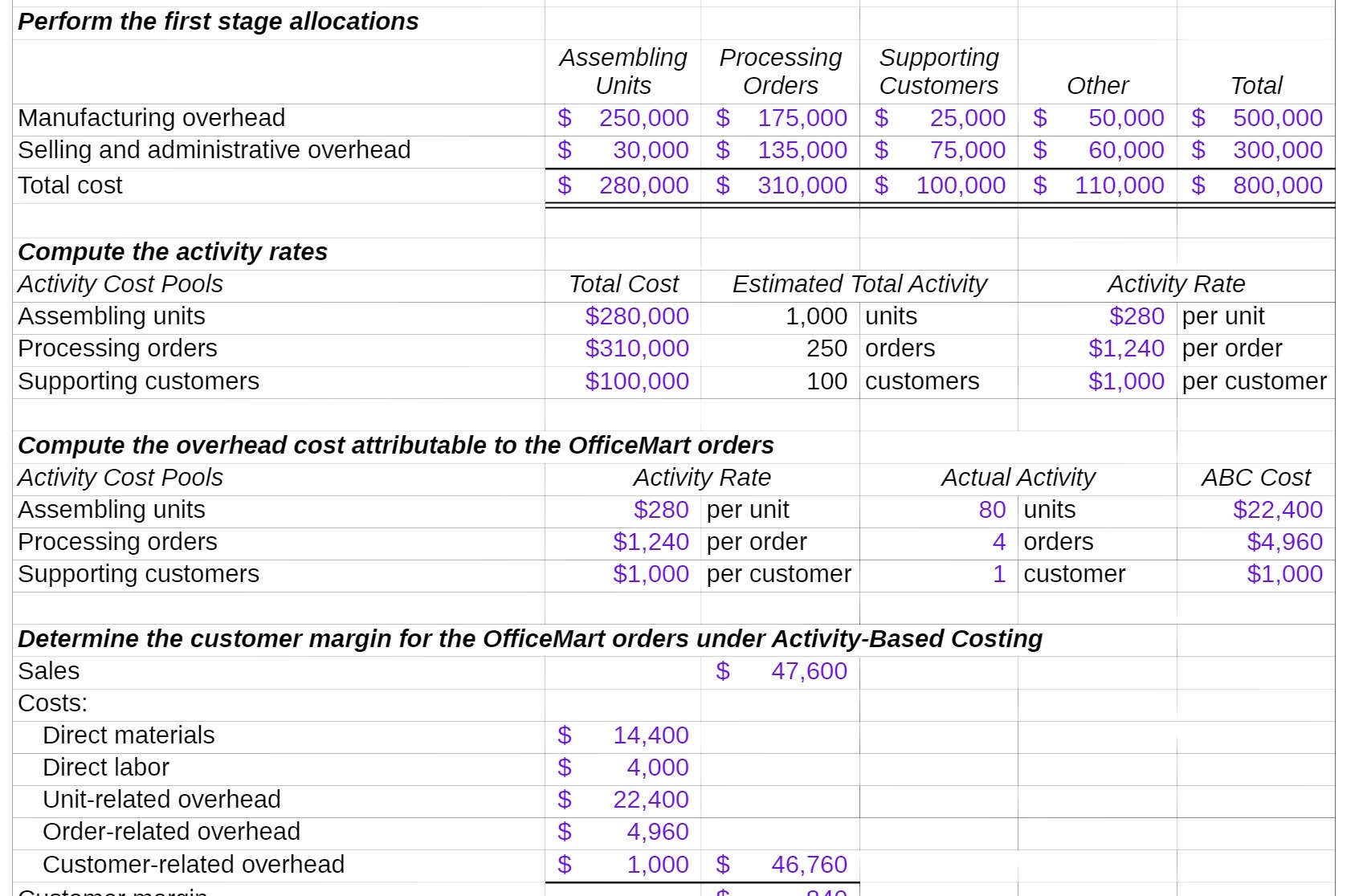

Question: Perform the first stage allocations l Assembling Processing Supporting Units Orders Customers Other Total Manufacturing overhead $ 250,000 $ 175,000 $ 25,000 $ 50,000 $

Perform the first stage allocations l Assembling Processing Supporting Units Orders Customers Other Total Manufacturing overhead $ 250,000 $ 175,000 $ 25,000 $ 50,000 $ 500,000 Selling and administrative overhead $ 30,000 $ 135,000 $ 75,000 $ 60,000 $ 300,000 Total cost $ 280,000 $ 310,000 $ 100,000 $ 110,000 $ 800,000 Compute the activity rates ' Activity Cost Pools ' Total Cost Estimated TotalActivily Activity Rate Assembling units ' $280,000 1,000 units $280 per unit Processing orders ' $310,000" 250 orders $1,240 per order Supporting customers $100,000 100 customers $1,000 per customer Compute the overhead cost attributable to the OfficeMart orders Activity Cost Pools l Activity Rate Actual Activity ABC Cost Assembling units ' $280 'per unit 80 units $22,400 Processing orders ' $1,240 per order 4 orders $4,960 Supporting customers $1,000 per customer 1 customer $1,000 Determine the customer margin for the OfficeMart orders under Activity-Based Costing Sales $ 47,600 Costs: ' Direct materials 35 14,400 _ Direct labor $ 4,000 Unitrelated overhead $ 22,400 Orderrelated overhead $ 4,960 Customer-related overhead $ 1,000 I $ 46,760 .._au_..._.._. ..... rh nan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts