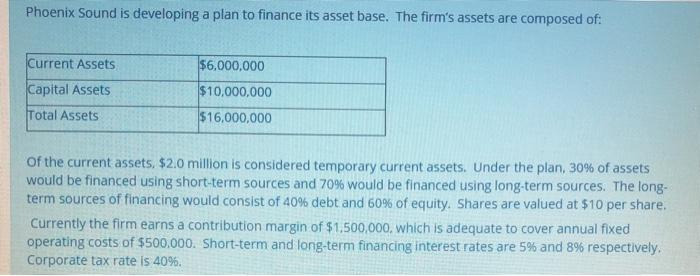

Question: Phoenix Sound is developing a plan to finance its asset base. The firm's assets are composed of: $6,000,000 Current Assets Capital Assets Total Assets $10,000,000

Phoenix Sound is developing a plan to finance its asset base. The firm's assets are composed of: $6,000,000 Current Assets Capital Assets Total Assets $10,000,000 $16,000,000 of the current assets. $2.0 million is considered temporary current assets. Under the plan, 30% of assets would be financed using short-term sources and 70% would be financed using long-term sources. The long- term sources of financing would consist of 40% debt and 60% of equity. Shares are valued at $10 per share. Currently the firm earns a contribution margin of $1,500,000, which is adequate to cover annual fixed operating costs of $500.000. Short-term and long-term financing interest rates are 5% and 8% respectively. Corporate tax rate is 40%. Phoenix Sound is developing a plan to finance its asset base. The firm's assets are composed of: $6,000,000 Current Assets Capital Assets Total Assets $10,000,000 $16,000,000 of the current assets. $2.0 million is considered temporary current assets. Under the plan, 30% of assets would be financed using short-term sources and 70% would be financed using long-term sources. The long- term sources of financing would consist of 40% debt and 60% of equity. Shares are valued at $10 per share. Currently the firm earns a contribution margin of $1,500,000, which is adequate to cover annual fixed operating costs of $500.000. Short-term and long-term financing interest rates are 5% and 8% respectively. Corporate tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts