Question: Problem: Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $40,000 and will be depreciated according to the 3 year MACRS

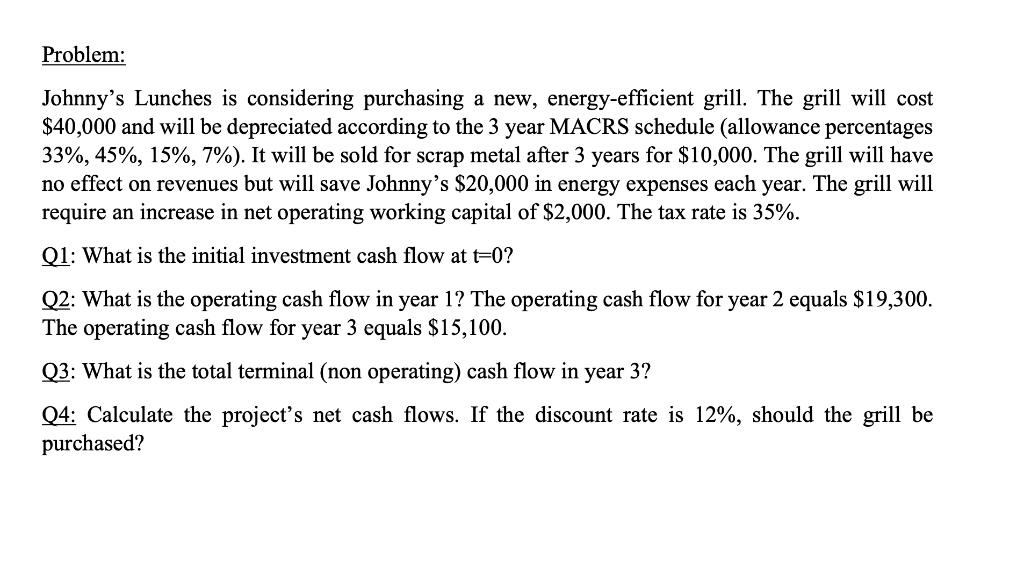

Problem: Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $40,000 and will be depreciated according to the 3 year MACRS schedule (allowance percentages 33%, 45%, 15%, 7%). It will be sold for scrap metal after 3 years for $10,000. The grill will have no effect on revenues but will save Johnny's $20,000 in energy expenses each year. The grill will require an increase in net operating working capital of $2,000. The tax rate is 35%. Q1: What is the initial investment cash flow at t=0? Q2: What is the operating cash flow in year 1? The operating cash flow for year 2 equals $19,300. The operating cash flow for year 3 equals $15,100. Q3: What is the total terminal (non operating) cash flow in year 3? Q4: Calculate the project's net cash flows. If the discount rate is 12%, should the grill be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts