Question: please answer 12 I 71% + QUESTION 1. The Kumar Corpotation, a firm in the 30% marginal tachnicket with a 15% required rate of retum

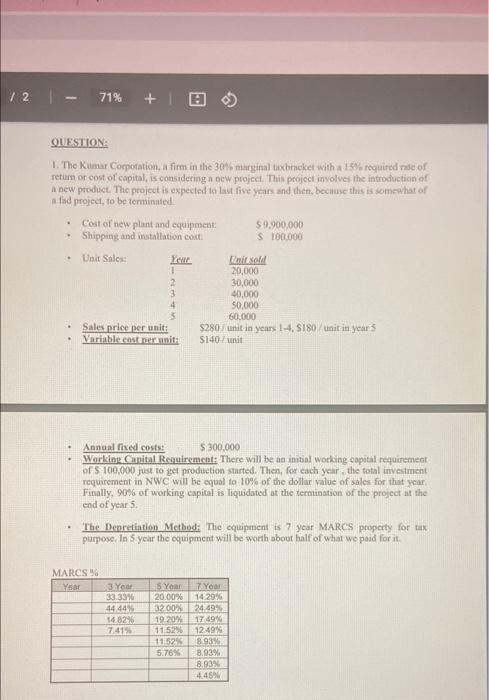

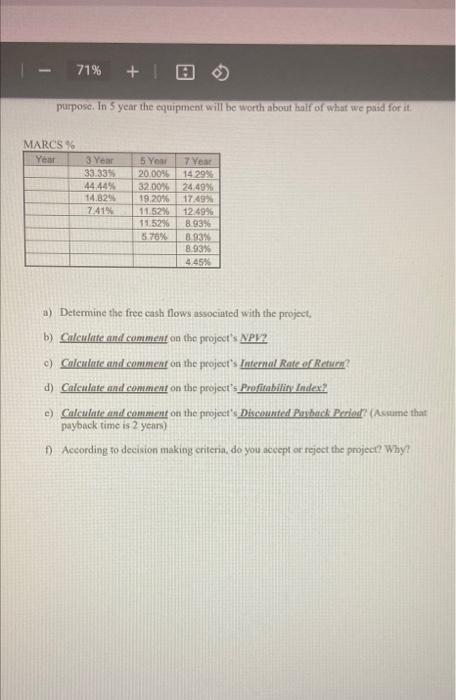

12 I 71% + QUESTION 1. The Kumar Corpotation, a firm in the 30% marginal tachnicket with a 15% required rate of retum or cost of capital, is considering a new project. This project involves the introduction of A new product. The project is expected to last five years and then, because this is somewhat of and project, to be terminated Cost of new plant and equipment 59.900,000 Shipping and installation costi $ 100.000 Unit Sales Year itsell 1 20,000 30,000 3 40,000 50.000 60,000 Sales price per unit: $280/unit in years 1-4, S180/unit in years Variable costruit S140/unit 4 Annual fixed costs $ 300,000 Working Capital Requirement: There will be an initial working capital requirement of $ 100,000 just to get production started. Then, for each year, the total investment requirement in NWC will be equal to 10% of the dollar value of sales for that year, Finally, 90% of working capital is liquidated at the termination of the project at the end of year 5. The Depretation Method: The equipment is 7 year MARCS property for tux purpose. In 5 year the equipment will be worth about half of what we paid for it MARCS Year 3. Your 33.33% 44.44 1482 7.41% 5 Year 20.00 32.00% 19 20% 1152 11.52 5.76% 7 Year 14.29% 24.49% 17 69% 124946 8.93% 8.93% 8.93% 4.45% 71% + 10 purpose. In 5 year the equipment will be worth about hoif of what we psid for it. MARCS% Yew 3 Year 33.33% 44449 14.829 741% 5 Your 7 Year 20.00% 14 29% 32.00% 24.49% 19,20% 17:49 11.52% 12.49% 11.52% 893% 5.76% 8.92 8.93% 4.45% a) Determine the free cash flows associated with the project, b) Calculate and comment on the project's NPH? c) Calculate and comment on the project's Paternal Rate of Return d) Calculate and comment on the project's Profitability Index? e) Calculate and comment on the project's Discounted Playback Period (Assume that payback time is 2 years) According to decision making criteria, do you accept or reject the project? Why? 12 I 71% + QUESTION 1. The Kumar Corpotation, a firm in the 30% marginal tachnicket with a 15% required rate of retum or cost of capital, is considering a new project. This project involves the introduction of A new product. The project is expected to last five years and then, because this is somewhat of and project, to be terminated Cost of new plant and equipment 59.900,000 Shipping and installation costi $ 100.000 Unit Sales Year itsell 1 20,000 30,000 3 40,000 50.000 60,000 Sales price per unit: $280/unit in years 1-4, S180/unit in years Variable costruit S140/unit 4 Annual fixed costs $ 300,000 Working Capital Requirement: There will be an initial working capital requirement of $ 100,000 just to get production started. Then, for each year, the total investment requirement in NWC will be equal to 10% of the dollar value of sales for that year, Finally, 90% of working capital is liquidated at the termination of the project at the end of year 5. The Depretation Method: The equipment is 7 year MARCS property for tux purpose. In 5 year the equipment will be worth about half of what we paid for it MARCS Year 3. Your 33.33% 44.44 1482 7.41% 5 Year 20.00 32.00% 19 20% 1152 11.52 5.76% 7 Year 14.29% 24.49% 17 69% 124946 8.93% 8.93% 8.93% 4.45% 71% + 10 purpose. In 5 year the equipment will be worth about hoif of what we psid for it. MARCS% Yew 3 Year 33.33% 44449 14.829 741% 5 Your 7 Year 20.00% 14 29% 32.00% 24.49% 19,20% 17:49 11.52% 12.49% 11.52% 893% 5.76% 8.92 8.93% 4.45% a) Determine the free cash flows associated with the project, b) Calculate and comment on the project's NPH? c) Calculate and comment on the project's Paternal Rate of Return d) Calculate and comment on the project's Profitability Index? e) Calculate and comment on the project's Discounted Playback Period (Assume that payback time is 2 years) According to decision making criteria, do you accept or reject the project? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts