Question: please answe all 4 questions, the first one has been partially completed. 1 012 During the current year ending on December 31, BSP Company completed

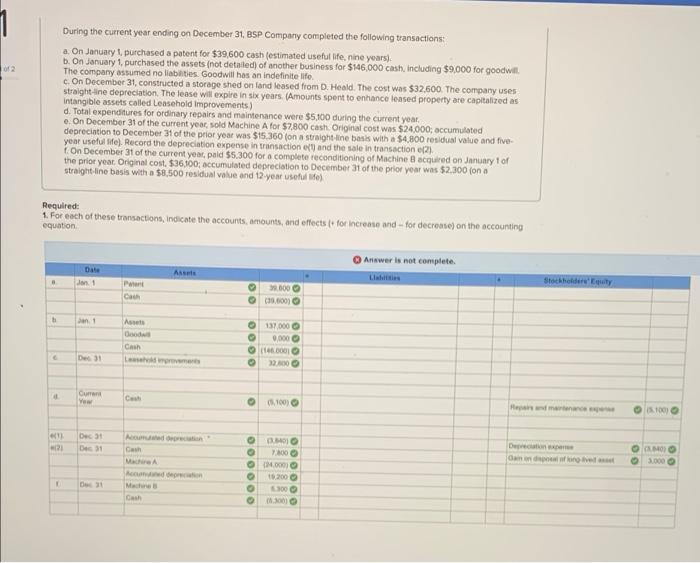

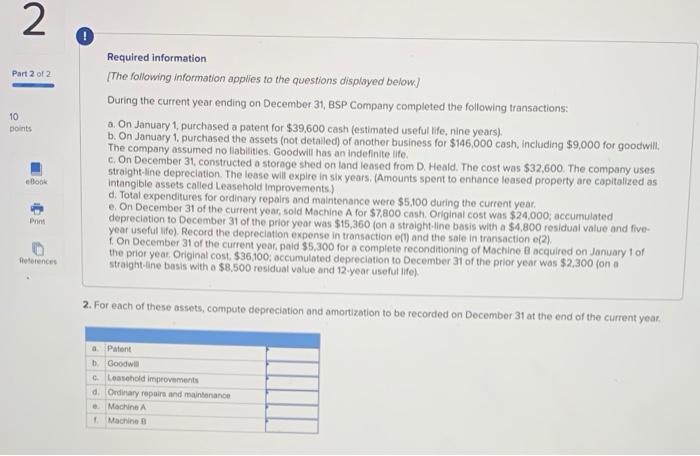

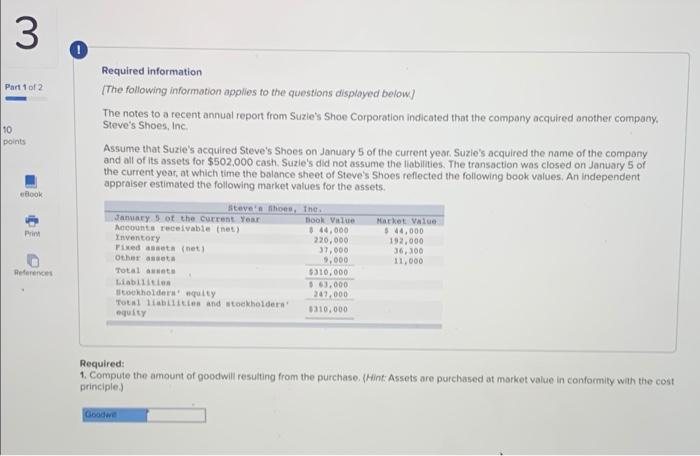

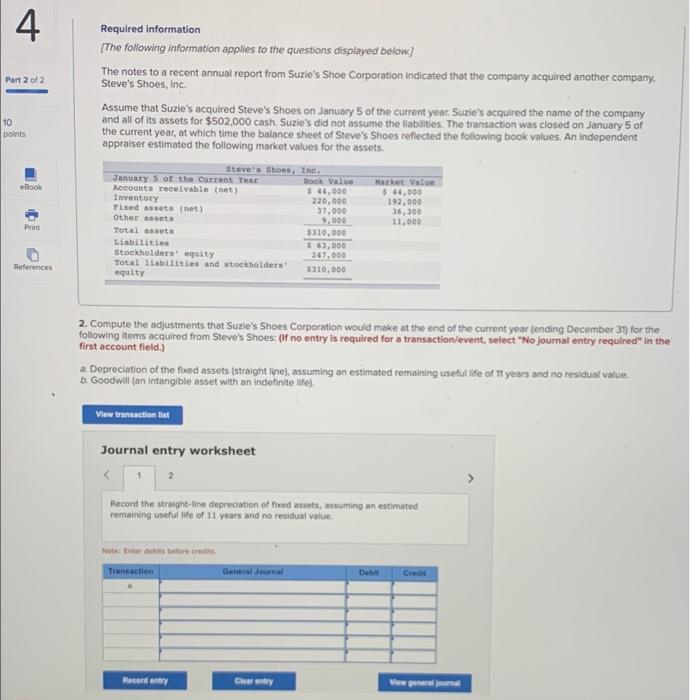

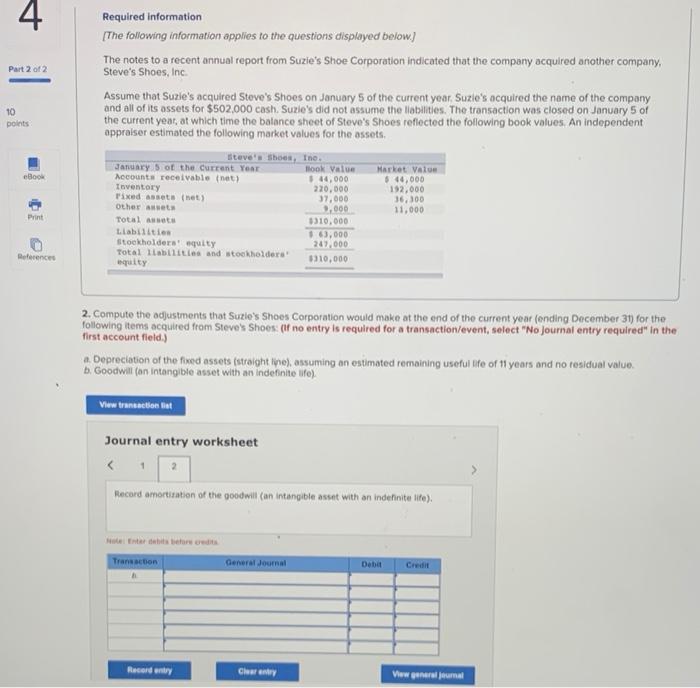

1 012 During the current year ending on December 31, BSP Company completed the following transactions: a. On January 1, purchased a patent for $39,600 cash (estimated useful life, nine years) b. On January 1, purchased the assets (not detailed) of another business for $146.000 cash, including $9.000 for goodwil The company assumed no liabilities. Goodwill has an indefinite life. c. On December 31, constructed a storage shed on fand leased from D. Heald. The cost was $32,600. The company uses straight-line depreciation. The lease will expire in six years. (Amounts spent to enhance leased property are capitalized as intangible assets called Leasehold Improvements) d. Total expenditures for ordinary repairs and maintenance were $5,100 during the current year. e On December 31 of the current yearsold Machine A for $2.800 cash Original cost was $24,000; accumulated depreciation to December 31 of the prior year was $15.360 (on a straight line basis with a $4.800 residual value and five year useful life). Record the depreciation expense in transaction et and the sale in transaction (2) On December 31 of the current year, paid $5.300 for a complete reconditioning of Machine Becured on January 1 of the prior yeat. Original cost $36.900; accumulated depreciation to December 3t of the prior year was $2.300 (on a straight line basis with a $8,500 residual value and 12 year useful fel Required: 1. For each of these transactions, indicate the accounts, amounts, and effects (+ for increate and - for decrease) on the accounting equation Answer is not complete As on 1 Stockholdere 30.000 (39.000 1 Ae Dod can BO 137.000 0,000 BOLO 32.000 Det Current Wow C (5.1001 Memand (Doc at De 23 Derection MA MO 3.000 00 OM 10.200 100 OOOOOO 11 Machines Cash mon 2 Part 2 of 2 10 Doints Required information [The following information applies to the questions displayed below) During the current year ending on December 31, BSP Company completed the following transactions: a. On January 1, purchased a patent for $39,600 cash (estimated useful life, nine years) b. On January 1, purchased the assets (not detailed) of another business for $146,000 cash, including $9,000 for goodwill, The company assumed no liabilities. Goodwill has an indefinite life c. On December 31, constructed a storage shed on land leased from D. Heald. The cost was $32,600. The company uses straight-line depreciation. The lease will expire in six years. (Amounts spent to enhance leased property are capitalized as Intangible assets called Leasehold Improvements) d. Total expenditures for ordinary repairs and maintenance were $5,100 during the current year. e On December 31 of the current year, sold Machine A for $7800 cash Original cost was $24,000; accumulated depreciation to December 31 of the prior year was $15,360 (on a straight line basis with a $4,800 residual value and five- year useful life). Record the depreciation expense in transaction e(t) and the sale in transaction (2) On December 31 of the current year, paid $5,300 for a complete reconditioning of Machine B acquired on January 1 of the prior year. Original cost $36,100; accumulated depreciation to December 31 of the prior year was $2,300 (one straight-line basis with a $8.500 residual value and 12-year useful life) eBook Print References 2. For each of these assets, compute depreciation and amortization to be recorded on December 31 at the end of the current year Patent Goodwill Leasehold improvements d. Ordinary repairs and maintenance Machine Machine 3 0 Part 1 of 2 10 points Book Required information (The following information applies to the questions displayed below) The notes to a recent annual report from Suzie's Shoe Corporation indicated that the company acquired another company. Steve's Shoes, Inc Assume that Suzie's acquired Steve's Shoes on January 5 of the current year. Suzie's acquired the name of the company and all of its assets for $502,000 cash. Suzie's did not assume the lobilities. The transaction was closed on January 5 or the current year, at which time the balance sheet of Steve's Shoes reflected the following book values. An independent appraiser estimated the following market values for the assets. Steve shoes. The January of the current Year Took Ville Market value Accounts receivable (net) 44,000 $.46,000 Inventory 220.000 192,000 Fixed at net 37,000 36,100 Others 9.000 11,000 Total auto $310,000 Liabilities 03.000 tokholderulty 247.000 Total abilities and stockholders equity 0310.000 Print Reference Required: 1. Compute the amount of goodwill resulting from the purchase. (Hint: Assets are purchased at market value in conformity with the cost principle) Good 4. Part 2 of 2 10 points Required information The following information applies to the questions displayed below) The notes to a recent annual report from Suzio's Shoe Corporation indicated that the company acquired another company, Steve's Shoes, Inc. Assume that Suzie's acquired Steve's Shoes on January 5 of the current year. Suzie's acquired the name of the company and all of its assets for $502,000 cash. Suzie's did not assume the liabilities. The transaction was closed on January 5 of the current year, at which time the balance sheet of Steve's Shoes reflected the following book values. An independent appraiser estimated the following market values for the assets. Steve's Shoes, The January 5 of the current rear Book Value Market value Accounts receivable (net) $14.000 $ 46,000 Inventory 220,000 192,000 Fixed assets (het) 37.000 36,300 Other asset 0.000 11.000 Total assets $310.000 Liabilities $ 63,000 Stockholders' equity 247.000 Total liabilities and stockholders equity 5310,000 Print References 2. Compute the adjustments that Suzie's Shoes Corporation would make at the end of the current year (ending December 31) for the following items acquired from Steve's Shoes (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. Depreciation of the fixed assets (straight line), assuming an estimated remaining useful life of years and no residual value b. Goodwill (an intangible asset with an indefinite life) View transaction ist Journal entry worksheet Record the straight-line depreciation of fixed assets, assuming an estimated remaining useful life of 11 years and no residual value Note: terebatur cream, Transaction General Journal Cr Record Clary View 4 Part 2 of 2 Required information [The following information applies to the questions displayed below) The notes to a recent annual report from Suzie's Shoe Corporation indicated that the company acquired another company, Steve's Shoes, Inc Assume that Suzie's acquired Steve's Shoes on January 5 of the current year, Suzie's acquired the name of the company and all of its assets for $502,000 cash. Suzie's did not assume the abilities. The transaction was closed on January 5 of the current year, at which time the balance sheet of Steve's Shoes reflected the following book values. An independent appraiser estimated the following market values for the assets. 10 points Bo Steve's Shoes, Ine January of the current Year Hook Value Accounts receivable (net) 344,000 Inventory 220,000 Fixed assets (net) 37.000 Other at Total $310.000 Liabilities 163,000 Stockholders' equity 267.000 Total liabilities and stockholdere equity $310,000 Market VA 544,000 192,000 36,300 11,000 9.000 Print References 2. Compute the adjustments that Suzie's Shoes Corporation would make at the end of the current year (ending December 31) for the following items acquired from Steve's Shoes: (if no entry is required for a transaction/event, select "No journal entry required in the first account field.) Depreciation of the fixed assets (straight line), assuming an estimated remaining useful life of 11 years and no residual value. b. Goodwill (an intangible asset with an indefinito Ufe). View transaction that Journal entry worksheet Record the straight-line depreciation of fixed assets, assuming an estimated remaining useful life of 11 years and no residual value Note: terebatur cream, Transaction General Journal Cr Record Clary View 4 Part 2 of 2 Required information [The following information applies to the questions displayed below) The notes to a recent annual report from Suzie's Shoe Corporation indicated that the company acquired another company, Steve's Shoes, Inc Assume that Suzie's acquired Steve's Shoes on January 5 of the current year, Suzie's acquired the name of the company and all of its assets for $502,000 cash. Suzie's did not assume the abilities. The transaction was closed on January 5 of the current year, at which time the balance sheet of Steve's Shoes reflected the following book values. An independent appraiser estimated the following market values for the assets. 10 points Bo Steve's Shoes, Ine January of the current Year Hook Value Accounts receivable (net) 344,000 Inventory 220,000 Fixed assets (net) 37.000 Other at Total $310.000 Liabilities 163,000 Stockholders' equity 267.000 Total liabilities and stockholdere equity $310,000 Market VA 544,000 192,000 36,300 11,000 9.000 Print References 2. Compute the adjustments that Suzie's Shoes Corporation would make at the end of the current year (ending December 31) for the following items acquired from Steve's Shoes: (if no entry is required for a transaction/event, select "No journal entry required in the first account field.) Depreciation of the fixed assets (straight line), assuming an estimated remaining useful life of 11 years and no residual value. b. Goodwill (an intangible asset with an indefinito Ufe). View transaction that Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts