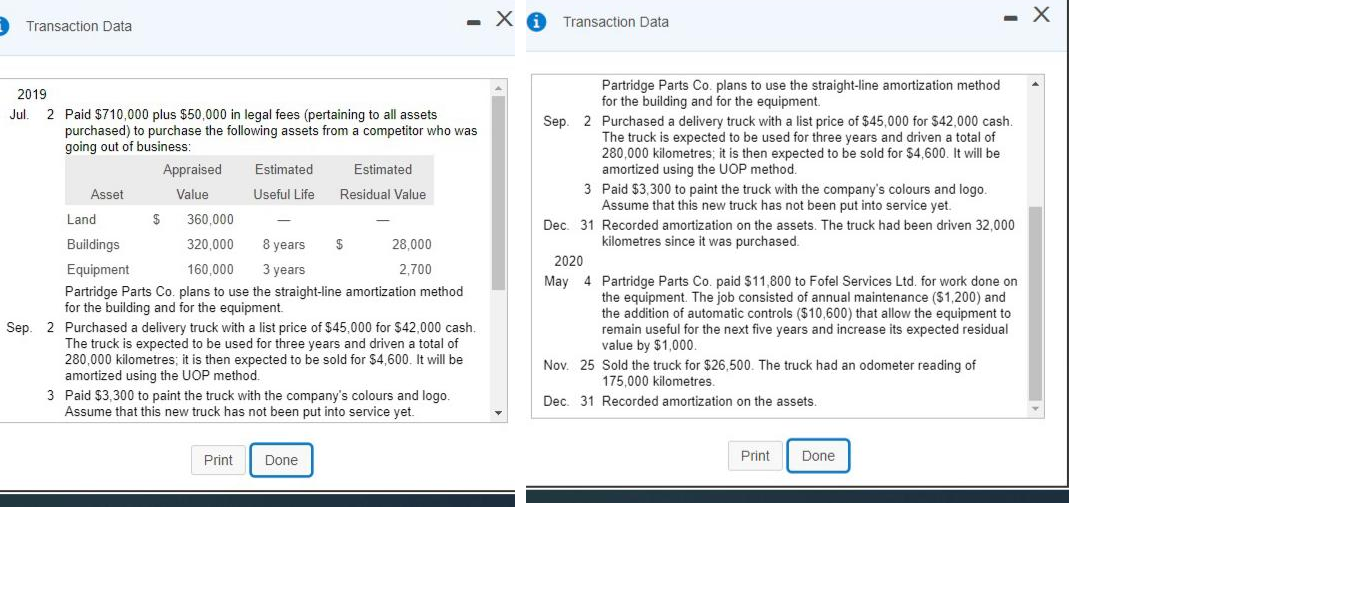

Question: Transaction Data Transaction Data 2019 Jul. 2 Paid $710,000 plus $50,000 in legal fees (pertaining to all assets purchased) to purchase the following assets from

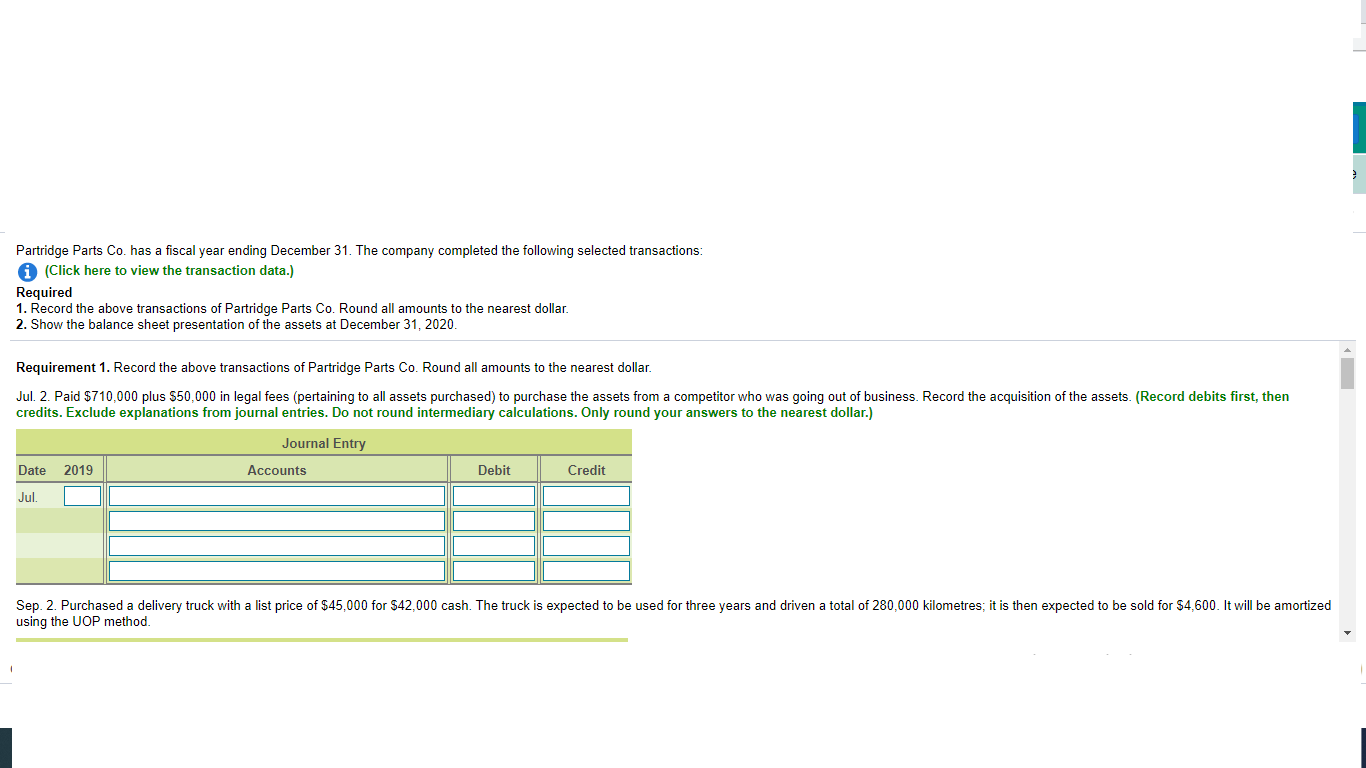

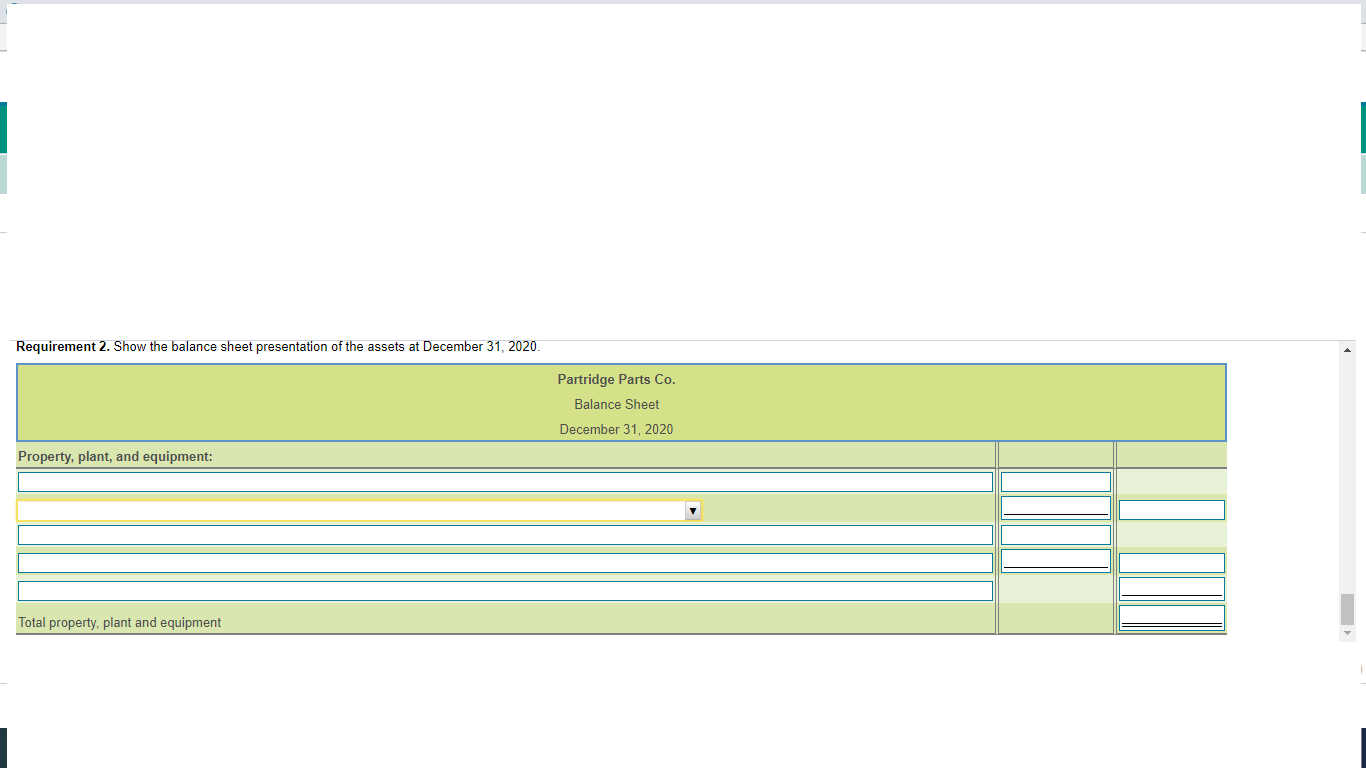

Transaction Data Transaction Data 2019 Jul. 2 Paid $710,000 plus $50,000 in legal fees (pertaining to all assets purchased) to purchase the following assets from a competitor who was going out of business: Appraised Estimated Estimated Asset Value Useful Life Residual Value Land $ 360,000 Buildings 320,000 8 years $ 28,000 Equipment 160,000 2,700 Partridge Parts Co plans to use the straight-line amortization method for the building and for the equipment. Sep. 2 Purchased a delivery truck with a list price of $45,000 for $42,000 cash, The truck is expected to be used for three years and driven a total of 280,000 kilometres, it is then expected to be sold for $4,600. It will be amortized using the UOP method. 3 Paid $3,300 to paint the truck with the company's colours and logo. Assume that this new truck has not been put into service yet. Partridge Parts Co plans to use the straight-line amortization method for the building and for the equipment Sep 2 Purchased a delivery truck with a list price of $45,000 for $42,000 cash. The truck is expected to be used for three years and driven a total of 280,000 kilometres, it is then expected to be sold for $4,600. It will be amortized using the UOP method. 3 Paid $3,300 to paint the truck with the company's colours and logo Assume that this new truck has not been put into service yet Dec 31 Recorded amortization on the assets. The truck had been driven 32,000 kilometres since it was purchased. 2020 May 4 Partridge Parts Co. paid $11,800 to Fofel Services Ltd. for work done on the equipment. The job consisted of annual maintenance ($1,200) and the addition of automatic controls ($10,600) that allow the equipment to remain useful for the next five years and increase its expected residual value by $1,000 Nov. 25 Sold the truck for $26,500. The truck had an odometer reading of 175,000 kilometres Dec 31 Recorded amortization on the assets. 3 years Print Done Print Done Partridge Parts Co. has a fiscal year ending December 31. The company completed the following selected transactions: (Click here to view the transaction data.) Required 1. Record the above transactions of Partridge Parts Co. Round all amounts to the nearest dollar. 2. Show the balance sheet presentation of the assets at December 31, 2020. Requirement 1. Record the above transactions of Partridge Parts Co. Round all amounts to the nearest dollar. Jul. 2. Paid $710,000 plus $50,000 in legal fees (pertaining to all assets purchased) to purchase the assets from a competitor who was going out of business. Record the acquisition of the assets. (Record debits first, then credits. Exclude explanations from journal entries. Do not round intermediary calculations. Only round your answers to the nearest dollar.) Journal Entry Date 2019 Accounts Debit Credit Jul. Sep. 2. Purchased a delivery truck with a list price of $45,000 for $42,000 cash. The truck is expected to be used for three years and driven a total of 280,000 kilometres; it is then expected to be sold for $4,600. It will be amortized using the UOP method. Requirement 2. Show the balance sheet presentation of the assets at December 31, 2020. Partridge Parts Co. Balance Sheet December 31, 2020 Property, plant, and equipment: Total property, plant and equipment Transaction Data Transaction Data 2019 Jul. 2 Paid $710,000 plus $50,000 in legal fees (pertaining to all assets purchased) to purchase the following assets from a competitor who was going out of business: Appraised Estimated Estimated Asset Value Useful Life Residual Value Land $ 360,000 Buildings 320,000 8 years $ 28,000 Equipment 160,000 2,700 Partridge Parts Co plans to use the straight-line amortization method for the building and for the equipment. Sep. 2 Purchased a delivery truck with a list price of $45,000 for $42,000 cash, The truck is expected to be used for three years and driven a total of 280,000 kilometres, it is then expected to be sold for $4,600. It will be amortized using the UOP method. 3 Paid $3,300 to paint the truck with the company's colours and logo. Assume that this new truck has not been put into service yet. Partridge Parts Co plans to use the straight-line amortization method for the building and for the equipment Sep 2 Purchased a delivery truck with a list price of $45,000 for $42,000 cash. The truck is expected to be used for three years and driven a total of 280,000 kilometres, it is then expected to be sold for $4,600. It will be amortized using the UOP method. 3 Paid $3,300 to paint the truck with the company's colours and logo Assume that this new truck has not been put into service yet Dec 31 Recorded amortization on the assets. The truck had been driven 32,000 kilometres since it was purchased. 2020 May 4 Partridge Parts Co. paid $11,800 to Fofel Services Ltd. for work done on the equipment. The job consisted of annual maintenance ($1,200) and the addition of automatic controls ($10,600) that allow the equipment to remain useful for the next five years and increase its expected residual value by $1,000 Nov. 25 Sold the truck for $26,500. The truck had an odometer reading of 175,000 kilometres Dec 31 Recorded amortization on the assets. 3 years Print Done Print Done Partridge Parts Co. has a fiscal year ending December 31. The company completed the following selected transactions: (Click here to view the transaction data.) Required 1. Record the above transactions of Partridge Parts Co. Round all amounts to the nearest dollar. 2. Show the balance sheet presentation of the assets at December 31, 2020. Requirement 1. Record the above transactions of Partridge Parts Co. Round all amounts to the nearest dollar. Jul. 2. Paid $710,000 plus $50,000 in legal fees (pertaining to all assets purchased) to purchase the assets from a competitor who was going out of business. Record the acquisition of the assets. (Record debits first, then credits. Exclude explanations from journal entries. Do not round intermediary calculations. Only round your answers to the nearest dollar.) Journal Entry Date 2019 Accounts Debit Credit Jul. Sep. 2. Purchased a delivery truck with a list price of $45,000 for $42,000 cash. The truck is expected to be used for three years and driven a total of 280,000 kilometres; it is then expected to be sold for $4,600. It will be amortized using the UOP method. Requirement 2. Show the balance sheet presentation of the assets at December 31, 2020. Partridge Parts Co. Balance Sheet December 31, 2020 Property, plant, and equipment: Total property, plant and equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts