Question: ****PLEASE ADD EXCEL EQUATIONS IN TOP YELLOW BOXES. BOX 1 STARS AT D22 IRR: Mutually exclusive projects Bell Manufacturing is attempting to choose the better

****PLEASE ADD EXCEL EQUATIONS IN TOP YELLOW BOXES. BOX 1 STARS AT D22

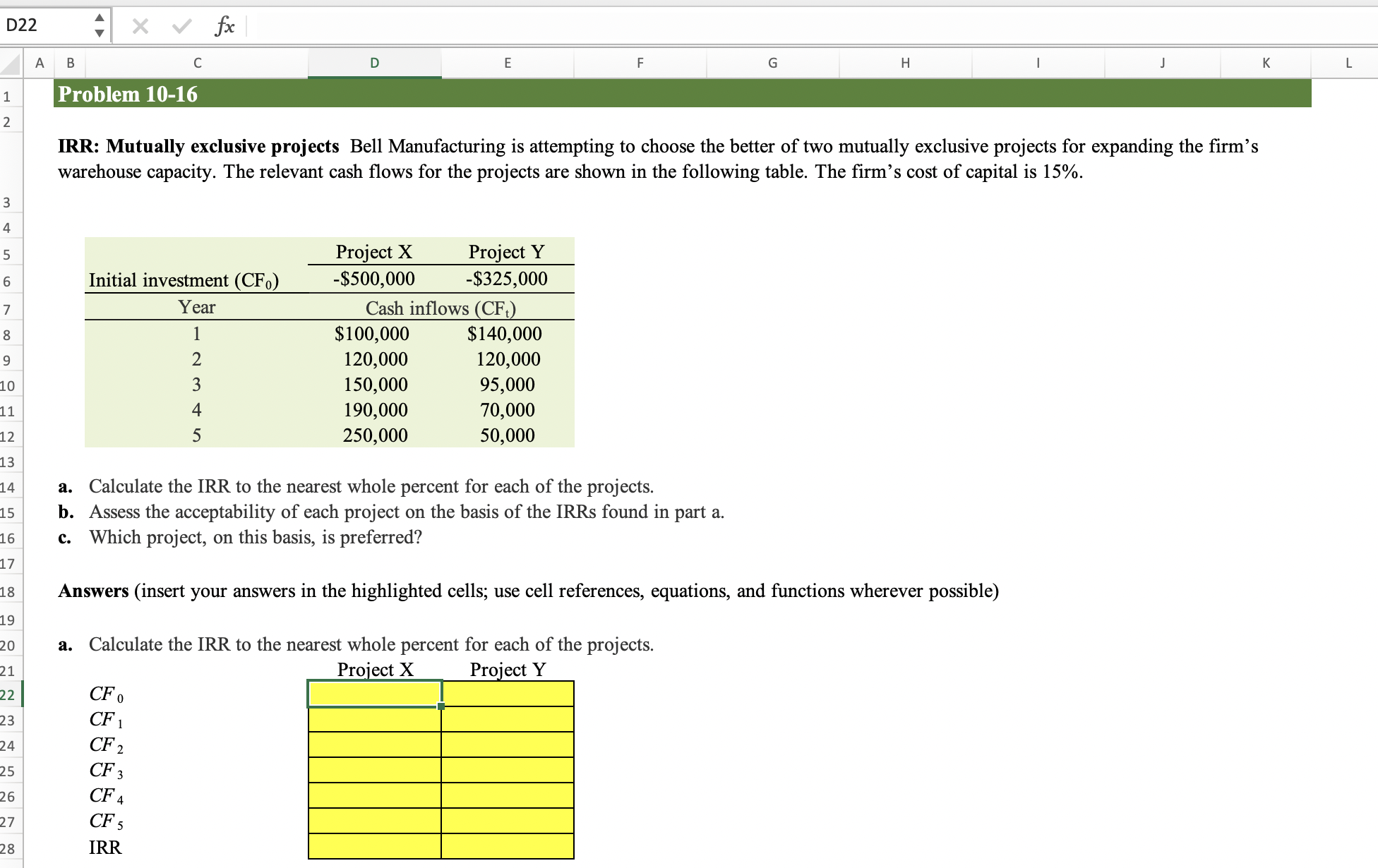

IRR: Mutually exclusive projects Bell Manufacturing is attempting to choose the better of two mutually exclusive projects for expanding the firm's warehouse capacity. The relevant cash flows for the projects are shown in the following table. The firm's cost of capital is 15%. a. Calculate the IRR to the nearest whole percent for each of the projects. b. Assess the acceptability of each project on the basis of the IRRs found in part a. c. Which project, on this basis, is preferred? Answers (insert your answers in the highlighted cells; use cell references, equations, and functions wherever possible) a. Calculate the IRR to the nearest whole percent for each of the projects. b. Assess the acceptability of each project on the basis of the IRRs found in part a. c. Which project, on this basis, is preferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts