Question: please advise :) Squamish Equipment Selected financial information Expected net income after tax next year before new financing Sinking-fund payments due next year on existing

please advise :)

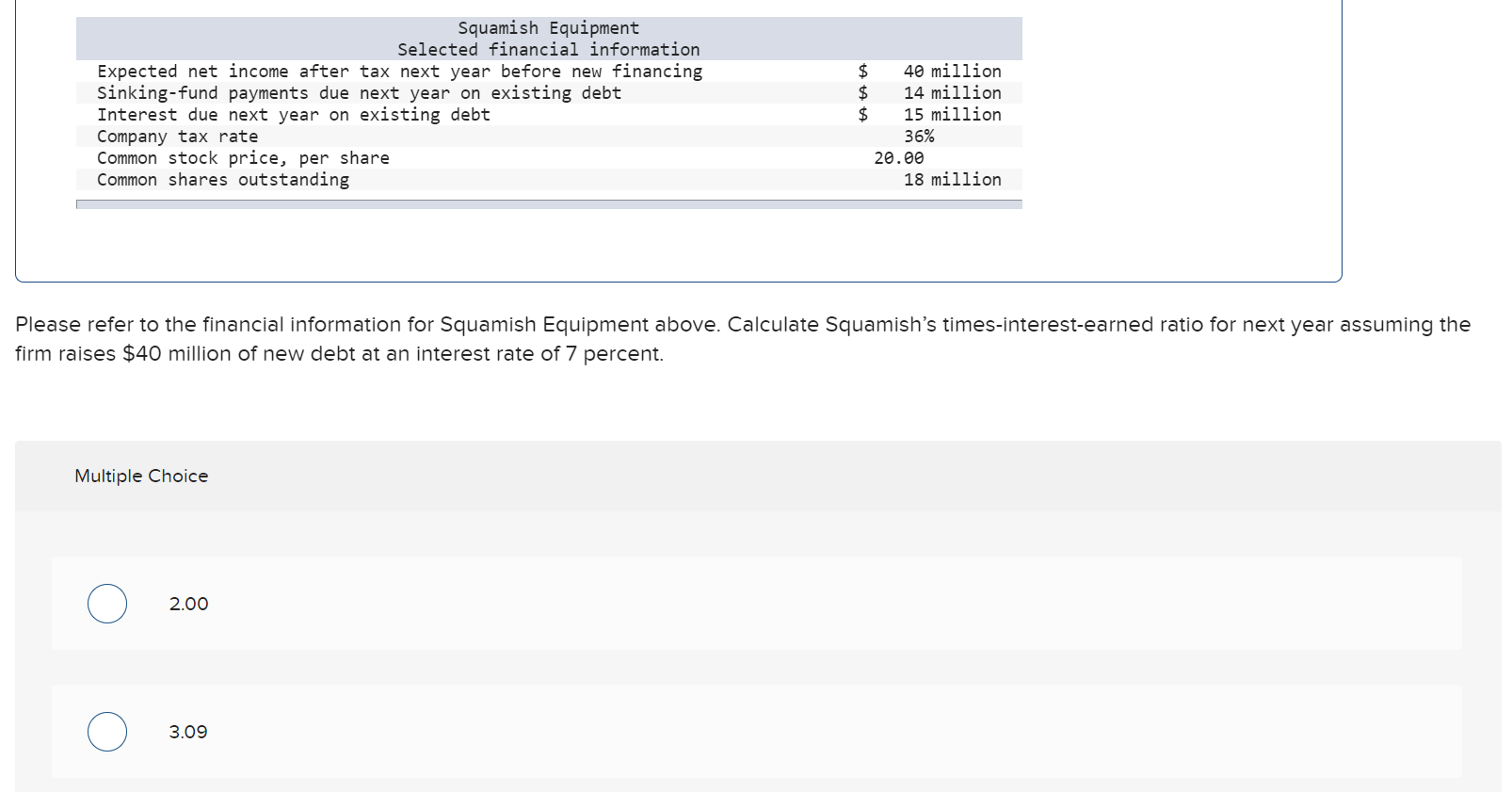

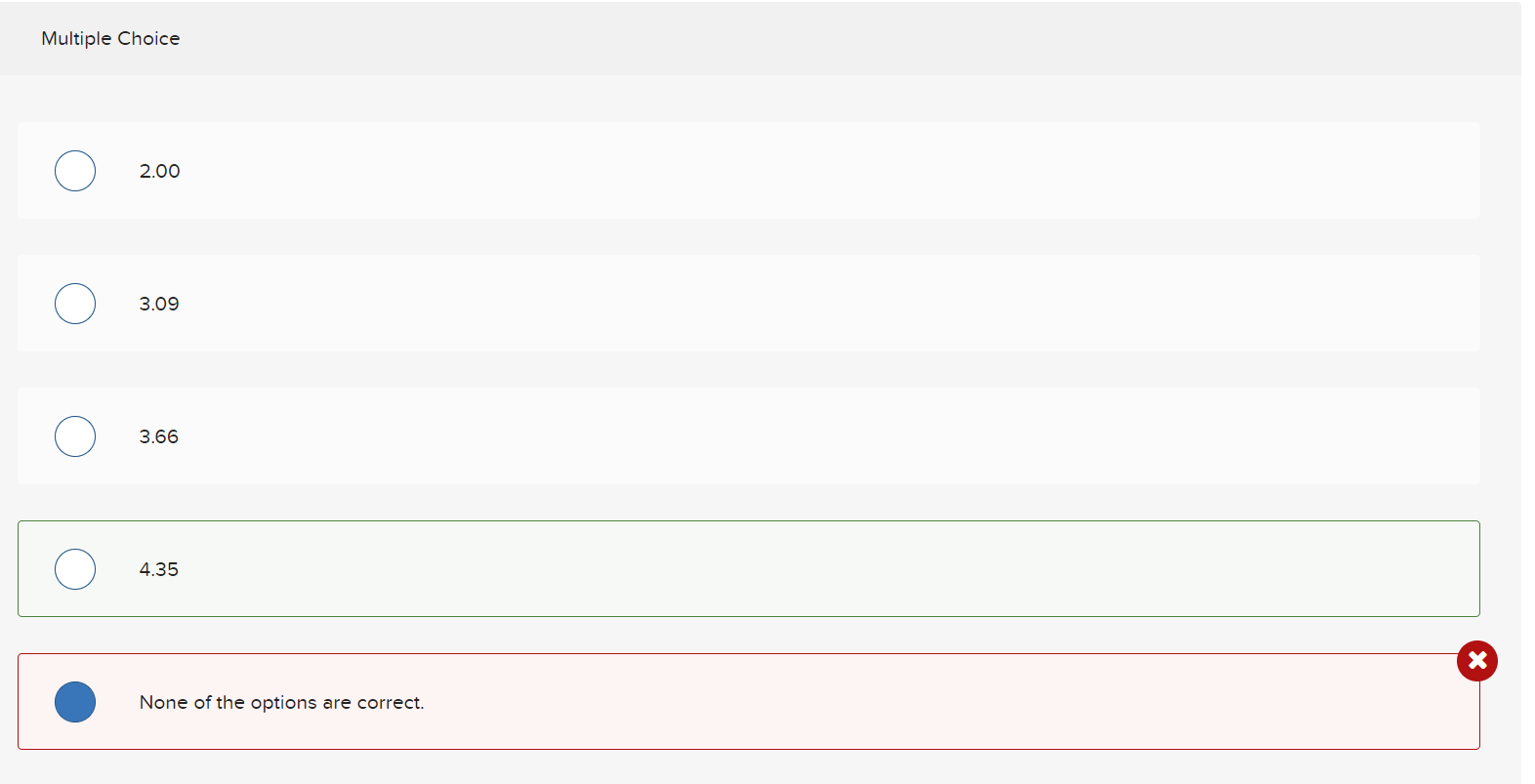

Squamish Equipment Selected financial information Expected net income after tax next year before new financing Sinking-fund payments due next year on existing debt Interest due next year on existing debt Company tax rate Common stock price, per share Common shares outstanding $ 40 million $ 14 million $ 15 million 36% 20.00 18 million Please refer to the financial information for Squamish Equipment above. Calculate Squamish's times-interest-earned ratio for next year assuming the firm raises $40 million of new debt at an interest rate of 7 percent. Multiple Choice 2.00 3.09 Multiple Choice 2.00 3.09 3.66 4.35 X None of the options are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts