Question: pleaaasse hurry up A Moving to another question will save this response. stion 10 Zietlow Corporation has 2.1 million shares of common stock outstanding with

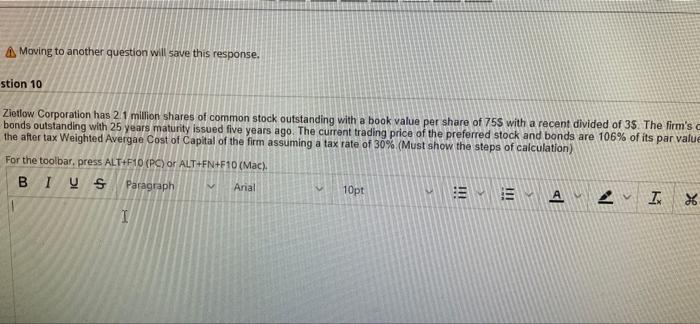

A Moving to another question will save this response. stion 10 Zietlow Corporation has 2.1 million shares of common stock outstanding with a book value per share of 75$ with a recent divided of 35. The firm's c bonds outstanding with 25 years maturity issued five years ago. The current trading price of the preferred stock and bonds are 106% of its par value the after tax Weighted Avergae Cost of Capital of the firm assuming a tax rate of 30% (Must show the steps of calculation) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph V Arial 10pt EYEY I I X 26 Question 10 of 17 9 points Sm ed of 3$. The firm's capital also includes 2900 shares of 4.2% preferred stock outstanding with a par value of 100 and the fems debt include 2250 4.5 percent quarterly 106% of its par value and comomon stock trades for 155 with a constant growth rate of 5%. The beta of the stock is 1.13 and the market risk premium is 7% Calculate *** I Q XX, & N X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts