Question: Pierce Corp. has a December 31 year end. It received its property tax invoice of $72,000 for the calendar year on April 30 . The

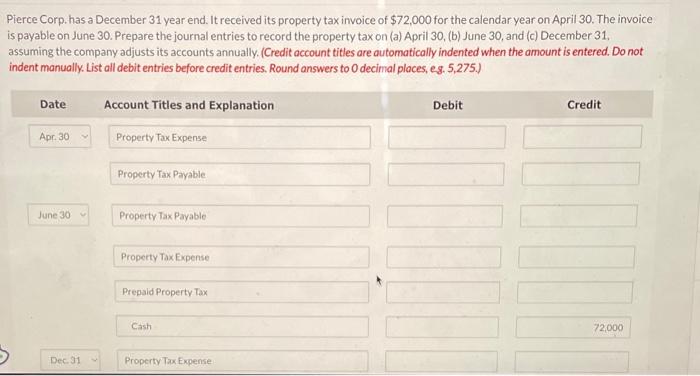

Pierce Corp. has a December 31 year end. It received its property tax invoice of $72,000 for the calendar year on April 30 . The invoice is payable on June 30. Prepare the journal entries to record the property tax on (a) April 30, (b) June 30, and (c) December 31. assuming the company adjusts its accounts annually. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to 0 decimal places, es. 5,275. Dec. 31 Property Tax Expense Prepaid Property Tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock