Question: Place your answer in the corresponding green answer cell for each question. The answer cell must contain a formula that references one or more cells

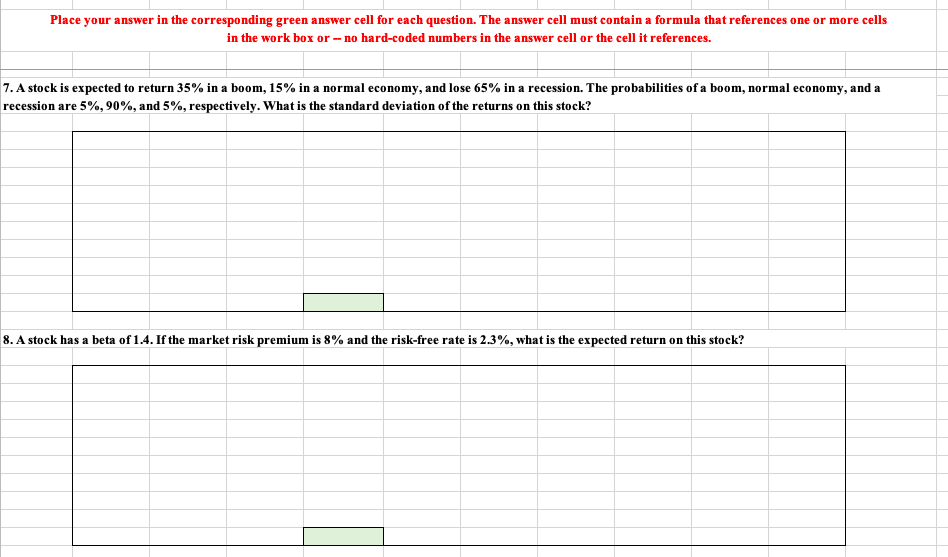

Place your answer in the corresponding green answer cell for each question. The answer cell must contain a formula that references one or more cells in the work box or - no hard-coded numbers in the answer cell or the cell it references. 7. A stock is expected to return 35% in a boom, 15% in a normal economy, and lose 65% in a recession. The probabilities of a boom, normal economy, and a recession are 5%, 90%, and 5%, respectively. What is the standard deviation of the returns on this stock? 8. A stock has a beta of 1.4. If the market risk premium is 8% and the risk-free rate is 2.3%, what is the expected return on this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts