Question: please ALL or none Question 15 A sinking fund provision on a bond issue requires the issuing corporation to: Is not a desirable feature of

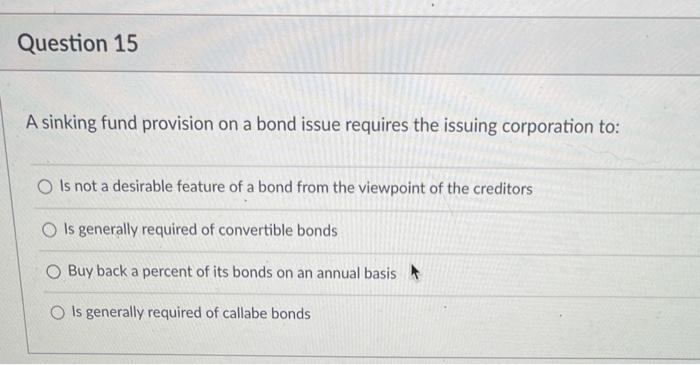

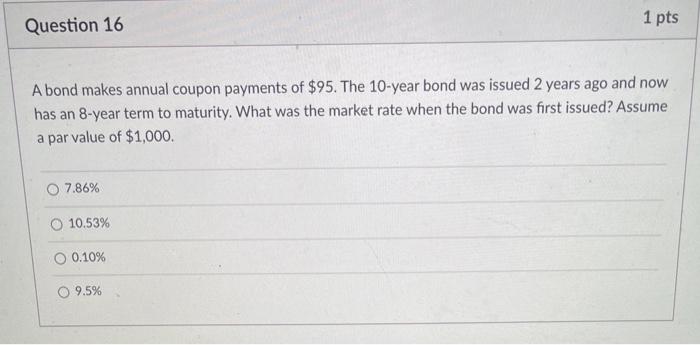

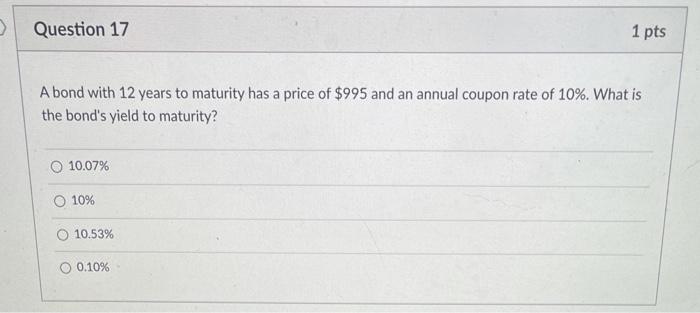

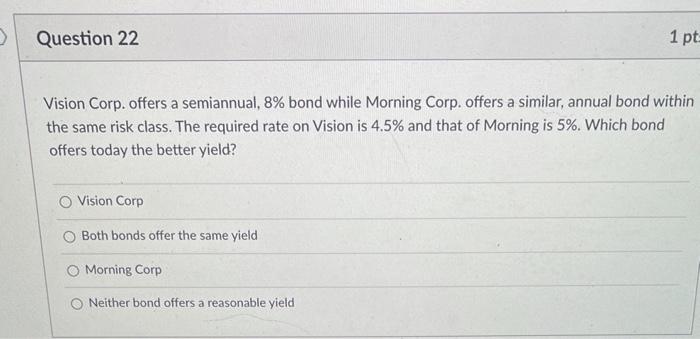

Question 15 A sinking fund provision on a bond issue requires the issuing corporation to: Is not a desirable feature of a bond from the viewpoint of the creditors Is generally required of convertible bonds Buy back a percent of its bonds on an annual basis O is generally required of callabe bonds Question 16 1 pts A bond makes annual coupon payments of $95. The 10-year bond was issued 2 years ago and now has an 8-year term to maturity. What was the market rate when the bond was first issued? Assume a par value of $1,000 O 7.86% 10.53% 0.10% 09.5% > Question 17 1 pts A bond with 12 years to maturity has a price of $995 and an annual coupon rate of 10%. What is the bond's yield to maturity? 10.07% O 10% O 10.53% O 0.10% > Question 22 1 pt Vision Corp. offers a semiannual, 8% bond while Morning Corp. offers a similar, annual bond within the same risk class. The required rate on Vision is 4.5% and that of Morning is 5%. Which bond offers today the better yield? Vision Corp Both bonds offer the same yield Morning Corp Neither bond offers a reasonable yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts