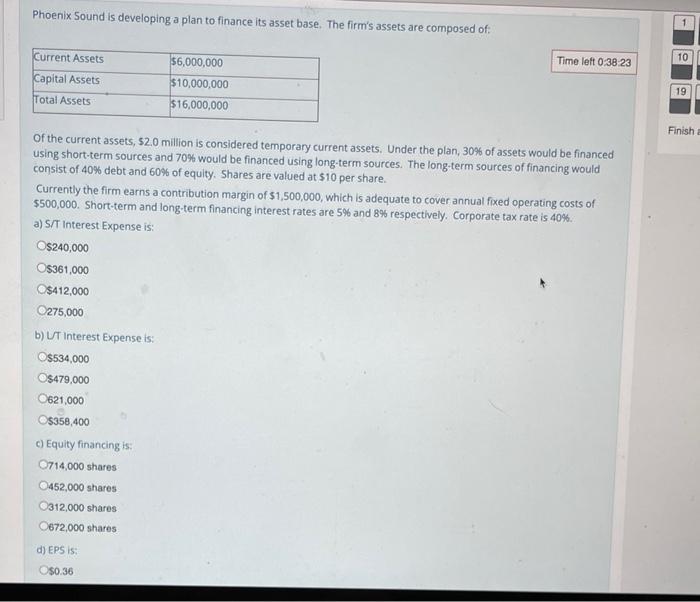

Question: | Phoenix sound is developing a plan to finance its asset base. The firm's assets are composed of 1 Current Assets Time left 0:38.23 TO

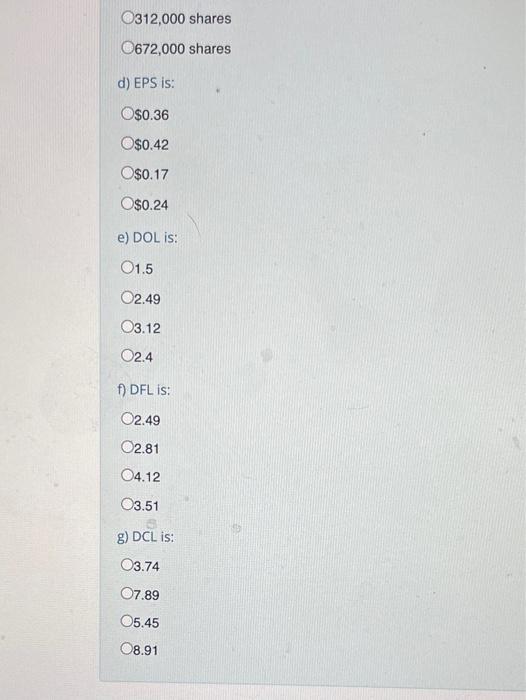

| Phoenix sound is developing a plan to finance its asset base. The firm's assets are composed of 1 Current Assets Time left 0:38.23 TO Capital Assets Total Assets 56,000,000 $10.000.000 $16,000,000 19. Finish of the current assets, $2.0 milion is considered temporary current assets. Under the plar, 30% of assets would be financed using short-term sources and 70% would be financed using long-term sources. The long-term sources of financing would consist of 40% debt and box of equity shares are valued at sia per share. Currently the firm earns a contribution margin of $1,500,000, which is adequate to cover annual fixed operating costs of $500,000. short-term and long-term financing interest rates are 5% and 59s respectively, Corporate tax rate is 40%. al sat Interest Expense is. O$240,000 O$361,000 $412,000 O275,000 b) T Interest Expense is: O$534.000 O$479,000 0621,000 $358,400 c) Equity financing is 0714,000 shares 452,000 shares 0312,000 shares 0672,000 shares d) EPS IS $0.36 0312,000 shares 0672,000 shares d) EPS is: $0.36 O$0.42 $0.17 $0.24 e) DOL is: 01.5 O2.49 03.12 2.4 f) DFL is: O2.49 2.81 04.12 3.51 g) DCL is: 3.74 O7.89 05.45 08.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts