Question: Peterrose Software Inc. has assembled the following data for the year ended December 31, 2020. (Click the icon to view the current accounts.) (Click the

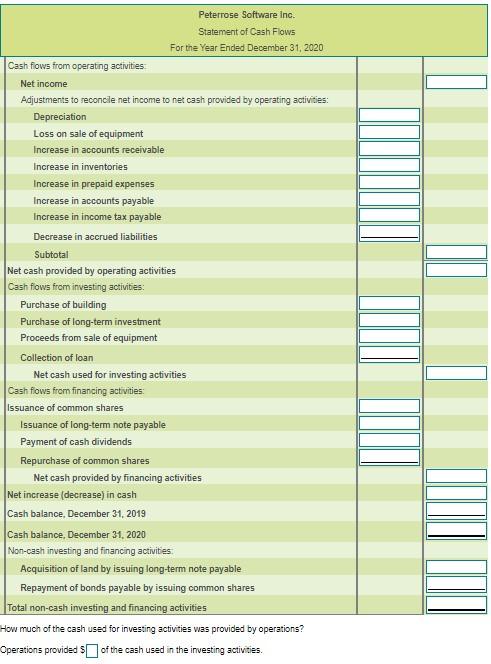

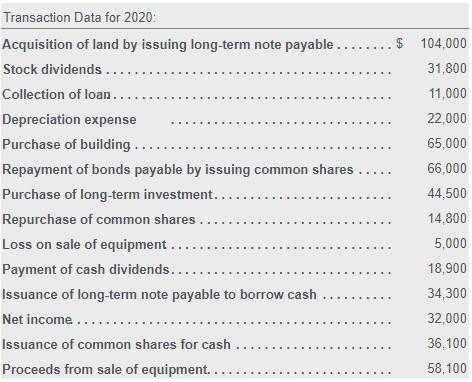

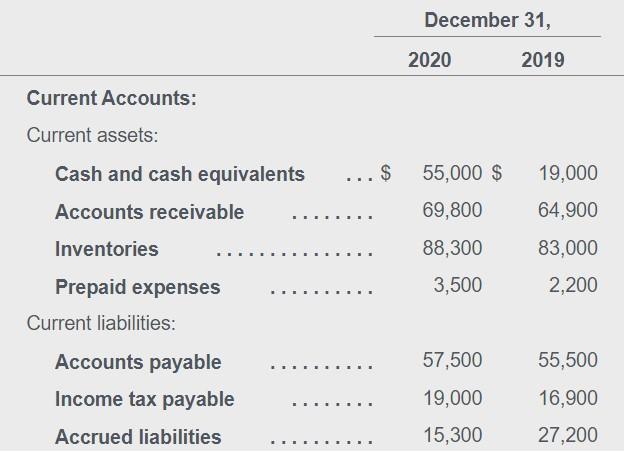

Peterrose Software Inc. has assembled the following data for the year ended December 31, 2020. (Click the icon to view the current accounts.) (Click the icon to view the transaction data.) Requirement Prepare Peterrose Software Inc.'s statement of cash flows using the indirect method to report operating activities. Include an accompanying schedule of non-cash investing and financing activities. How much of the cash used for investing activities was provided by operations? Start by completing the cash flows from operating activities. Then, continue with completing the investing and financing activities sections. Finally, determine the net increase (decrease) in cash. (Use a minus sign or parentheses for subtracting numbers that are typically shown enclosed in parentheses in a statement of cash flows.) Peterrose Software Inc. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Loss on sale of equipment Increase in accounts receivable Increase in inventories Increase in prepaid expenses Increase in accounts payable Increase in income tax payable Decrease in accrued liabilities Subtotal Net cash provided by operating activities Cash flows from investing activities: Purchase of building Purchase of long-term investment Proceeds from sale of equipment Collection of loan Net cash used for investing activities Cash flows from financing activities: Issuance of common shares Issuance of long-term note payable Payment of cash dividends Repurchase of common shares Net cash provided by financing activities Net increase (decrease) in cash Cash balance, December 31, 2019 Cash balance, December 31, 2020 Non-cash investing and financing activities Acquisition of land by issuing long-term note payable Repayment of bonds payable by issuing common shares Total non-cash investing and financing activities How much of the cash used for investing activities was provided by operations? Operations provided of the cash used in the investing activities. Transaction Data for 2020: Acquisition of land by issuing long-term note payable. $ 104,000 Stock dividends... 31,800 Collection of loan.. 11,000 Depreciation expense 22,000 Purchase of building. 65,000 Repayment of bonds payable by issuing common shares ..... 66,000 Purchase of long-term investment.... 44,500 Repurchase of common shares 14,800 Loss on sale of equipment. 5.000 Payment of cash dividends... 18,900 Issuance of long-term note payable to borrow cash 34,300 Net income 32,000 Issuance of common shares for cash. 36.100 Proceeds from sale of equipment..... 58,100 December 31, 2020 2019 Current Accounts: Current assets: Cash and cash equivalents ..$ 55,000 $ 19,000 Accounts receivable 69,800 64,900 Inventories 88,300 83,000 3,500 2,200 Prepaid expenses Current liabilities: 57,500 55,500 Accounts payable Income tax payable 19,000 16,900 Accrued liabilities 15,300 27,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts