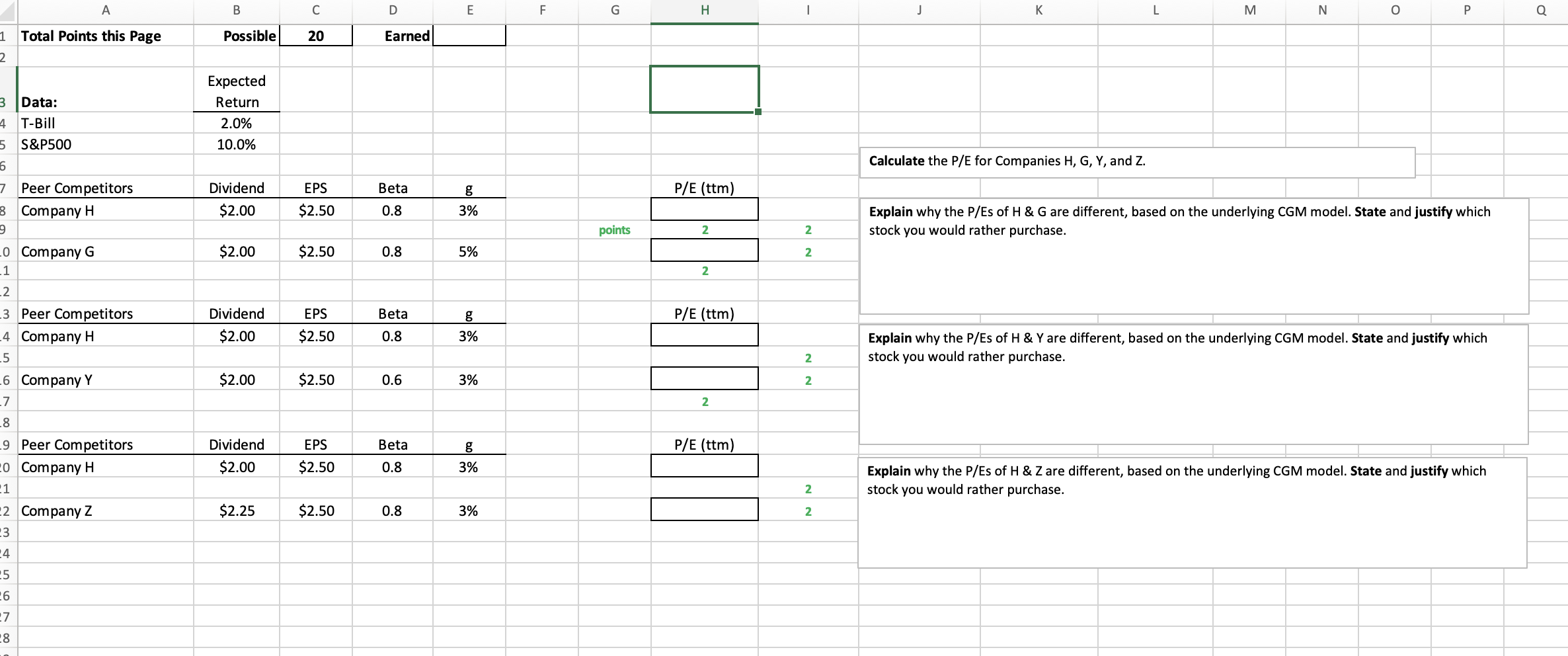

Question: please add formulas !!! A B D E F G H 1 J L M N o P Q Possible 20 Earned 1 Total Points

A B D E F G H 1 J L M N o P Q Possible 20 Earned 1 Total Points this Page 2 3 Data: 4. T-Bill 5 S&P500 Expected Return 2.0% 10.0% 6 Calculate the P/E for Companies H, G, Y, and Z. EPS Beta P/E (ttm) Dividend $2.00 g 3% $2.50 0.8 Explain why the P/Es of H & G are different, based on the underlying CGM model. State and justify which stock you would rather purchase. points 2 2. $2.00 $2.50 0.8 5% 2 2 EPS Beta P/E (ttm) Dividend $2.00 8 3% $2.50 0.8 Explain why the P/Es of H & Y are different, based on the underlying CGM model. State and justify which stock you would rather purchase. 2. $2.00 $2.50 0.6 3% 2 2 7 Peer Competitors 8 Company H 9 0 Company G 1 _2 -3 Peer Competitors -4 Company H -5 .6 Company Y 7 28 -9 Peer Competitors 20 Company H 1 2 Company Z 23 -4 -5 26 -7 28 Dividend EPS Beta P/E (ttm) g 3% $2.00 $2.50 0.8 Explain why the P/Es of H & Z are different, based on the underlying CGM model. State and justify which stock you would rather purchase. 2 $2.25 $2.50 0.8 3% 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts