Question: please answer 1,2,3 and use EXCEL and show ALL FORMULAS IN CELLS. Thank you! BeveraShootout Coca-Cola Pepsi Financial Statement Analysis First you need to export

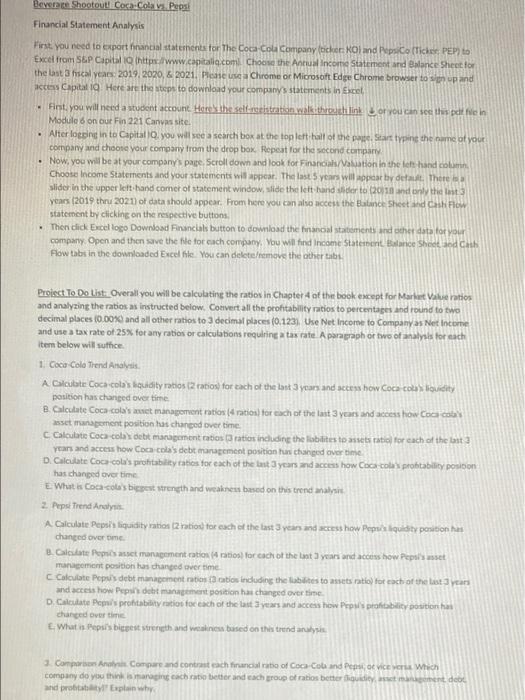

BeveraShootout Coca-Cola Pepsi Financial Statement Analysis First you need to export hinancial statements for The Coca-Cola Company (ticker: Roland PepsiCo (Ticke PEPto Excel from SSP Capital http://www.capital.com. Choose the Annual income Statement and wance Sheet for the last 3 hrscal years 2019 2020,6 2021, Pete usca Chrome or Microsoft Edge Chrome browser to up and a Capital Here are the steps to download your company's statements in Excel First, you will need a student account. Here the self-restration was through link or you can see the diffeln Module on out Fin 221 Canvas site Alter losing in to Capital, you will see a search box at the top left all of the pate Start typing the came at your company and choose your company from the drop box. Repeat for the second company Now, you will be at your company page. Scroll down and look for Financials/Valuation in the left hand column Choose Income Statements and your statements will appear. The last 5 years will opear by deut. There slider in the upper left hand comer of statement windowslide the left hand sider to (2010 and only the last 3 years (2019 thn 2021) of data should appear. From here you can also access the Blance Sheet and allow statement by clicking on the respective buttons Then did Excel logo Download Financials button to download the financial statements and other data for your company Open and then save the file for each company. You will find income Statement Brice Sheet and the How tbs in the downloaded Excel file. You can delete/remove the other tabs Proiect. To Do List Overall you will be calculating the ratios in Chapter 4 of the book except for Market Value ration and analyzing the ratios as instructed below. Convert all the profitability ratios to percentages and round to two decimal places (0.00%) and all other ratios to 3 decimal places (0.122) Use Net Income to Company as Net Income and use a tax rate of 25% for any ratios or calculations requiring tax rate. A paragraph or two of analysis for each item below will sutice 1. Coca Cola Tiend Analysis A Calculate Coca colo's biquidity ratios (2 ratios for each of the last 3 years and access how Coca cola louidity position has changed over time B Calculate Coca-cola's wet manaporent ratios (4 ratios for each of the last 3 years and access how Cocco asset management position has changed over time. C Calculate Coca cola debt management ratios 3 ratios including the liablites to stratil for each of the last 3 years and access how Coca-cola's debt management position to changed over time D. Calculate Coca-cola's profitability rates for each of the last years and access how Coca-cola probability posicion has changed over time E What is Coca-cola's biggest strength and weakness based on this trend analysis 2 Pepsi Trend Analyst A Calculate Pepuis liquidity ratio 12 ratios for each of the last 3 years and see how Pepuis quity position has changed over me B. Calculate Pepsis asset management cation ( ratios) for each of the last 3 years and access how Pepal's asset management position as changed over time Calculate Pepuis debt management ration cations including the tables to assets ratio) for each of the last 3 years and aceshow Pepsi det management position has changed over time D. Calculate Popis profitability ratios for each of the last years and access how Prol's profitability positions chanced over time What is Pepils bicpestrength and weakne based on this trend analysis Compre Anal Compare and contrasteach financial ratio of Coca-Coland Pep Vic Which company do you thing cach to better and each group of ratio better idity, at det and proyExplain why BeveraShootout Coca-Cola Pepsi Financial Statement Analysis First you need to export hinancial statements for The Coca-Cola Company (ticker: Roland PepsiCo (Ticke PEPto Excel from SSP Capital http://www.capital.com. Choose the Annual income Statement and wance Sheet for the last 3 hrscal years 2019 2020,6 2021, Pete usca Chrome or Microsoft Edge Chrome browser to up and a Capital Here are the steps to download your company's statements in Excel First, you will need a student account. Here the self-restration was through link or you can see the diffeln Module on out Fin 221 Canvas site Alter losing in to Capital, you will see a search box at the top left all of the pate Start typing the came at your company and choose your company from the drop box. Repeat for the second company Now, you will be at your company page. Scroll down and look for Financials/Valuation in the left hand column Choose Income Statements and your statements will appear. The last 5 years will opear by deut. There slider in the upper left hand comer of statement windowslide the left hand sider to (2010 and only the last 3 years (2019 thn 2021) of data should appear. From here you can also access the Blance Sheet and allow statement by clicking on the respective buttons Then did Excel logo Download Financials button to download the financial statements and other data for your company Open and then save the file for each company. You will find income Statement Brice Sheet and the How tbs in the downloaded Excel file. You can delete/remove the other tabs Proiect. To Do List Overall you will be calculating the ratios in Chapter 4 of the book except for Market Value ration and analyzing the ratios as instructed below. Convert all the profitability ratios to percentages and round to two decimal places (0.00%) and all other ratios to 3 decimal places (0.122) Use Net Income to Company as Net Income and use a tax rate of 25% for any ratios or calculations requiring tax rate. A paragraph or two of analysis for each item below will sutice 1. Coca Cola Tiend Analysis A Calculate Coca colo's biquidity ratios (2 ratios for each of the last 3 years and access how Coca cola louidity position has changed over time B Calculate Coca-cola's wet manaporent ratios (4 ratios for each of the last 3 years and access how Cocco asset management position has changed over time. C Calculate Coca cola debt management ratios 3 ratios including the liablites to stratil for each of the last 3 years and access how Coca-cola's debt management position to changed over time D. Calculate Coca-cola's profitability rates for each of the last years and access how Coca-cola probability posicion has changed over time E What is Coca-cola's biggest strength and weakness based on this trend analysis 2 Pepsi Trend Analyst A Calculate Pepuis liquidity ratio 12 ratios for each of the last 3 years and see how Pepuis quity position has changed over me B. Calculate Pepsis asset management cation ( ratios) for each of the last 3 years and access how Pepal's asset management position as changed over time Calculate Pepuis debt management ration cations including the tables to assets ratio) for each of the last 3 years and aceshow Pepsi det management position has changed over time D. Calculate Popis profitability ratios for each of the last years and access how Prol's profitability positions chanced over time What is Pepils bicpestrength and weakne based on this trend analysis Compre Anal Compare and contrasteach financial ratio of Coca-Coland Pep Vic Which company do you thing cach to better and each group of ratio better idity, at det and proyExplain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts