Question: Please and thank you Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1

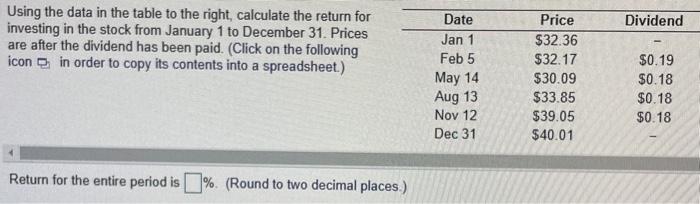

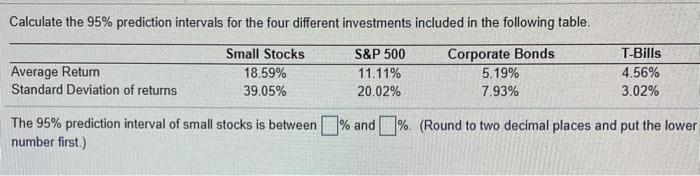

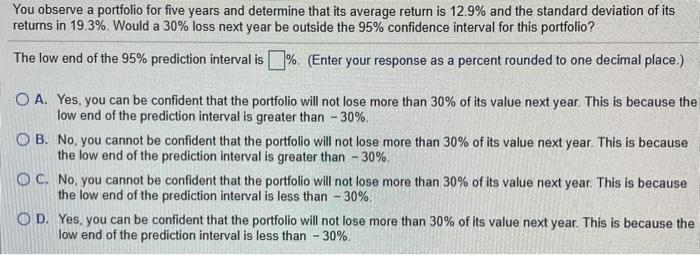

Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. (Click on the following icon in order to copy its contents into a spreadsheet.) Date Jan 1 Feb 5 May 14 Aug 13 Nov 12 Dec 31 Price $32.36 $32.17 $30.09 $33.85 $39.05 $40.01 $0.19 $0.18 $0.18 $0.18 Return for the entire period is % (Round to two decimal places) Calculate the 95% prediction intervals for the four different investments included in the following table, Average Return Standard Deviation of returns Small Stocks 18.59% 39.05% S&P 500 11.11% 20.02% Corporate Bonds 5.19% 7.93% T-Bills 4.56% 3.02% The 95% prediction interval of small stocks is between % and % (Round to two decimal places and put the lower number first.) You observe a portfolio for five years and determine that its average return is 12.9% and the standard deviation of its returns in 19.3%. Would a 30% loss next year be outside the 95% confidence interval for this portfolio? The low end of the 95% prediction interval is %. (Enter your response as a percent rounded to one decimal place.) O A. Yes, you can be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is greater than - 30% O B. No, you cannot be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is greater than - 30% O C. No, you cannot be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is less than - 30% OD. Yes, you can be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is less than - 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts