Question: Please adhere exactly to the rounding instructions, or the answer will be incorrect. thank you, definite thumbs up for answers!! Question 4 1 pts Fletcher

Please adhere exactly to the rounding instructions, or the answer will be incorrect. thank you, definite thumbs up for answers!!

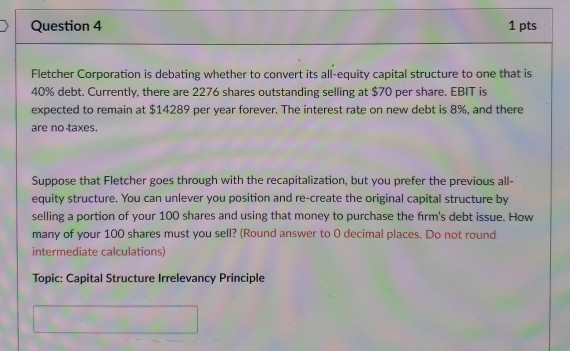

Question 4 1 pts Fletcher Corporation is debating whether to convert its all-equity capital structure to one that is 40% debt. Currently, there are 2276 shares outstanding selling at $70 per share, EBIT is expected to remain at $14289 per year forever. The interest rate on new debt is 8%, and there are no taxes. Suppose that Fletcher goes through with the recapitalization, but you prefer the previous all- equity structure. You can unlever you position and re-create the original capital structure by selling a portion of your 100 shares and using that money to purchase the firm's debt issue. How many of your 100 shares must you sell? (Round answer to 0 decimal places. Do not round Topic: Capital Structure Irrelevancy Principle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts