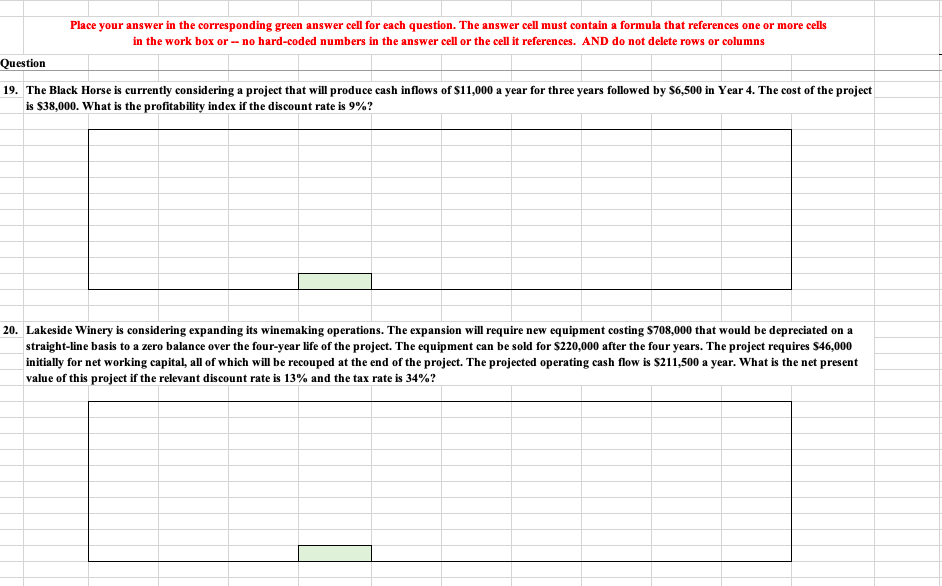

Question: Place your answer in the corresponding green answer cell for each question. The answer cell must contain a formula that references one or more cells

Place your answer in the corresponding green answer cell for each question. The answer cell must contain a formula that references one or more cells in the work box or - no hard-coded numbers in the answer cell or the cell it references. AND do not delete rows or columns Question 19. The Black Horse is currently considering a project that will produce cash inflows of $11,000 a year for three years followed by $6,500 in Year 4. The cost of the project is $38,000. What is the profitability index if the discount rate is 9%? 20. Lakeside Winery is considering expanding its winemaking operations. The expansion will require new equipment costing S708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold for $220,000 after the four years. The project requires $46,000 initially for net working capital, all of which will be recouped at the end of the project. The projected operating cash flow is $211,500 a year. What is the net present value of this project if the relevant discount rate is 13% and the tax rate is 34%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts