Question: Phyllo Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $26,000 per year and have a

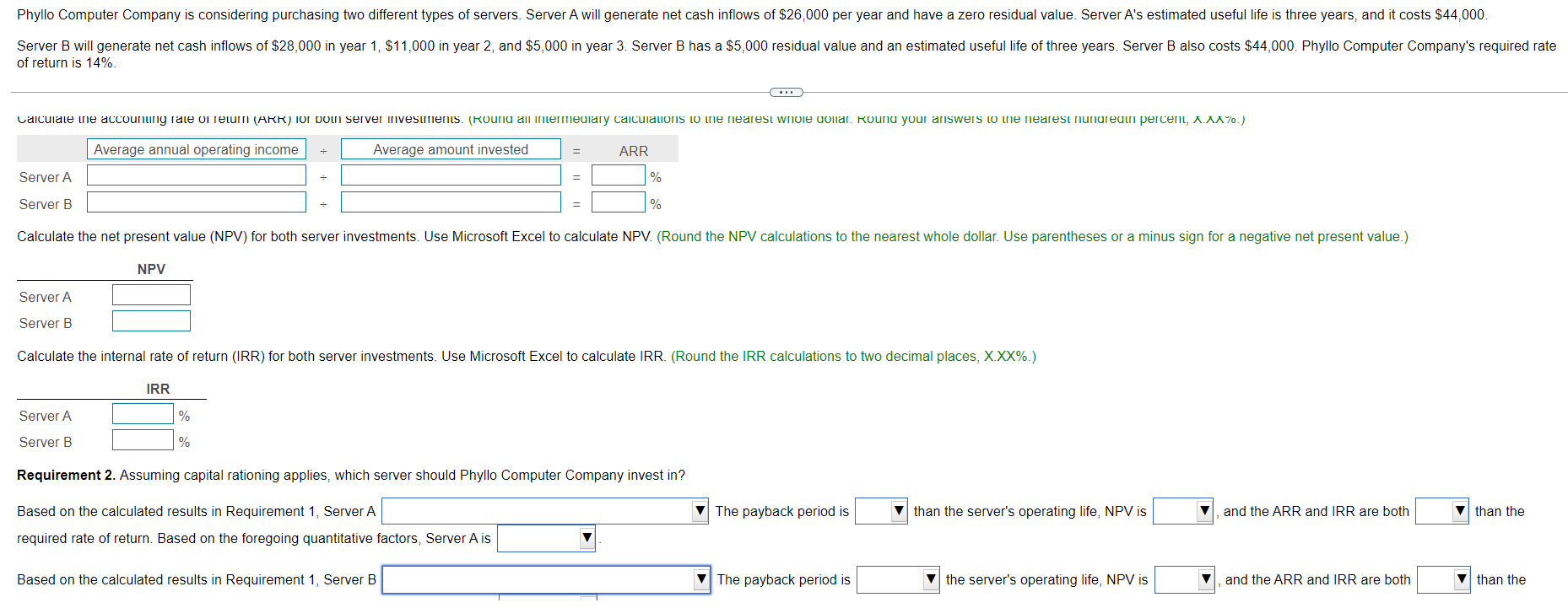

Phyllo Computer Company is considering purchasing two different types of servers. Server A will generate net cash inflows of $26,000 per year and have a zero residual value. Server A's estimated useful life is three years, and it costs $44,000. Server B will generate net cash inflows of $28,000 in year 1, $11,000 in year 2, and $5,000 in year 3. Server B has a $5,000 residual value and an estimated useful life of three years. Server B also costs $44,000. Phyllo Computer Company's required rate of return is 14%. ... Calculate the accounung Tale oi relumn (ARR) Iof Don Server investments. (Round all intermediary calculations to me nearest wnole uonial. Round your answers to the nearest nunureuin perceni, A.M%.) Average annual operating income - Average amount invested = ARR Server A % Server B % Calculate the net present value (NPV) for both server investments. Use Microsoft Excel to calculate NPV. (Round the NPV calculations to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) NPV Server A Server B Calculate the internal rate of return (IRR) for both server investments. Use Microsoft Excel to calculate IRR. (Round the IRR calculations to two decimal places, X.XX%.) IRR Server A % Server B % Requirement 2. Assuming capital rationing applies, which server should Phyllo Computer Company invest in? The payback period is than the server's operating life, NPV is and the ARR and IRR are both than the Based on the calculated results in Requirement 1, Server A required rate of return. Based on the foregoing quantitative factors, Server A is Based on the calculated results in Requirement 1, Server B The payback period is the server's operating life, NPV is and the ARR and IRR are both than the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts