Question: pleas show all written work, explnations, ans equations 2. (10 points). Suppose the real risk-free rate is 3.50%, the average future inflation rate is 2.50%,

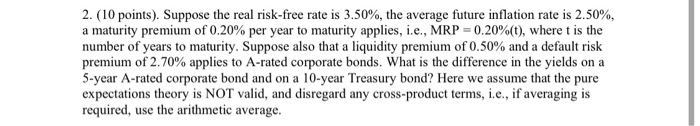

2. (10 points). Suppose the real risk-free rate is 3.50%, the average future inflation rate is 2.50%, a maturity premium of 0.20% per year to maturity applies, i.e., MRP = 0.20%(t), where t is the number of years to maturity. Suppose also that a liquidity premium of 0.50% and a default risk premium of 2.70% applies to A-rated corporate bonds. What is the difference in the yields on a 5-year A-rated corporate bond and on a 10-year Treasury bond? Here we assume that the pure expectations theory is NOT valid, and disregard any cross-product terms, i.e., if averaging is required, use the arithmetic average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts