Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PINNACLE ELECTRONICS Foreign Exchange Risk Management Pinnacle's sales, cost of sales, overhead expenses, trade receivables and trade payables are in the currencies as shown

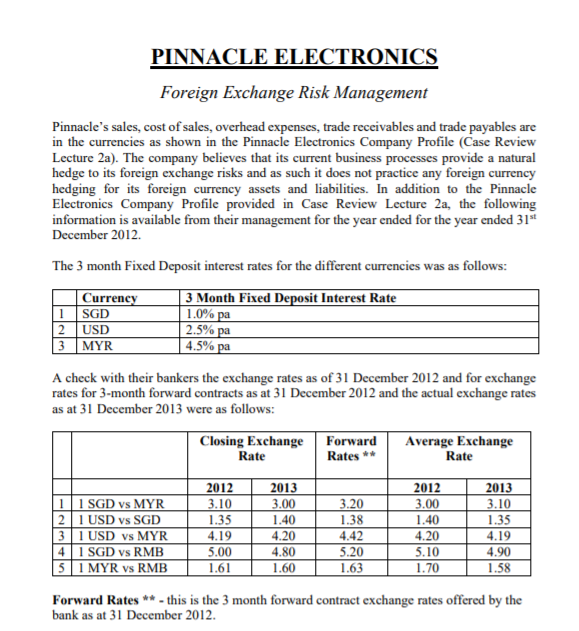

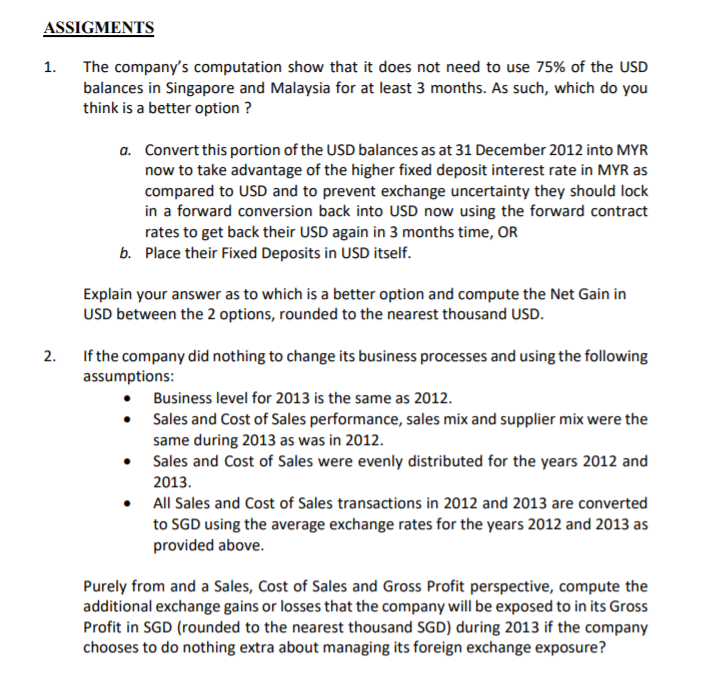

PINNACLE ELECTRONICS Foreign Exchange Risk Management Pinnacle's sales, cost of sales, overhead expenses, trade receivables and trade payables are in the currencies as shown in the Pinnacle Electronics Company Profile (Case Review Lecture 2a). The company believes that its current business processes provide a natural hedge to its foreign exchange risks and as such it does not practice any foreign currency hedging for its foreign currency assets and liabilities. In addition to the Pinnacle Electronics Company Profile provided in Case Review Lecture 2a, the following information is available from their management for the year ended for the year ended 31st December 2012. The 3 month Fixed Deposit interest rates for the different currencies was as follows: Currency SGD 3 Month Fixed Deposit Interest Rate 1 2 USD 3 MYR 1.0% pa 2.5% pa 4.5% pa A check with their bankers the exchange rates as of 31 December 2012 and for exchange rates for 3-month forward contracts as at 31 December 2012 and the actual exchange rates as at 31 December 2013 were as follows: Closing Exchange Rate Forward Rates ** Average Exchange Rate 2012 2013 2012 2013 1 1 SGD vs MYR 3.10 3.00 3.20 3.00 3.10 2 1 USD vs SGD 1.35 1.40 1.38 1.40 1.35 | 3|1 USD vs MYR 4.19 4.20 4.42 4.20 4.19 4 | 1 SGD vs RMB 5.00 4.80 5.20 5.10 4.90 5 1 MYR vs RMB 1.61 1.60 1.63 1.70 1.58 Forward Rates **- this is the 3 month forward contract exchange rates offered by the bank as at 31 December 2012. ASSIGMENTS 1. The company's computation show that it does not need to use 75% of the USD balances in Singapore and Malaysia for at least 3 months. As such, which do you think is a better option? 2. a. Convert this portion of the USD balances as at 31 December 2012 into MYR now to take advantage of the higher fixed deposit interest rate in MYR as compared to USD and to prevent exchange uncertainty they should lock in a forward conversion back into USD now using the forward contract rates to get back their USD again in 3 months time, OR b. Place their Fixed Deposits in USD itself. Explain your answer as to which is a better option and compute the Net Gain in USD between the 2 options, rounded to the nearest thousand USD. If the company did nothing to change its business processes and using the following assumptions: Business level for 2013 is the same as 2012. Sales and Cost of Sales performance, sales mix and supplier mix were the same during 2013 as was in 2012. Sales and Cost of Sales were evenly distributed for the years 2012 and 2013. All Sales and Cost of Sales transactions in 2012 and 2013 are converted to SGD using the average exchange rates for the years 2012 and 2013 as provided above. Purely from and a Sales, Cost of Sales and Gross Profit perspective, compute the additional exchange gains or losses that the company will be exposed to in its Gross Profit in SGD (rounded to the nearest thousand SGD) during 2013 if the company chooses to do nothing extra about managing its foreign exchange exposure?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started