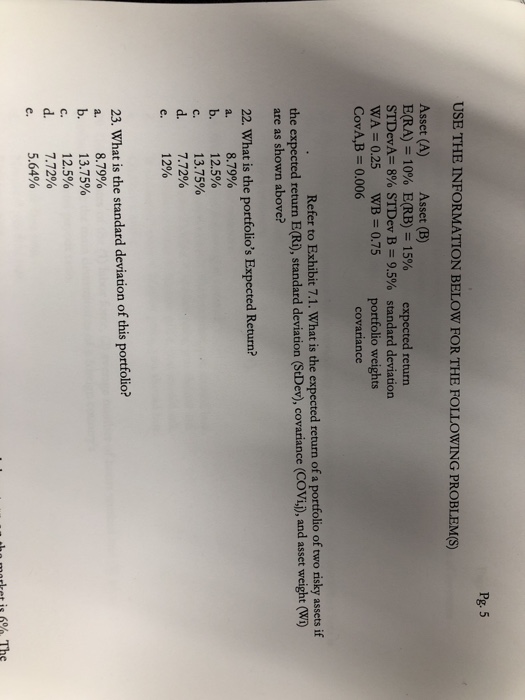

Question: Pg. 5 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S Asset (A)Asset (B) E(RA) = 10% E(RB) = 15% expected return STDevA= 8% STDev B=

Pg. 5 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S Asset (A)Asset (B) E(RA) = 10% E(RB) = 15% expected return STDevA= 8% STDev B= 9.5% standard deviation WA = 0.25 WB = 0.75 portfolio weights CovA,B = 0.006 covariance Refer to Exhibit 7.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (StDev) are as shown above? Vij), and asset weight (W) 22. What is the portfolio's Expected Return? a, 8.79% b. 12.5% c. 13.75% 7 72% 12% 23. What is the standard deviation of this portfolio? 8.79% 13.75% 12.5% 7.72% 5.64% 2 . d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts