Question: pl answer the following questions. 1.In your opinion is it ethical for U.S. drug firms to charge so much for their pharmacueticals . How can

pl answer the following questions.

1.In your opinion is it ethical for U.S. drug firms to charge so much for their pharmacueticals . How can one justify the far less expnsive prices charged by their European counterparts

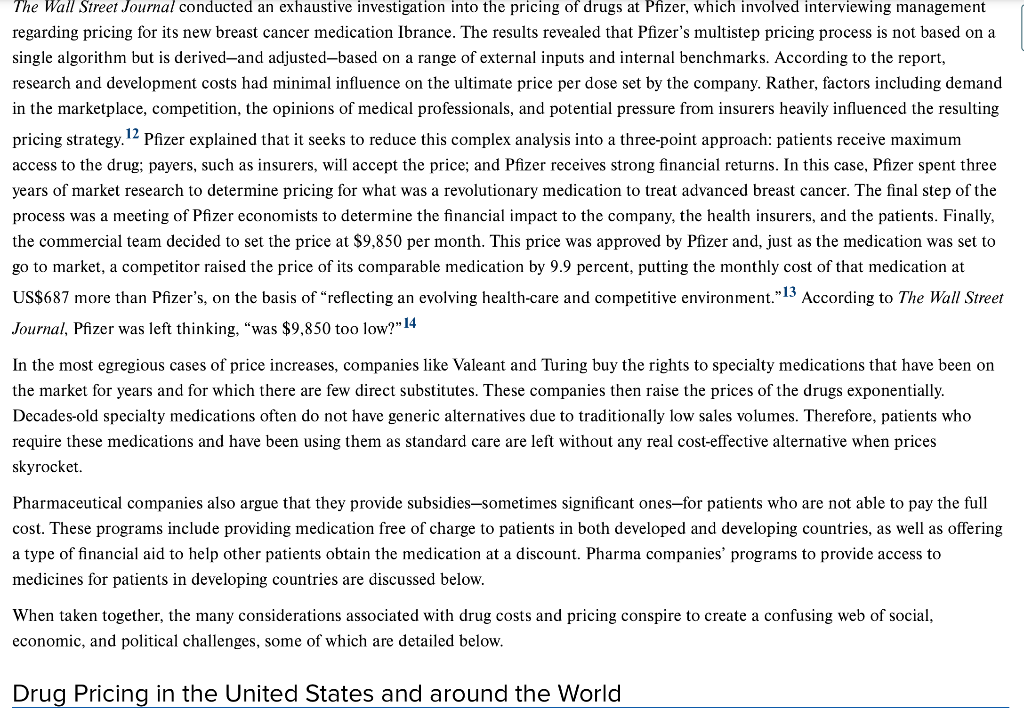

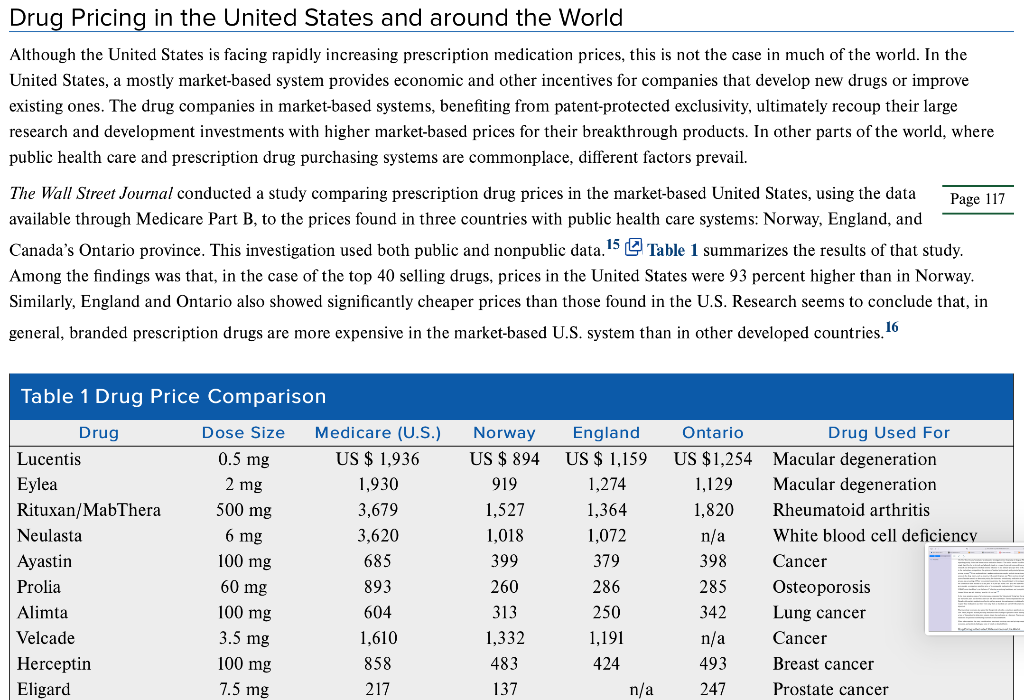

The Ethics of Global Drug Pricing In early 2019, over 30 different drug manufacturers announced price increases on more than 1000 different drugs. U.S.-based drug producer 7T Pharma raised the price of its pain medication Zingo by over 100 percent, and biopharmaceutical company AbbVie Inc spiked the price of Humira, the world's top-selling arthritis drug. Several larger pharma companies initiated price increases on significant portions of their entire drug portfolio, including Allergan Plc, which raised price on 50 different drugs accounting for half of its entire portfolio, and Pfizer, the world's largest drug manufacturer, which raised the price on 41 drugs accounting for 10 percent of its portfolio. 1,2,3 Annual price increases such as these, which are far in excess of the inflation rate, are nothing new in the drug manufacturing industry. In 2018, Virtus Pharmaceuticals increased the price of muscle relaxant Methocarbamol by over 1000 percent, and in 2015, Turing Pharmaceuticals increased the price of a 62-year-old drug used for treating life-threatening parasitic infections in HIV and cancer patients by over 5,000 percent-from US$13.50 to US$750 per tablet.4,5,6 These highlight just a few examples of numerous extreme price increases that continue to fuel the debate regarding the cost of prescription medication in the United States, prompting comparisons to drug prices in other industrialized countries. Moreover, a related debate has simmered regarding access to life-saving medicine in developing countries, the relatively low investments by major global pharma companies in developing new medicines for diseases such as tuberculosis and malaria, and the prices major pharmaceutical companies charge for HIV/AIDS medications. Pharmaceuticals and Pricing-a Complicated Calculation The issue of drug pricing is incredibly complex and, as more prescription medications are becoming available to the growing global population, that complexity is increasing. Debates regarding prescription medication pricing involve such hot-button issues as the appropriate levels of corporate profits, the responsibility of the corporations who own the medication (profit for shareholders versus providing a need for suffering patients), and insurance coverage, to name a few. The ethical debate over drug pricing is not confined to just the United States, but extends to developed and developing companies alike. The pricing of pharmaceuticals is influenced by a myriad of stakeholders who represent a wide range of competing interests. These include the patients taking the drugs, the doctors prescribing the drugs, the insurance companies paying for the drugs, the pharmaceutical manufacturers that either produce or acquire the rights and supply the drug, and the governmental forces that often act as a bulk purchaser and regulator, policing the entire process. Tensions among these diverse stakeholders are aggravated by continued growth in prescription- drug spending. In 2019, drug prices grew by an estimated 6.3 percent from the previous year, and prices for some medications grew by as The pricing of pharmaceuticals is influenced by a myriad of stakeholders who represent a wide range of competing interests. These include the patients taking the drugs, the doctors prescribing the drugs, the insurance companies paying for the drugs, the pharmaceutical manufacturers that either produce or acquire the rights and supply the drug, and the governmental forces that often act as a bulk purchaser and regulator, policing the entire process. Tensions among these diverse stakeholders are aggravated by continued growth in prescription- drug spending. In 2019, drug prices grew by an estimated 6.3 percent from the previous year, and prices for some medications grew by as much as 30 percent.? Patients need reliable drugs that can be used to treat their conditions; however, the costs to patients vary widely based on the health-care system of the countries in which they live, whether they are subject to public or private insurance (or no insurance at all), and various other factors. In the United States, insurance options vary widely, with some patients paying out of pocket, others opting for coverage under their employer-paid or commercial insurance, and some utilizing a form of government-paid insurance, like Medicare. The type of provider and type of plan ultimately determine the cost that the patient must pay out of pocket for any prescription medications. Some plans require co- pays, premiums, or deductibles to cover the costs of prescriptions, and some pay a certain percentage of prescription costs, leaving the balance to the patient. In many countries featuring single-payer models, health plans determine which drugs are available and how they are to be allocated to patients. In a similar vein, insurance plans in the United States maintain a "booklet" or listing of what prescription medications are covered under a given plan. This booklet can change from year-to-year, meaning that one year a given insurance company will cover costs for a certain medication and, due to factors like huge price increases, the medication may not be covered the following year. In the United States, prescribing doctors are an important stakeholder in this issue. Until recently, their responsibility and incentives were not always well established. In the past, it was common practice for pharmaceutical companies to offer doctors fees for research and clinical assessments. Because these fees created at least the appearance of a conflict of interest, legislation and regulation began to require greater disclosure and reporting. Now, all compensation, including nonmonetary items such as food and entertainment, that pharmaceutical companies provide to doctors in exchange for research and promotional activities must be reported. 8 Putting that role aside, doctors are generally expected to treat patients with whatever means result in the highest efficacy levels. F prescription drug prices inevitably interact with that responsibility. Recent trends seem to indicate that these tensions will only g number of drug prescriptions filled annually in the United States has increased by 85 percent in the last 20 years, and more than 55 percent of Americans now regularly take prescription medicine. In fact, the average American adult has four prescriptions. As drug prices continue 9 to soar, doctors are placed in the difficult situation of prescribing their patients medication that may not be affordable or performing Putting that role aside, doctors are generally expected to treat patients with whatever means result in the highest efficacy levels. Higher prescription drug prices inevitably interact with that responsibility. Recent trends seem to indicate that these tensions will only grow; the number of drug prescriptions filled annually in the United States has increased by 85 percent in the last 20 years, and more than 55 percent of Americans now regularly take prescription medicine. In fact, the average American adult has four prescriptions. As drug prices continue to soar, doctors are placed in the difficult situation of prescribing their patients medication that may not be affordable or performing alternative methods with lower efficacy. In defending relatively high prices of drugs, pharmaceutical companies routinely cite the high failure rate of new drugs during the FDA approval process and the steep costs of research and development. Indeed, some estimates put the price of developing a new drug at nearly $3 billion when including the cost of failures and drugs that never reach the marketplace. T Opponents of this argument cite the fact that, in 10 cases where a new drug is successful, it enjoys approximately two decades of protection from any competition under strict patent laws. Additionally, some companies, especially in the "orphan" drug industry, which will be discussed later, receive grants for research and development. Finally, in extreme cases of companies like Valeant Pharmaceuticals, which gained notoriety after raising the price of Wilson's disease drug Cuprimine by more than 3,000 percent in 2015, critics point to the fact that some companies do not appear to invest much if any financial resources into developing new drugs. Valeant, for example, invests less than 3 percent of revenue into research and development activities.11 The Wall Street Journal conducted an exhaustive investigation into the pricing of drugs at Pfizer, which involved interviewing management regarding pricing for its new breast cancer medication Ibrance. The results revealed that Pfizer's multistep pricing process is not based on a single algorithm but is derived-and adjusted-based on a range of external inputs and internal benchmarks. According to the report, research and development costs had minimal influence on the ultimate price per dose set by the company. Rather, factors including demand in the marketplace, competition, the opinions of medical professionals, and potential pressure from insurers heavily influenced the resulting pricing strategy. 12 Pfizer explained that it seeks to reduce this complex analysis into a three-point approach: patients receive max access to the drug: payers, such as insurers, will accept the price; and Pfizer receives strong financial returns. In this case, Pfizer : years of market research to determine pricing for what was a revolutionary medication to treat advanced breast cancer. The final process was a meeting of Pfizer economists to determine the financial impact to the company, the health insurers, and the patien the commercial team decided to set the price at $9,850 per month. This price was approved by Pfizer and, just as the medication was set to go to market, a competitor raised the price of its comparable medication by 9.9 percent, putting the monthly cost of that medication at UOMO The Wall Street Journal conducted an exhaustive investigation into the pricing of drugs at Pfizer, which involved interviewing management regarding pricing for its new breast cancer medication Ibrance. The results revealed that Pfizer's multistep pricing process is not based on a single algorithm but is derived and adjusted-based on a range of external inputs and internal benchmarks. According to the report, research and development costs had minimal influence on the ultimate price per dose set by the company. Rather, factors including demand in the marketplace, competition, the opinions of medical professionals, and potential pressure from insurers heavily influenced the resulting pricing strategy 12 Pfizer explained that it seeks to reduce this complex analysis into a three-point approach: patients receive maximum access to the drug; payers, such as insurers, will accept the price; and Pfizer receives strong financial returns. In this case, Pfizer spent three years of market research to determine pricing for what was a revolutionary medication to treat advanced breast cancer. The final step of the process was a meeting of Pfizer economists to determine the financial impact to the company, the health insurers, and the patients. Finally, the commercial team decided to set the price at $9,850 per month. This price was approved by Pfizer and, just as the medication was set to go to market, a competitor raised the price of its comparable medication by 9.9 percent, putting the monthly cost of that medication at US$687 more than Pfizer's, on the basis of reflecting an evolving health-care and competitive environment.13 According to The Wall Street Journal, Pfizer was left thinking, "was $9,850 too low?" 14 In the most egregious cases of price increases, companies like Valeant and Turing buy the rights to specialty medications that have been on the market for years and for which there are few direct substitutes. These companies then raise the prices of the drugs exponentially. Decades-old specialty medications often do not have generic alternatives due to traditionally low sales volumes. Therefore, patients who require these medications and have been using them as standard care are left without any real cost-effective alternative when prices skyrocket. Pharmaceutical companies also argue that they provide subsidies,sometimes significant ones-for patients who are not able to pay the full cost. These programs include providing medication free of charge to patients in both developed and developing countries, as well as offering a type of financial aid to help other patients obtain the medication at a discount. Pharma companies' programs to provide access to medicines for patients in developing countries are discussed below. When taken together, the many considerations associated with drug costs and pricing conspire to create a confusing web of social, economic, and political challenges, some of which are detailed below. Drug Pricing in the United States and around the World Drug Pricing in the United States and around the World Although the United States is facing rapidly increasing prescription medication prices, this is not the case in much of the world. In the United States, a mostly market-based system provides economic and other incentives for companies that develop new drugs or improve existing ones. The drug companies in market-based systems, benefiting from patent-protected exclusivity, ultimately recoup their large research and development investments with higher market-based prices for their breakthrough products. In other parts of the world, where public health care and prescription drug purchasing systems are commonplace, different factors prevail. The Wall Street Journal conducted a study comparing prescription drug prices in the market-based United States, using the data Page 117 available through Medicare Part B, to the prices found in three countries with public health care systems: Norway, England, and Canada's Ontario province. This investigation used both public and nonpublic data. 15 Table 1 summarizes the results of that study. Among the findings was that, in the case of the top 40 selling drugs, prices in the United States were 93 percent higher than in Norway. Similarly, England and Ontario also showed significantly cheaper prices than those found in the U.S. Research seems to conclude that, in general, branded prescription drugs are more expensive in the market-based U.S. system than in other developed countries. 16 0.5 mg Table 1 Drug Price Comparison Drug Dose Size Medicare (U.S.) Lucentis US $ 1,936 Eylea 2 mg 1,930 Rituxan/MabThera 500 mg 3,679 Neulasta 6 mg 3,620 Ayastin 685 Prolia 893 Alimta 604 Velcade 1,610 Herceptin 858 Eligard 7.5 mg 217 100 mg 60 mg 100 mg 3.5 mg 100 mg Norway US $ 894 919 1,527 1,018 399 260 313 1,332 483 137 England US $ 1,159 1,274 1,364 1,072 379 286 250 1,191 424 n/a Ontario Drug Used For US $1,254 Macular degeneration 1,129 Macular degeneration 1,820 Rheumatoid arthritis n/a White blood cell deficiency 398 Cancer 285 Osteoporosis 342 Lung cancer n/a Cancer 493 Breast cancer 247 Prostate cancer The patent protection and exclusivity prevalent in the market-based U.S. system are not the only reason for steep drug prices, structural differences in the health-care system, the lobbying and political power of pharmaceutical companies, and the fear of rationing all contribute to the increased prices in the market. 17 Conversely, the state-run health systems in other developed countries, like Norway, exert strong negotiating leverage with drug companies. In these countries, nearly all drug purchasing is completed by government agencies, shifting the power from pure market demand to a single government purchaser. In these systems, it is common for government health-care agencies to set firm caps on pricing, require strong evidence that breakthrough drugs truly provide higher value than existing medications, and refuse to pay for higher-priced drugs that offer only minimal improvements over cheaper alternatives. 18 By contrast, the U.S. marketplace is more disjointed. Individuals, employers, large and small insurance companies, and even state and federal government agencies foot the bill for medications, resulting in decreased bargaining power. Furthermore, Medicare, which pays for more medications than any other company or agency in the country, is legally prevented from negotiating pricing. 19 Drug manufacturers and developers are quick to note the huge financial disincentives posed by European public health-care systems. Lower returns coupled with strong governmental control arguably result in decreased research investment and less patient access to life-saving drugs. Without the large profits achieved through the U.S. pricing model, new drug development would sharply decline 20 Per Pharmaceutical Research and Manufacturers of America (PhRMA) executive vice president Lori Reilly, The U.S. has a competitive biopharmaceutical marketplace that works to control costs while encouraging the development of new treatments and cures. "21 Below is a brief summary of drug pricing approaches in key European countries. Norway, Canada, and the United Kingdom Norway created the Norwegian Medicines Agency (NMA) to determine the appropriateness of specific drugs for treatment. The agency evaluates patient information to determine the cost-effectiveness of new drugs. Pharmaceutical companies submit a price for reimbursement, which must be below the maximum price set by the agency, and the pharmaceutical companies must file detailed documents out! additional benefits and value that the new drug provides that existing drugs do not. QALY, or quality-adjusted life year, is a metri often used to measure the value of the drug. 22 Interestingly, Medicare in the U.S. is prohibited from incorporating such an appro drug companies ultimately discount their drugs to ensure that they are accepted by NMA for inclusion in the health-care system, though England's health-care cost agency, the National Institute for Health and Care Excellence (NICE), is one of Europe's strictest regulators. Providing a high value is critical to any specific drug's acceptance by NICE; the agency evaluates the cost versus effectiveness of drugs, ultimately determining whether the medication provides enough benefit to warrant coverage. If NICE determines that the value offered by the new drug is too low compared to the price, drug makers have the opportunity to try for acceptance again with a revised price point.24 The level of spending by the National Health Service (NHS) on individual drugs is also capped, and the pharmaceutical industry must reimburse the NHS for any additional spending over that cap. Nearly every drug covered by both Medicare Part B and the English health-care system was more expensive in the U.S.25 Page 118 Though the Canadian health-care system does not include a centralized government agency responsible for all drug payments and negotiations, the country has been able to maintain lower drug costs due to government regulation.26 First, maximum drug prices, based on the effectiveness and overall value of the pharmaceutical product as well as the cost of the drug in the U.S. and Europe, are set by Canada's Patented Medicine Prices Review Board. After the price ceiling is set on a particular drug, the pharmaceutical company producing the product is prohibited from increasing the price above the comparable U.S. or European price. Additionally, the annual rate of price increase is capped at Canada's rate of inflation.27 Because Canada has a nationalized system with heavy subsidies for low- and fixed-income citizens, the Canadian government also must determine whether or not any specific drug will be available to seniors and those on government assistance. The Canadian Agency for Drugs and Technologies in Health ultimately makes this decision. These regulations appear to effectively reduce costs, especially when compared to the U.S. For example, of 30 pharmaceutical drugs covered by both Ontario's Ministry of Health and Long-Term Care and the U.S.'s Medicare Part B, only 7 percent of the drugs were more expensive in Canada.28 Obviously, the significant difference in health care systems and prescription medication practices makes it extremely difficult to debate whether the U.S. approach or the Norway-England-Canada approach is better. Of more practical relevance, it would be extremely difficult for the U.S. to adopt the approach used in these three countries. Indeed, the U.S. has (so far) rejected a universal, government-paid health-care system. 29 The arguments for and against that type of system are well-documented and will not be addressed here, but it is worth that there are valid reasons for opposing it. One is that adopting a universal system could result in the government being unwillin certain medications, something that is quite controversial in the U.S., where freedom and choice are highly valued. 30 This reality complicates the process for encouraging development of specialty and orphan drugs that by definition treat a very small portion of the population. In these cases, there is usually a lack of effective alternatives or generic medications and it is only with strong economic incentives that pharmaceutical companies are willing to take the risk of developing new products. As such, a public health-care system does Germany, Spain, and Italy Another approach to drug pricing, which has features of both a private, market-based system, like that of the United States, and a public system, like that of Norway, can be found in Germany, Spain, and Italy. A New York Times analysis described how these countries approach the pricing challenge. In Germany, Spain, and Italy, pharmaceutical drugs are categorized into groupings with other similar drugs. 32 Insurers, whether public or private, then set a single specific price that they will pay for any drug that is grouped within a specific category. This price is referred to as the "reference price." If any individual drug within a category is priced higher than the set reference price for that category, the consumer must pay the excess cost if he or she wants the more expensive drug. This approach results in significant consumer pressure on the drug 33 manufacturer. When a low reference price is set, consumers become more willing to switch the specific drug that they are taking to avoid any additional, uncovered cost. Drug companies, with the desire to keep consumers, respond by lowering their price to as close to the reference price as possible.34 Germany, Italy, and Spain vary slightly in how reference prices are actually set. In Germany and Spain, averages are used to calculate the proper reference price, while in Italy, the lowest price in each drug category effectively acts as the reference price. Price controls, whether through government agencies or insurers, are often blamed for slowing drug research and development. While this may be rooted in some truth, the reference price strategy can still result in financial incentive for innovation. When a new, breakthrough drug is developed, reference pricing allows for that drug to be placed into a category by itself, eliminating the price competition seen in categories of drugs established with multiple competitors. The new drug is still able to reap the financial benefits of being a first-to-market innovator, likely for many years.35 Additionally, the reference pricing strategy can encourage innovations within long-established drug categories. When an existing drug within a crowded, competitive drug category is improved and its cost to manufacture is reduced, the drug manufacturer can likewise lower its price point in an attempt to steal market share. This results in savings to the end consumer. As stated already, it is difficult to argue against a system that has prices a fraction of those in the U.S., but it is worth mentioning system is still difficult to implement in cases where there are no comparable drugs. Furthermore, companies could shave margins that have comparable alternatives but attempt to make up those margins in areas where they provide novel medications. Finally, Pfizer's pricing example, pharmaceutical companies routinely look to competitors for guidance on pricing. Implementing a reference-pricing system could incentivize companies to set higher prices knowing that the government will be imposing a bottom price or average price and oncouronn tune of nrico fixingStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts