Question: Periodic Method**** OWL Question for Unit 5-1 Inventory costing methods Question Status: ? ? 2 5. 8:15 PM 2 Here's a similar problem. Note that

Periodic Method****

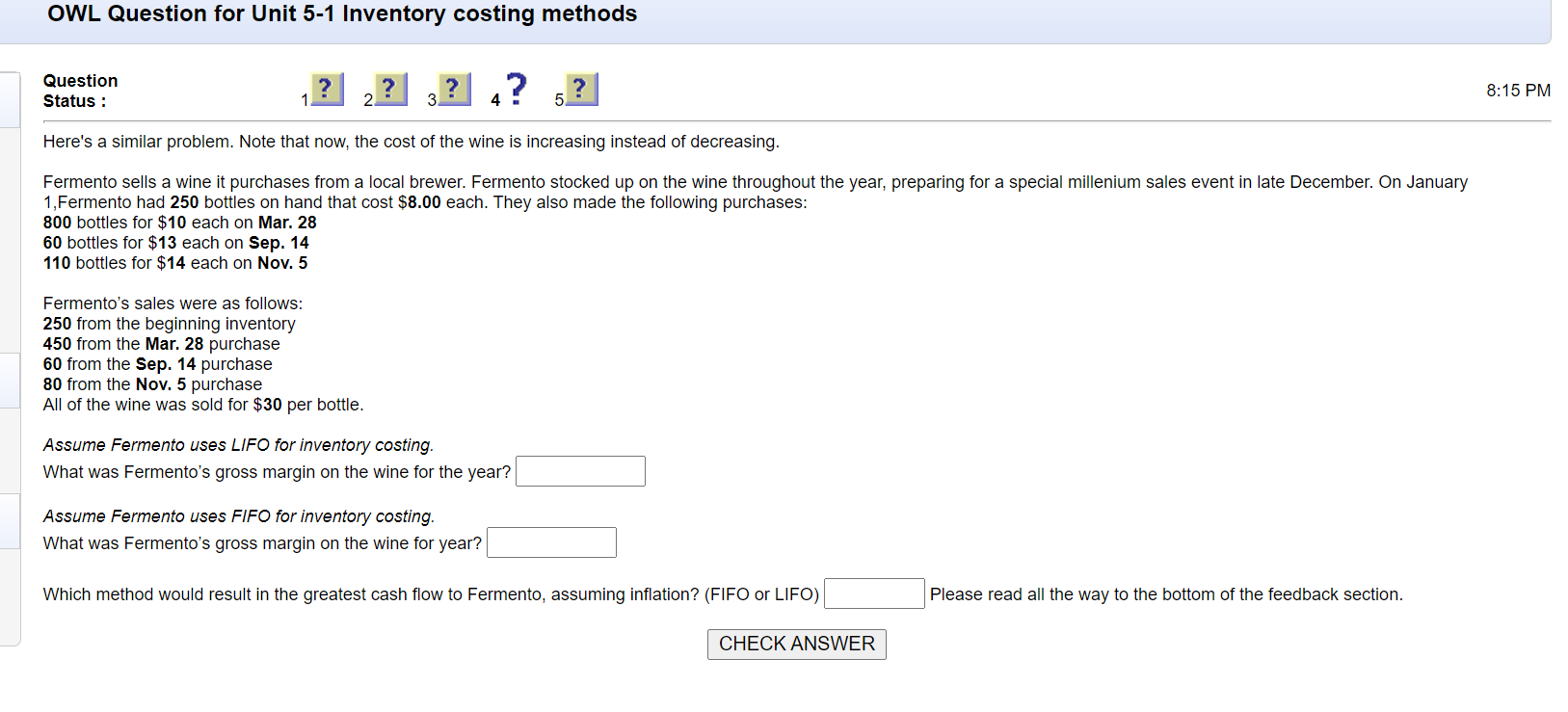

OWL Question for Unit 5-1 Inventory costing methods Question Status: ? ? 2 5. 8:15 PM 2 Here's a similar problem. Note that now, the cost of the wine is increasing instead of decreasing. Fermento sells a wine it purchases from a local brewer. Fermento stocked up on the wine throughout the year, preparing for a special millenium sales event in late December. On January 1,Fermento had 250 bottles on hand that cost $8.00 each. They also made the following purchases: 800 bottles for $10 each on Mar. 28 60 bottles for $13 each on Sep. 14 110 bottles for $14 each on Nov. 5 Fermento's sales were as follows: 250 from the beginning inventory 450 from the Mar. 28 purchase 60 from the Sep. 14 purchase 80 from the Nov. 5 purchase All of the wine was sold for $30 per bottle. Assume Fermento uses LIFO for inventory costing. What was Fermento's gross margin on the wine for the year? Assume Fermento uses FIFO for inventory costing. What was Fermento's gross margin on the wine for year? Which method would result in the greatest cash flow to Fermento, assuming inflation? (FIFO or LIFO) Please read all the way to the bottom of the feedback section. CHECK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts