Question: Periodic Method ** Question Status: ? ? 8:13 PM 1 2 THE OWL PROBLEMS WILL ASSUME USE OF THE PERIODIC METHOD. (All sales are treated

Periodic Method **

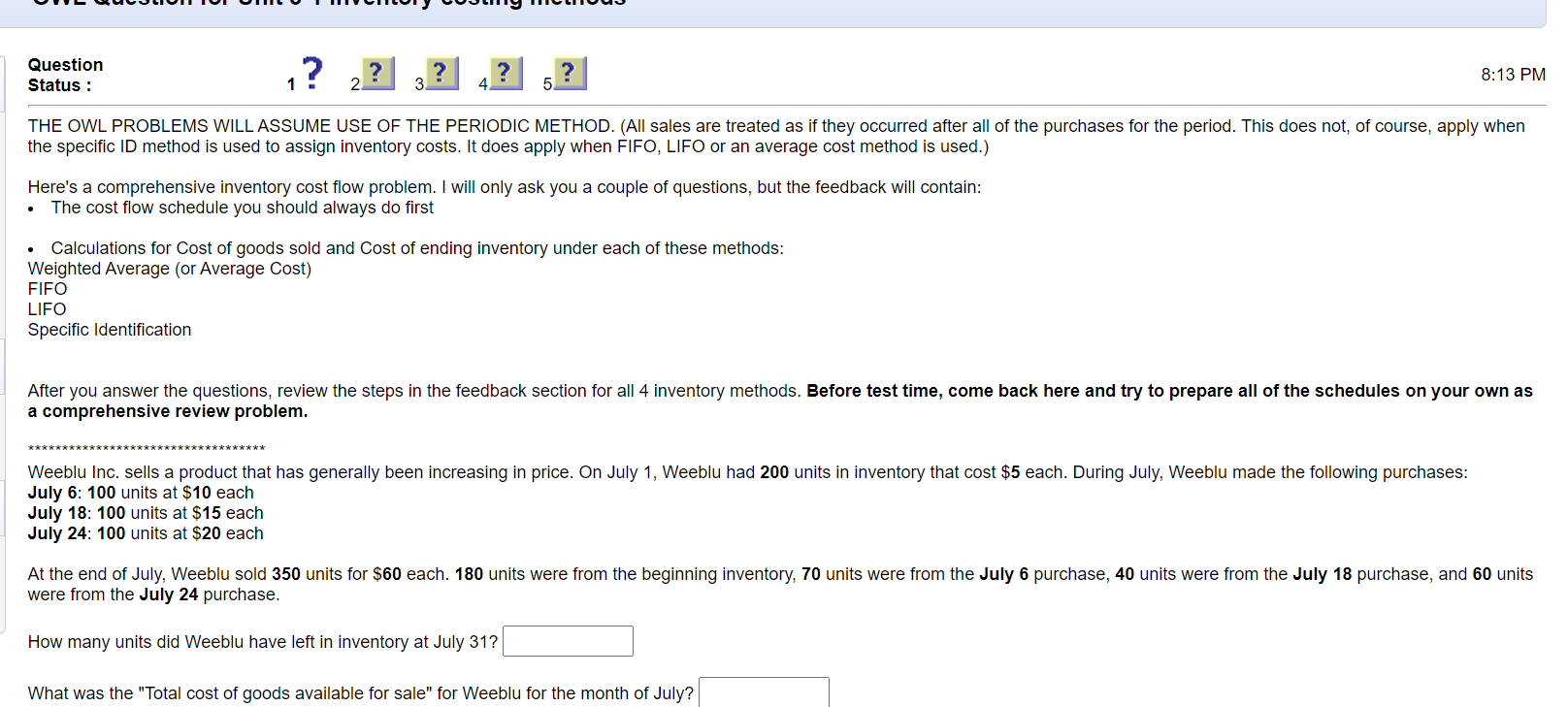

Question Status: ? ? 8:13 PM 1 2 THE OWL PROBLEMS WILL ASSUME USE OF THE PERIODIC METHOD. (All sales are treated as if they occurred after all of the purchases for the period. This does not, of course, apply when the specific ID method is used to assign inventory costs. It does apply when FIFO, LIFO or an average cost method is used.) Here's a comprehensive inventory cost flow problem. I will only ask you a couple of questions, but the feedback will contain: The cost flow schedule you should always do first Calculations for Cost of goods sold and Cost of ending inventory under each of these methods: Weighted Average (or Average Cost) FIFO LIFO Specific Identification After you answer the questions, review the steps in the feedback section for all 4 inventory methods. Before test time, come back here and try to prepare all of the schedules on your own as a comprehensive review problem. Weeblu Inc. sells a product that has generally been increasing in price. On July 1, Weeblu had 200 units in inventory that cost $5 each. During July, Weeblu made the following purchases: July 6: 100 units at $10 each July 18: 100 units at $15 each July 24: 100 units at $20 each At the end of July, Weeblu sold 350 units for $60 each. 180 units were from the beginning inventory, 70 units were from the July 6 purchase, 40 units were from the July 18 purchase, and 60 units were from the July 24 purchase. How many units did Weeblu have left in inventory at July 31? What was the "Total cost of goods available for sale" for Weeblu for the month of July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts