Question: Plastic Technologies Inc. has developed a 3D printer that is significantly more precise than existing 3D printers on the market. The company spent $1,000,000 on

Plastic Technologies Inc. has developed a 3D printer that is significantly more precise than existing 3D printers on the market. The company spent $1,000,000 on Research & Development for this product and a further $200,000 for assessing market demand. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the 3D printer. The project would require net working capital at the beginning of each year equal to 10% of sales (NOWC0 = 10%(Sales1), NOWC1 = 10%(Sales2), etc.). The 3D printers would sell for $6,000 per unit, and Plastic Technologies believes that variable costs would amount to $1,500 per unit. The company expects that the sales price and variable costs would increase at the inflation rate of 3% after year 1. The companys non-variable costs would be $500,000 in Year 1 and are expected to increase with inflation. The 3D printer project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the projects returns are expected to be highly correlated with returns on the firms other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated using a CCA rate of 30%. The estimated market value of the equipment at the end of the projects 4-year life is its undepreciated capital cost (i.e. book value) at the end of year 4. Plastic Technologies has other assets in this asset class. Plastic Technologies Inc.s WACC is 10% and the federal-plus-provincial tax rate is 35%. Assume that the half-year rule applies to the CCA.

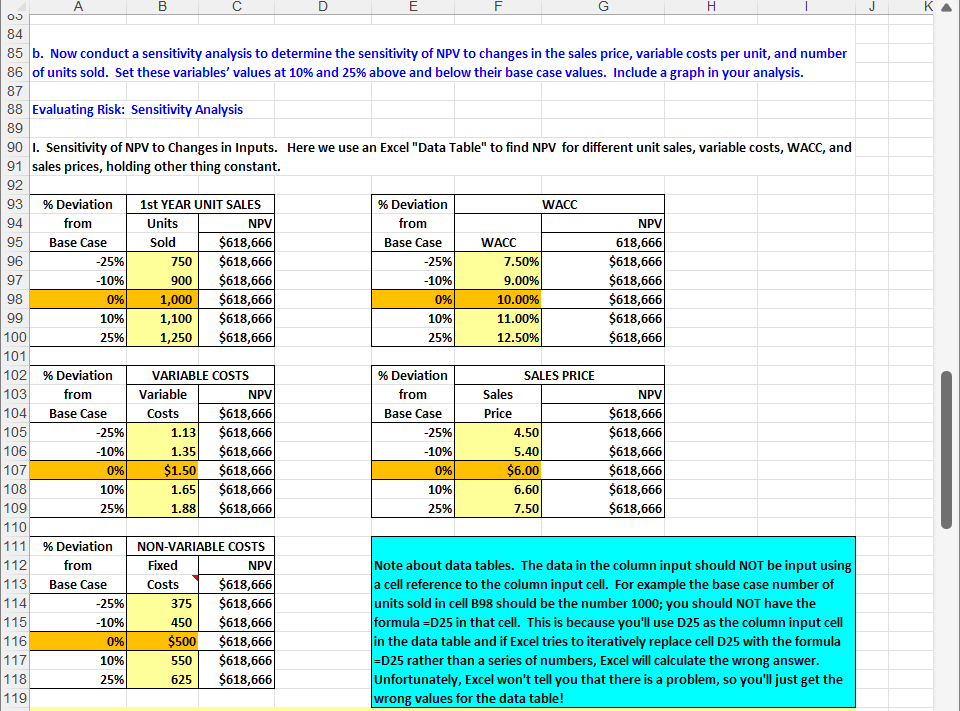

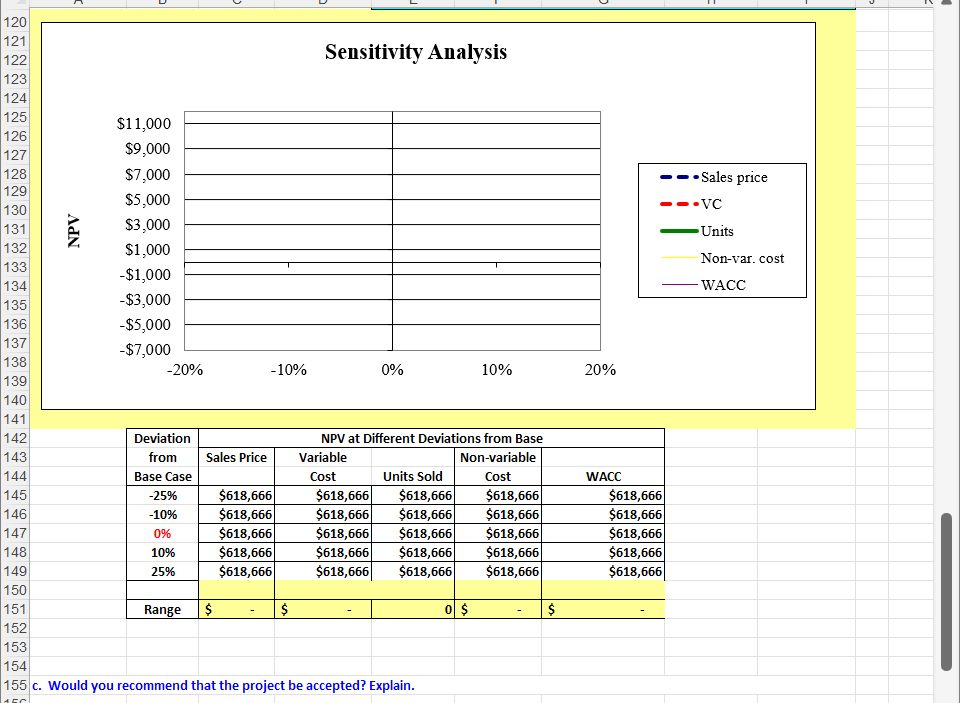

b. Now conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, variable costs per unit, and number of units sold. Set these variables' values at 10% and 25% above and below their base case values. Include a graph in your analysis. Evaluating Risk: Sensitivity Analysis I. Sensitivity of NPV to Changes in Inputs. Here we use an Excel "Data Table" to find NPV for different unit sales, variable costs, WACC, and sales prices, holding other thing constant. Note about data tables. The data in the column input should NOT be input using a cell reference to the column input cell. For example the base case number of units sold in cell B98 should be the number 1000; you should NOT have the formula =D25 in that cell. This is because you'll use D25 as the column input cell in the data table and if Excel tries to iteratively replace cell D25 with the formula =D25 rather than a series of numbers, Excel will calculate the wrong answer. Unfortunately, Excel won't tell you that there is a problem, so you'll just get the wrong values for the data table! Sensitivity Analysis c. Would you recommend that the project be accepted? Explain. b. Now conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, variable costs per unit, and number of units sold. Set these variables' values at 10% and 25% above and below their base case values. Include a graph in your analysis. Evaluating Risk: Sensitivity Analysis I. Sensitivity of NPV to Changes in Inputs. Here we use an Excel "Data Table" to find NPV for different unit sales, variable costs, WACC, and sales prices, holding other thing constant. Note about data tables. The data in the column input should NOT be input using a cell reference to the column input cell. For example the base case number of units sold in cell B98 should be the number 1000; you should NOT have the formula =D25 in that cell. This is because you'll use D25 as the column input cell in the data table and if Excel tries to iteratively replace cell D25 with the formula =D25 rather than a series of numbers, Excel will calculate the wrong answer. Unfortunately, Excel won't tell you that there is a problem, so you'll just get the wrong values for the data table! Sensitivity Analysis c. Would you recommend that the project be accepted? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts