Question: QUESTION 34 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Asset (A) Asset (B) E(RA) = 10% E(RB) = 15% expected return STDevA= 8% STDev

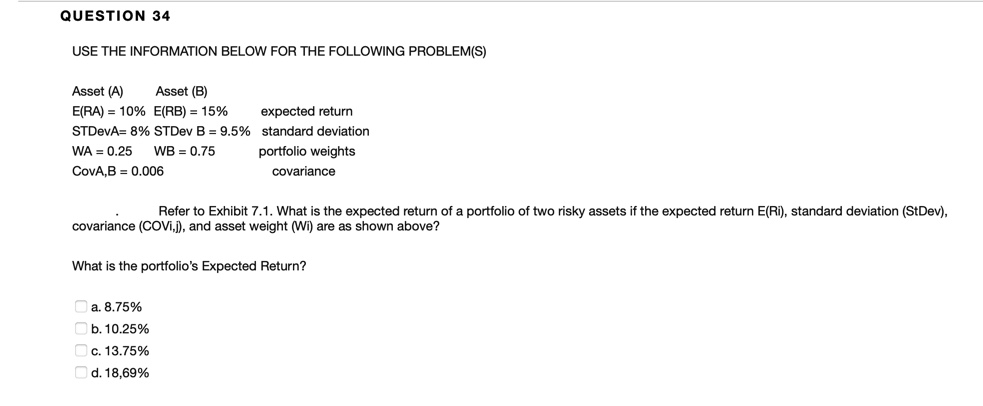

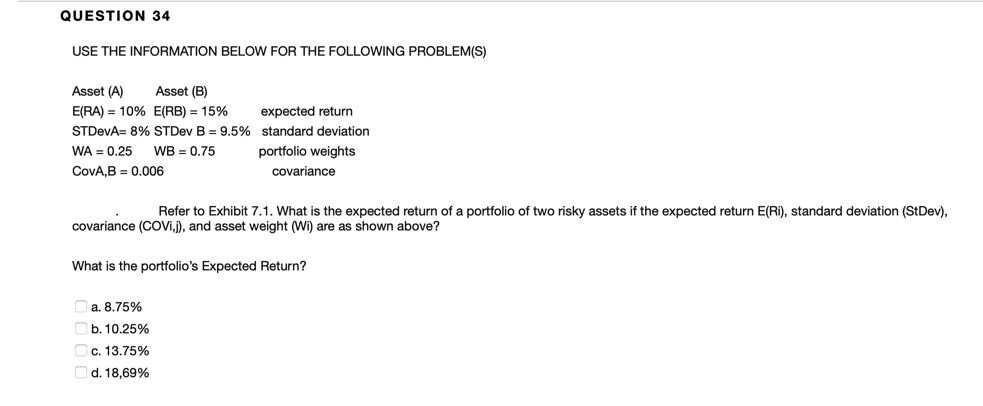

QUESTION 34 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Asset (A) Asset (B) E(RA) = 10% E(RB) = 15% expected return STDevA= 8% STDev B = 9.5% standard deviation WA = 0.25 WB = 0.75 portfolio weights COVA,B = 0.006 covariance Refer to Exhibit 7.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (StDev), covariance (COVi,j), and asset weight (Wi) are as shown above? What is the portfolio's Expected Return? a. 8.75% b. 10.25% O c. 13.75% Od. 18,69%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts