Question: Please adhere exactly to the rounding instructions (in red), or the answer will be incorrect. Thanks! Definite thumbs up for help! Question 3 6.5 pts

Please adhere exactly to the rounding instructions (in red), or the answer will be incorrect. Thanks! Definite thumbs up for help!

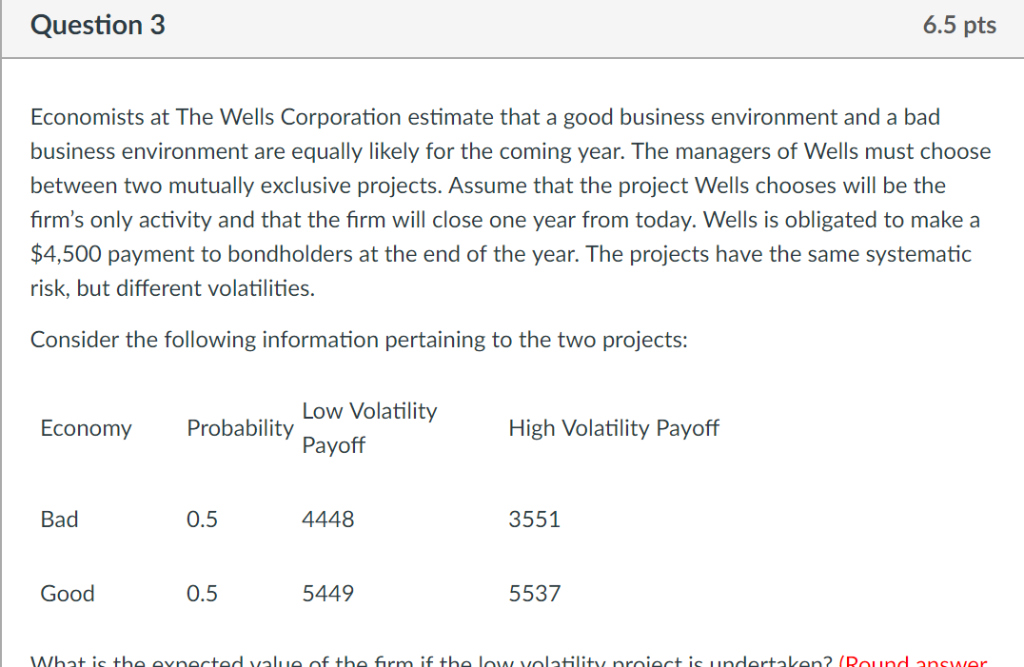

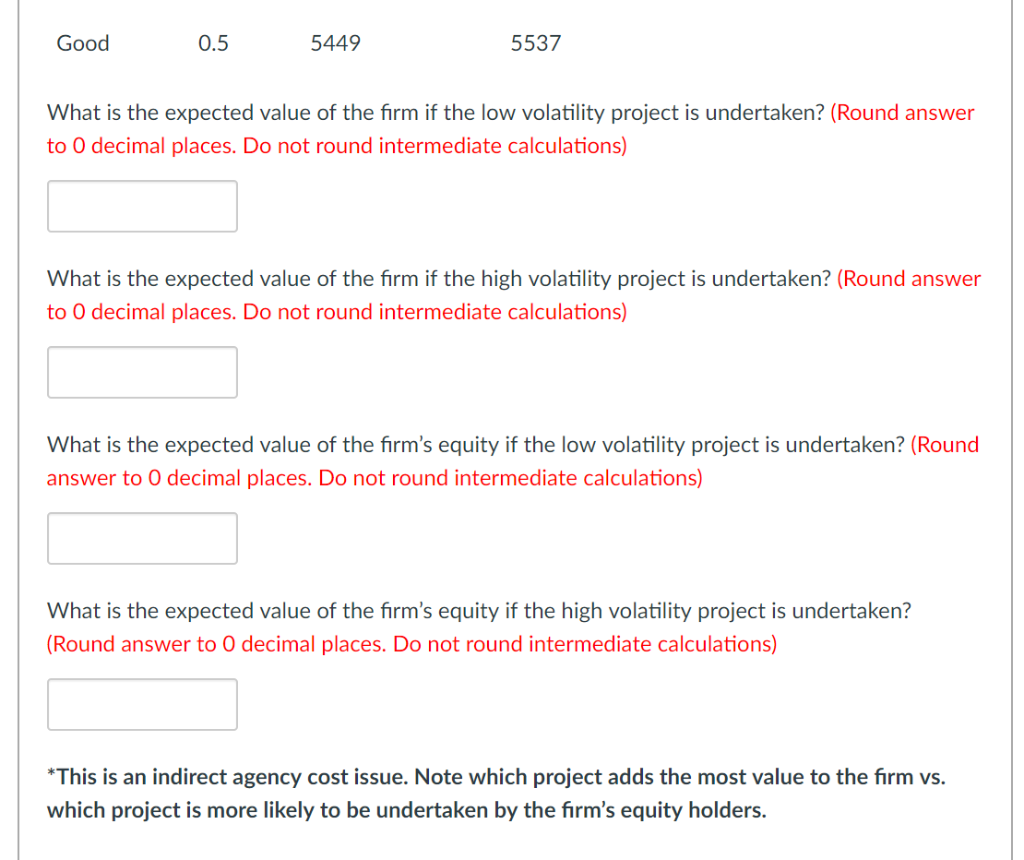

Question 3 6.5 pts Economists at The Wells Corporation estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of Wells must choose between two mutually exclusive projects. Assume that the project Wells chooses will be the firm's only activity and that the firm will close one year from today. Wells is obligated to make a $4,500 payment to bondholders at the end of the year. The projects have the same systematic risk, but different volatilities. Consider the following information pertaining to the two projects: Low Volatility Economy Probability High Volatility Payoff Bad 0.5 3551 4448 0.5 5449 5537 Good 5449 5537 Good 0.5 What is the expected value of the firm if the low volatility project is undertaken? (Round answer to O decimal places. Do not round intermediate calculations) What is the expected value of the firm if the high volatility project is undertaken? (Round answer to O decimal places. Do not round intermediate calculations) What is the expected value of the firm's equity if the low volatility project is undertaken? (Round answer to 0 decimal places. Do not round intermediate calculations) What is the expected value of the firm's equity if the high volatility project is undertaken? Round answer to O decimal places. Do not round intermediate calculations) This is an indirect agency cost issue. Note which project adds the most value to the firm vs. which project is more likely to be undertaken by the firm's equity holders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts