Question: Pitchfork, Inc. began a long-term construction project for a building intended for the company's own use in 20x1. Construction began on January 31, 20x1

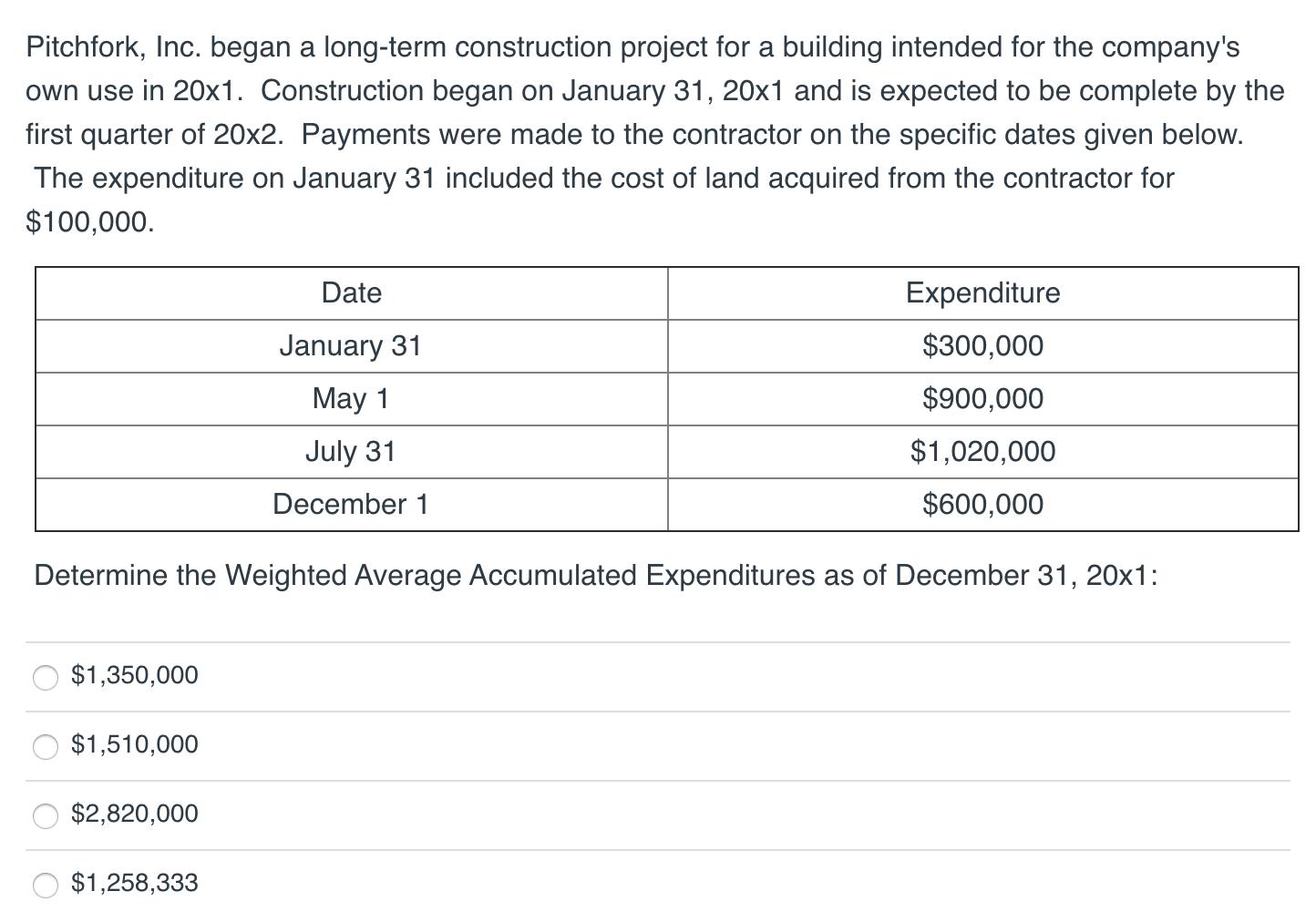

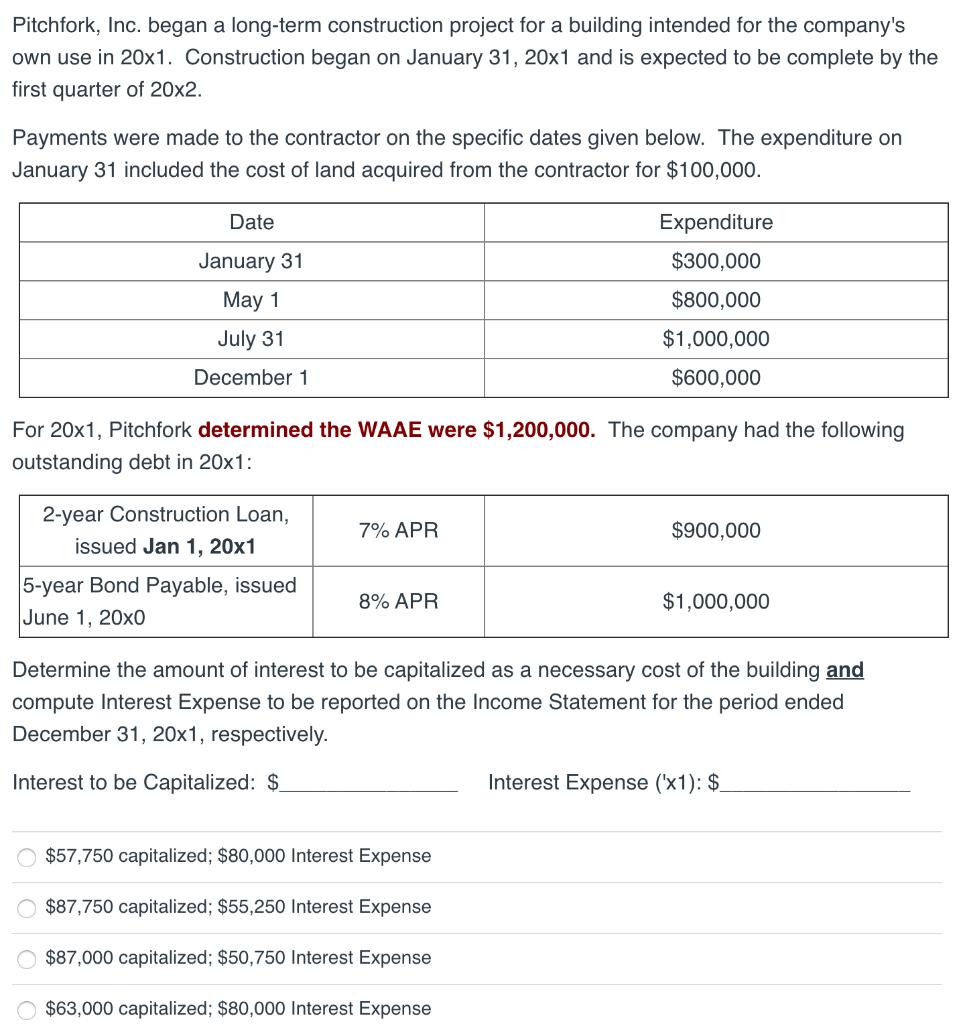

Pitchfork, Inc. began a long-term construction project for a building intended for the company's own use in 20x1. Construction began on January 31, 20x1 and is expected to be complete by the first quarter of 20x2. Payments were made to the contractor on the specific dates given below. The expenditure on January 31 included the cost of land acquired from the contractor for $100,000. $1,350,000 Determine the Weighted Average Accumulated Expenditures as of December 31, 20x1: $1,510,000 $2,820,000 Date January 31 May 1 July 31 December 1 $1,258,333 Expenditure $300,000 $900,000 $1,020,000 $600,000 Pitchfork, Inc. began a long-term construction project for a building intended for the company's own use in 20x1. Construction began on January 31, 20x1 and is expected to be complete by the first quarter of 20x2. Payments were made to the contractor on the specific dates given below. The expenditure on January 31 included the cost of land acquired from the contractor for $100,000. Date January 31 May 1 July 31 December 1 For 20x1, Pitchfork determined the WAAE were $1,200,000. The company had the following outstanding debt in 20x1: 2-year Construction Loan, issued Jan 1, 20x1 5-year Bond Payable, issued June 1, 20x0 OOOO 7% APR 8% APR Expenditure $300,000 $800,000 $1,000,000 $600,000 $57,750 capitalized; $80,000 Interest Expense $87,750 capitalized; $55,250 Interest Expense $87,000 capitalized; $50,750 Interest Expense $63,000 capitalized; $80,000 Interest Expense $900,000 Determine the amount of interest to be capitalized as a necessary cost of the building and compute Interest Expense to be reported on the Income Statement for the period ended December 31, 20x1, respectively. Interest to be Capitalized: $ $1,000,000 Interest Expense (x1): $

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

January 11 May 1 July 31 December 1 Date ... View full answer

Get step-by-step solutions from verified subject matter experts