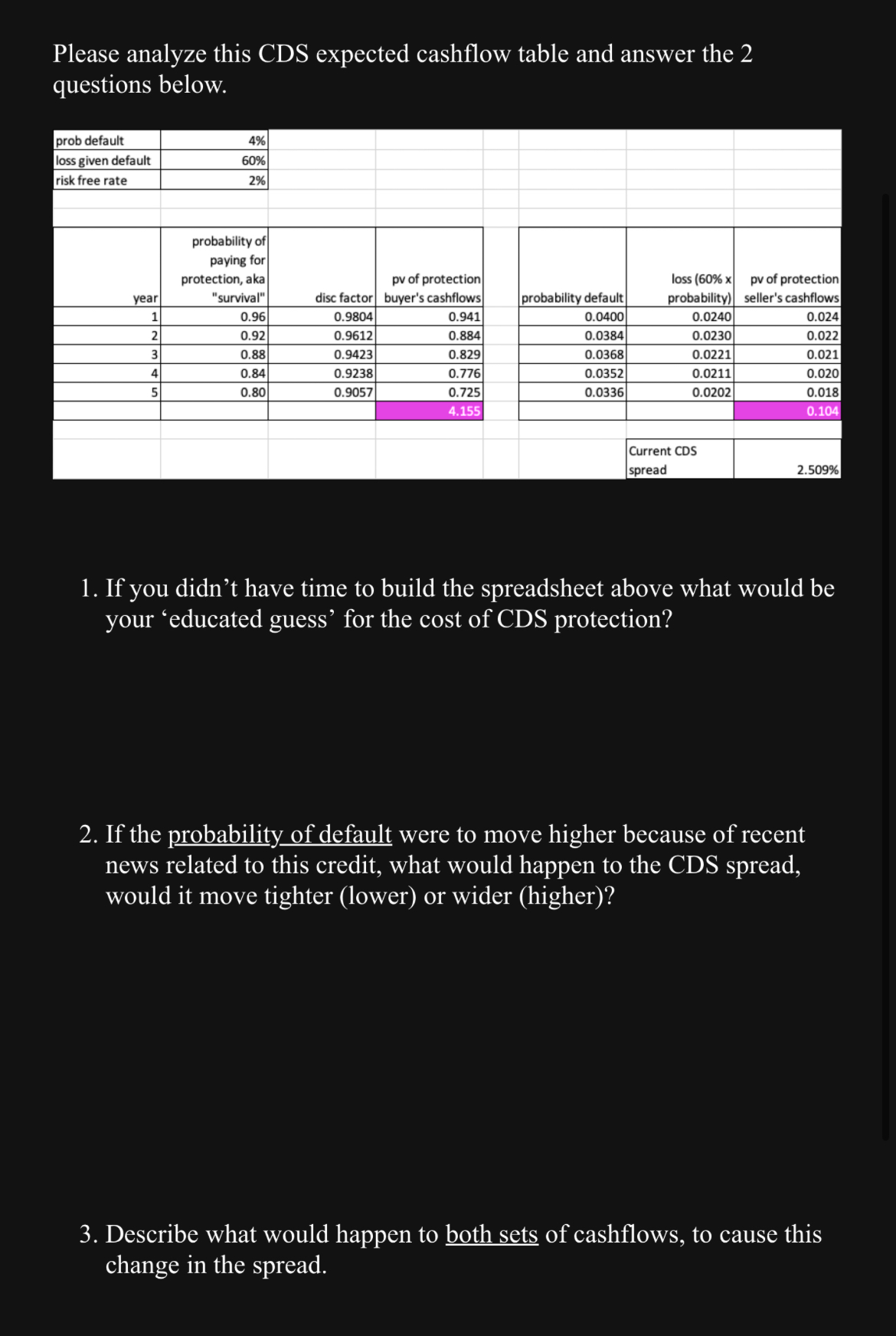

Question: Please analyze this CDS expected cashflow table and answer the 2 questions below. prob default 4% loss given default 60% risk free rate 2%

Please analyze this CDS expected cashflow table and answer the 2 questions below. prob default 4% loss given default 60% risk free rate 2% probability of paying for protection, aka pv of protection loss (60% x pv of protection year "survival" disc factor buyer's cashflows probability default probability) seller's cashflows 1 0.96 0.9804 0.941 0.0400 0.0240 0.024 2 0.92 0.9612 0.884 0.0384 0.0230 0.022 3 0.88 0.9423 0.829 0.0368 0.0221 0.021 4 0.84 0.9238 0.776 0.0352 0.0211 0.020 5 0.80 0.9057 0.725 0.0336 0.0202 0.018 4.155 0.104 Current CDS spread 2.509% 1. If you didn't have time to build the spreadsheet above what would be your educated guess' for the cost of CDS protection? 2. If the probability of default were to move higher because of recent news related to this credit, what would happen to the CDS spread, would it move tighter (lower) or wider (higher)? 3. Describe what would happen to both sets of cashflows, to cause this change in the spread.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts