Question: Peter, Paul and Mary own 4 0 % , 4 0 % and 2 0 % of Brookfield Properties LLC . In

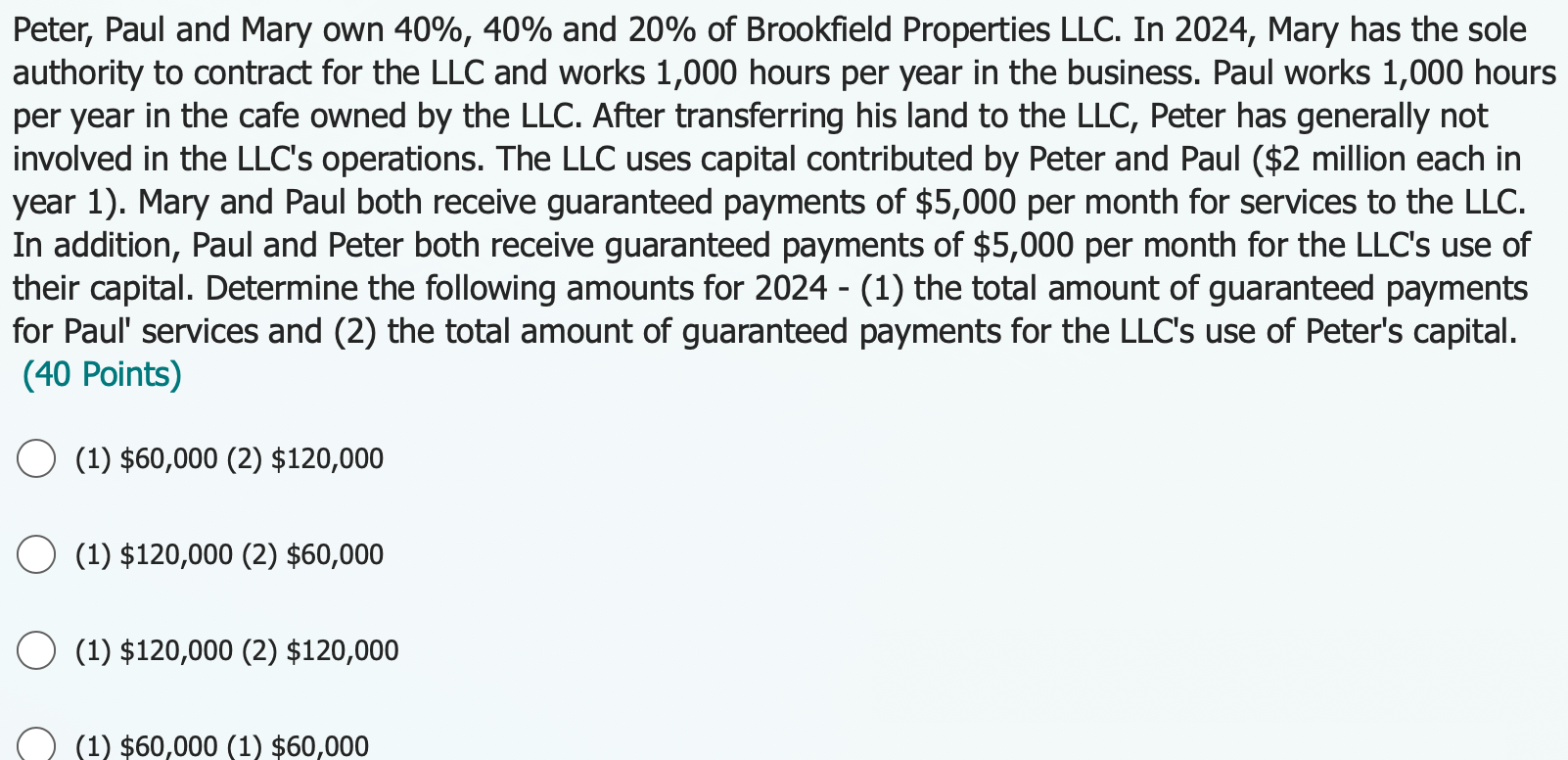

Peter, Paul and Mary own and of Brookfield Properties LLC In Mary has the sole authority to contract for the LLC and works hours per year in the business. Paul works hours per year in the cafe owned by the LLC After transferring his land to the LLC Peter has generally not involved in the LLCs operations. The LLC uses capital contributed by Peter and Paul $ million each in year Mary and Paul both receive guaranteed payments of $ per month for services to the LLC In addition, Paul and Peter both receive guaranteed payments of $ per month for the LLCs use of their capital. Determine the following amounts for the total amount of guaranteed payments for Paul' services and the total amount of guaranteed payments for the LLCs use of Peter's capital. Points

$

$

$

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock